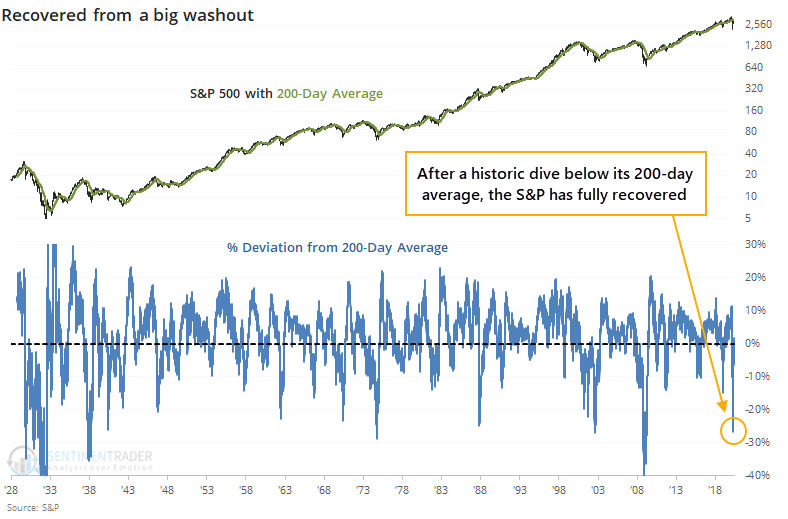

The most important index in the world has recovered from a devastating deviation

In what almost seems like no time at all, the S&P 500 has recovered above its 200-day moving average. That's quite a feat considering it was more than 25% below its average in March, one of its worst deviations from trend ever.

What's truly remarkable is how quickly it's gone. On average, it has taken the S&P more than 200 days to close above its average after falling more than 20% below it. This time, it took a mere 56 sessions. No other instance even comes close.

Once the S&P moved back above its average, it continued to rally for the next week, then started to fall apart in several cases. Only that one from 1962 still showed a gain after three months. It's a good sign that the S&P is back above its average, but we shouldn't necessarily count on it remaining above.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- In the S&P 500, the percentage of stocks above their 50-day moving averages cycled from < 10% to > 90%

- There was a similar move in small-cap stocks

- The percentage of major indexes around the world above their 200-day average has risen above 0

- More and more Australian stocks are rising above their medium-term averages

- Dumb Money is now more confident about a rally than Smart Money

- The Stock/Bond Ratio has returned to neutral

- Risk Appetite is rising