The Nasdaq loses key trends as overseas markets step up

The Nasdaq loses some key trends

A couple of weeks ago, we saw a historic number of securities on the Nasdaq had been cut in half. While similar (though less extreme) behavior wasn't necessarily a negative for an index like the Nasdaq Composite, there were some troubling precedents.

That internal deterioration has come home to roost, and the Composite has declined below its 200-day moving average for the first time in more than 400 days, ending its 3rd-longest streak above that long-term average.

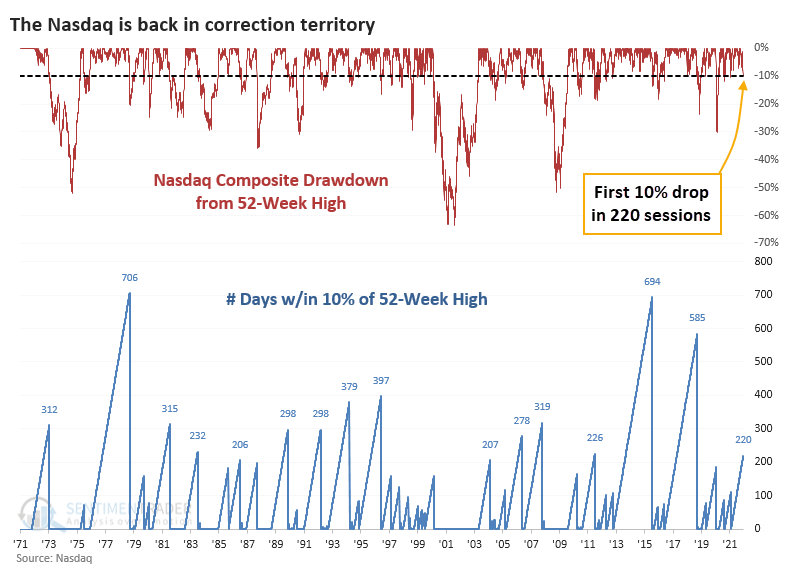

The selling pressure in recent days has also been enough to drag the Composite into correction territory, down more than 10% from its peak. This is the first time in more than 200 sessions that the index was more than 10% below its high.

In the very short-term, bulls made a stand after these streaks ended, with the Composite rebounding during the next week after 11 out of the last 12 signals. But over the next 2 months, the Nasdaq showed a positive return only 33% of the time.

| Stat box Traders pulled another $1 billion from the QQQ Nasdaq 100 fund on Thursday. Over the past 5 days, the fund has averaged an outflow of $588 million per day, the 6th-largest outflow of the past year. |

Overseas markets are stepping up

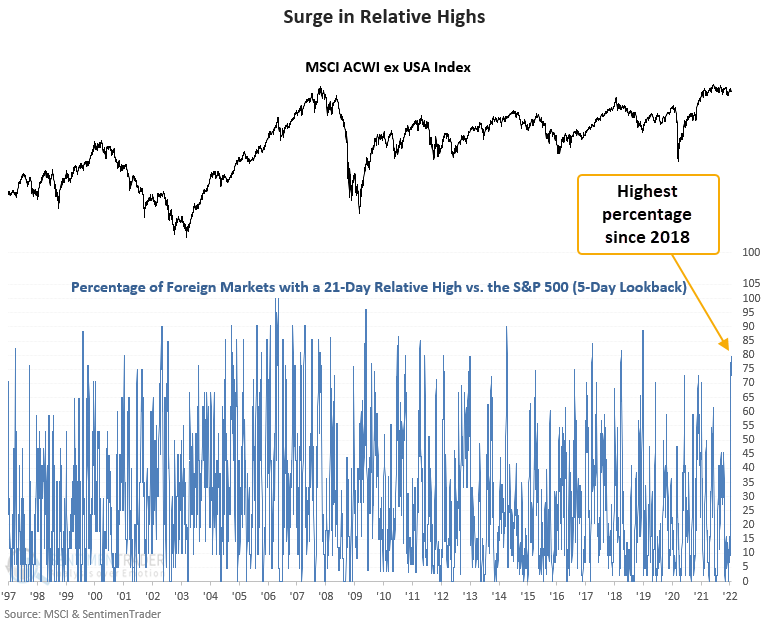

In 2021, most foreign markets underperformed the most widely followed domestic benchmark. The underperformance is now reversing, with 86% of the country ETFs that Dean tracks outperforming the S&P 500 on a YTD basis.

The percentage of foreign markets registering a 21-day relative high versus the S&P 500 surged to the highest level in more than 3 years.

In a recent note, Dean shared a trading signal that suggested the MSCI ACWI ex USA index could outperform the S&P 500 on a medium-term basis. While the trade is only four days old, the global benchmark outperforms the S&P 500 by 200 basis points.