The fear gauge suggests stocks will rally in September

Key points:

- The Volatility Index (VIX) diverged from its seasonal pattern and closed below 14 in August

- Similar contractions in volatility resulted in an 89% win rate for the S&P 500 over the next month

- Cross-asset volatility continues to hover near the low end of its annual range

The Volatility Index (VIX) flashes a buy signal for stocks

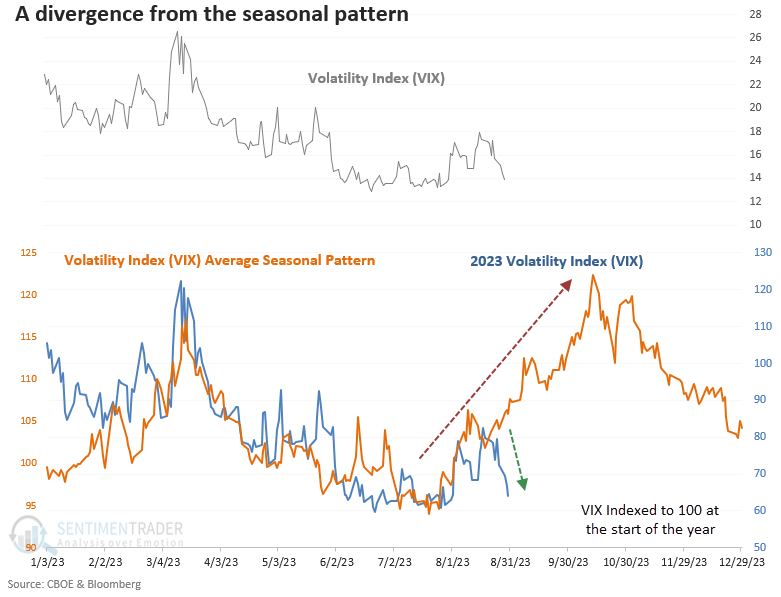

In a research note in June, Jason shed light on the annual seasonal pattern for the Volatility Index (VIX), underscoring how the fear gauge tends to bottom in July and rise into October.

While the VIX bottomed near the annual seasonal low since 1990 and rose in unison with historical trends, its trajectory took a notable turn in recent weeks, plummeting below 14 on Wednesday.

Let's assess the outlook for the S&P 500 when the Volatility Index (VIX) falls below 14 in August.

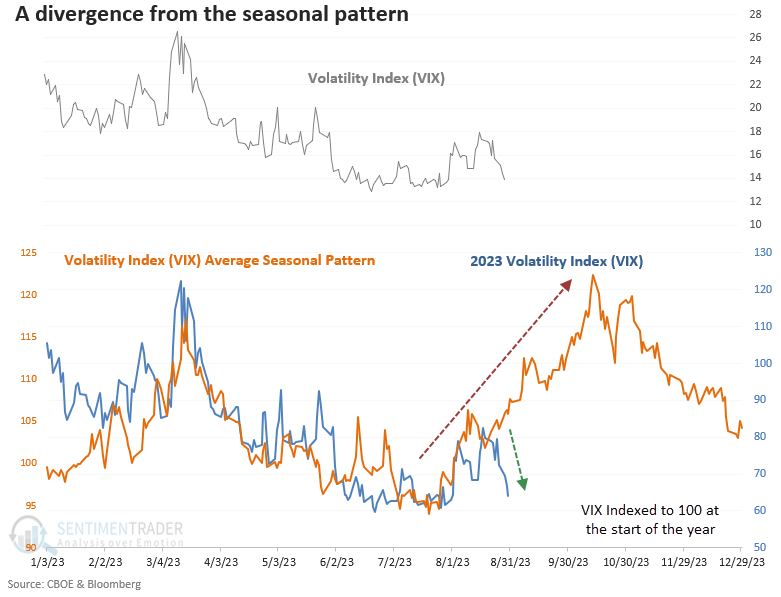

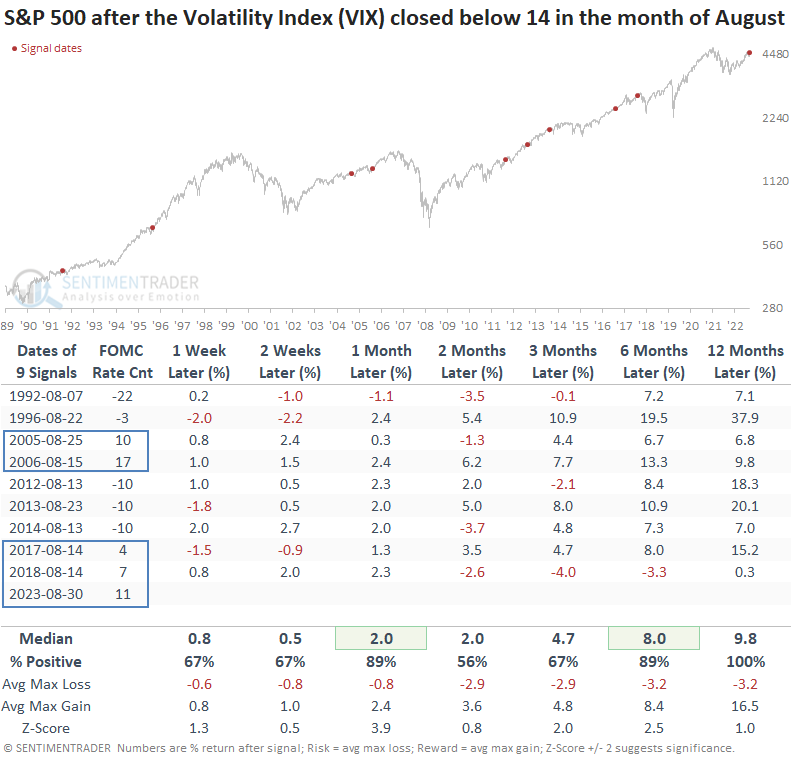

Similar volatility readings in August led to excellent returns for the S&P 500

When the Volatility Index (VIX) crossed below 14 in August, the S&P 500 rallied 89% of the time over the subsequent one and six-month periods. A year later, the large-cap index was higher every time despite several precedents that coincided with FOMC tightening cycles.

Over the next two months, the max loss never exceeded -4%. The August 2018 precedent is the only time a signal occurred ahead of a significant decline. Still, the S&P 500 gained 3.2% before peaking.

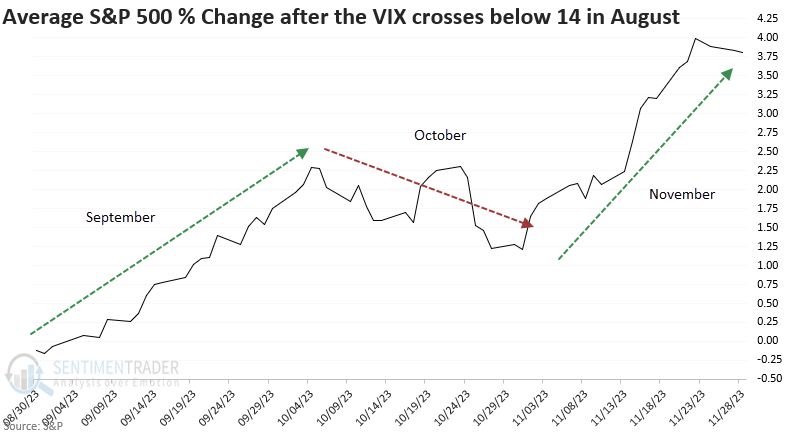

A potential year-end path for the S&P 500

When the Volatility Index falls below 14 in August, the S&P 500 tends to rally in September, consolidate/correct in October, and rally again in November. So, the traditional seasonality trends for stocks might play out differently than expected.

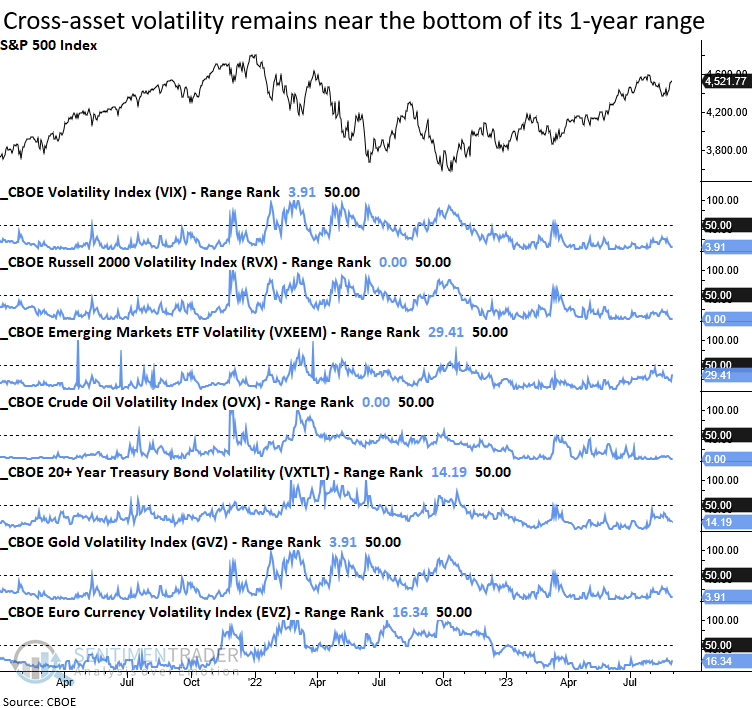

What about other asset classes

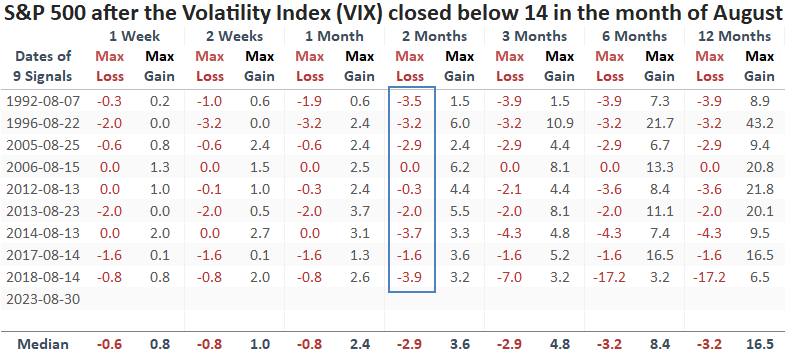

The fear gauge for various asset classes continues to hover near the lower end of their respective 1-year ranges, denoting a bullish backdrop for risk assets like stocks.

What the research tells us...

The Volatility Index (VIX) closed below 14 in August, triggering a bullish development for stocks. After similar signals, the S&P 500 was higher 86% of the time a month later, suggesting investors should not be cautious during the weakest month of the year, September. Should stocks rally in September, a consolidation/correction in October should set up a year-end rally.