The grandaddy of thrusts with a perfect record

Key points:

- The granddaddy of breadth thrusts has triggered on the NYSE

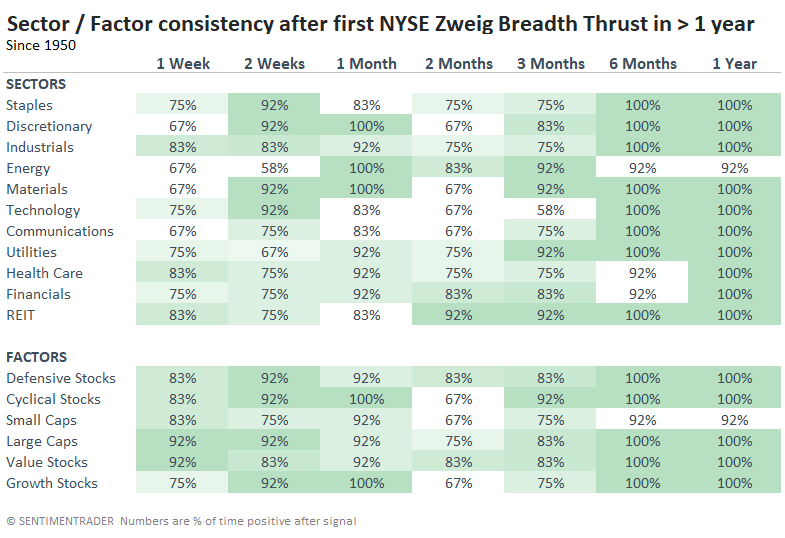

- Since 1950, the signal has had a perfect track record of gains across most sectors

- Before 1950, there were some failures in the 1930s

The granddaddy of thrusts has triggered

Everyone (well, "everyone") will be talking about thrusts from the past week. These have become a more and more popular topic over the past ten years, leading knee-jerk contrarians to determine that they are no longer effective because what everyone knows isn't worth knowing.

Fair enough, but we've seen limited evidence that their efficacy has diminished. I say "limited" and not "no" because various thrusts did give false signals during 2022. Whether that's because it's just one of those things - nothing works 100% of the time - or because the market structure has changed is impossible to know. All we know is that if they continue to give more false signals than they have in the past, then we have reason to believe something has changed, whatever that something is, and we should weigh them less aggressively.

The gold standard of breadth thrusts has become the Zweigh Breadth Thrust from well-respected late analyst and money manager Martin Zweig. A 10-day exponential moving average of the NYSE Advance-Decline figure must cycle from below 40% to above 61.5% within ten sessions.

Tomorrow, we'll see how these Thrusts have been spread out among sectors and smaller stocks, which has preceded compelling bullish environments over the past 70 years.

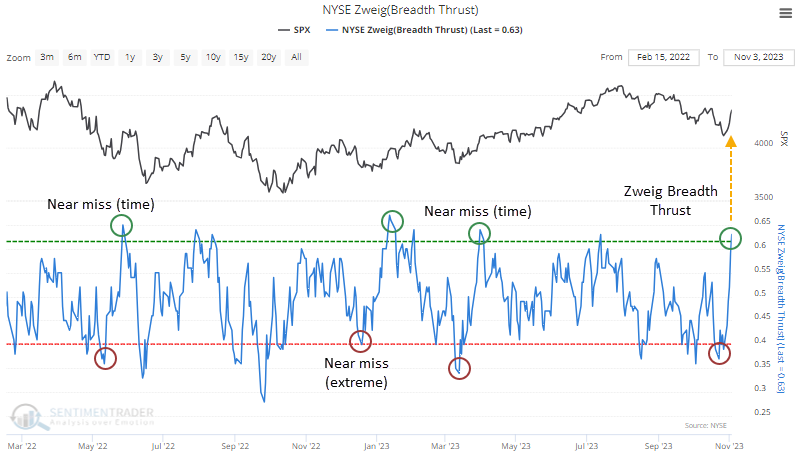

Across all stocks traded on the NYSE, the traditional Zweig Breadth Thrust just triggered after several very near misses since the 2021 peak.

This will vary depending on the data source, but according to our data, it has been triggered 19 other times since 1928. Those 1930s signals were painful for those hoping to hop onto a new uptrend, as they suffered an almost immediate rug-pull.

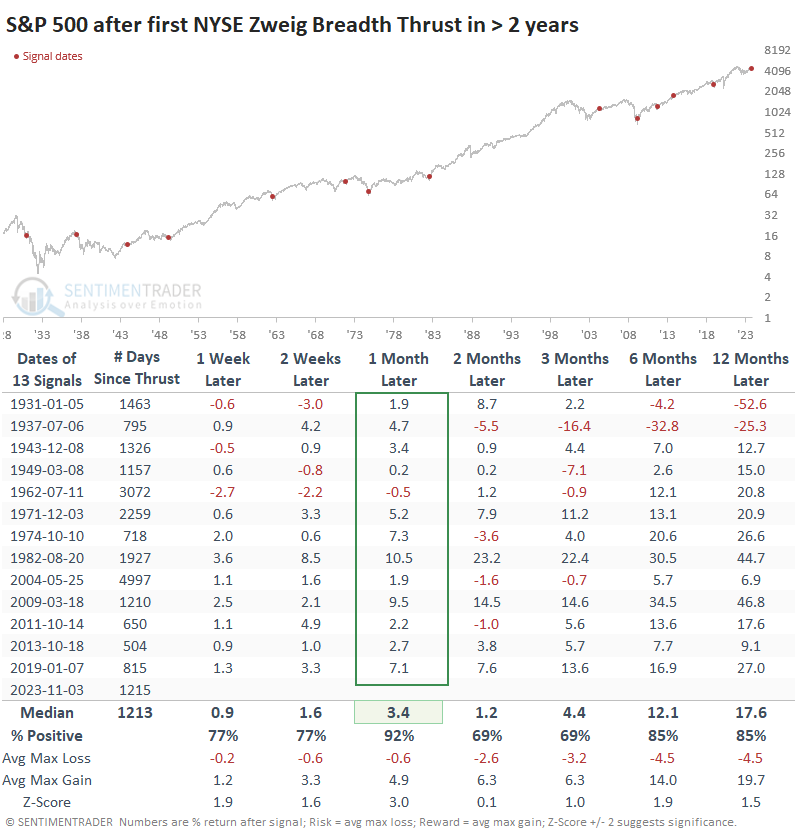

If we lengthen the time between signals and only look at the first Thrust in at least two years, even the 1930s signals preceded rallies over the next month.

Modern markets never declined after a ZBT

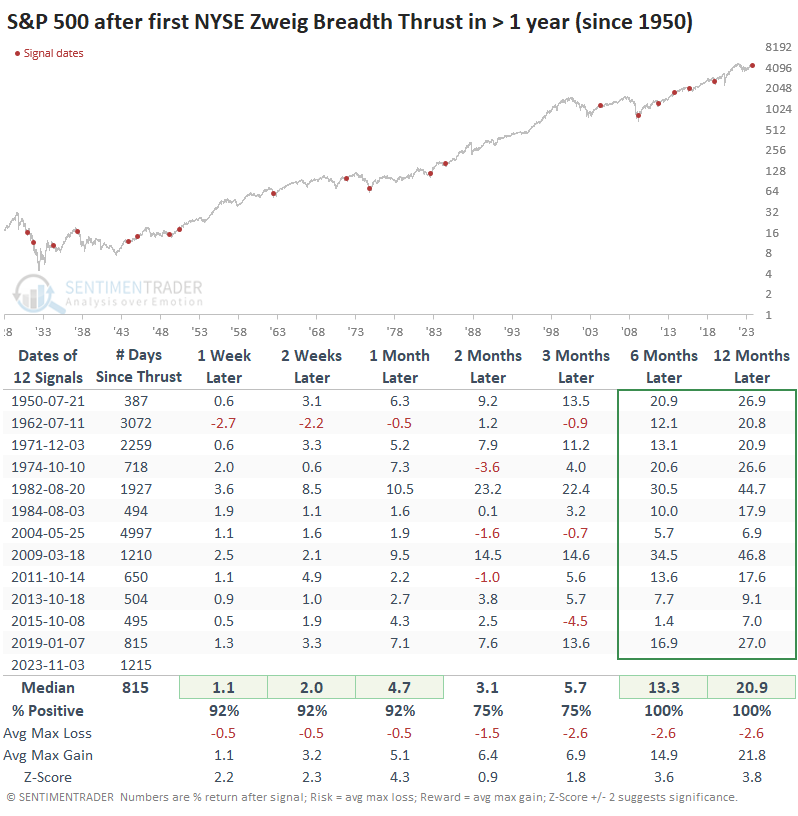

It's arguable whether signals from 90 years ago apply to modern markets, but that's an individual determination. If we want to focus on more modern markets when there were more stocks trading, regulations were heartier, and professional money managers were more of a force, then the S&P 500 never suffered a loss 6-12 months after these Thrusts.

The ratio of maximum losses to maximum gains across time frames was even more impressive. None of them suffered more than a -10% loss at any point within the following year.

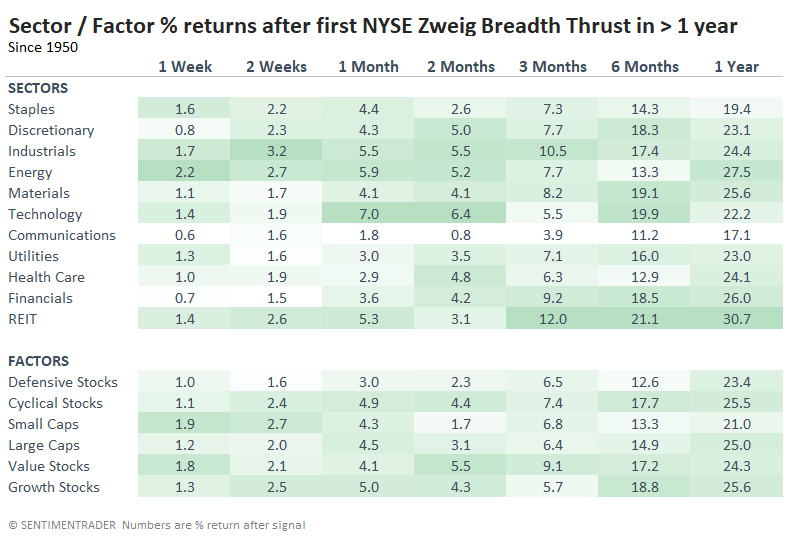

Among sectors and factors, Technology stocks enjoyed some of the best returns, but it was pretty much just the best entrée among a beautiful buffet.

Consistency across them was excellent. Only Energy and Small Caps suffered a loss a year later.

What the research tells us...

We'll undoubtedly see a bevy of notes about various aspects of the strong rebound from last week. Bulls will tout cherry-picked and data-mined examples with perfect track records, while bears will doubtlessly trot out the well-worn and mostly debunked idea that the strongest rallies only happen in bear markets. People never change.

The Zweig Breadth Thrust could be accused of being data-mined partly because it contains very specific criteria. What it has going for it is a long history in real-time and an excellent track record despite its origin and popularity. Unless these signals stop working consistently, we will continue to give them a heavy weight, and the last week has triggered several compelling reasons to expect buyers to continue to show interest in stocks.

You can find out more about Jason at White Oak Consultancy LLC (https://whiteoakconsultancy.com/).