The dollar ends its medium-term downtrend amid sour sentiment

Many markets seem to be keying off each other in recent weeks, with some version of a move in rates driving the dollar which drives gold and tech stocks which drives the broader market.

Rising above the 50-day average

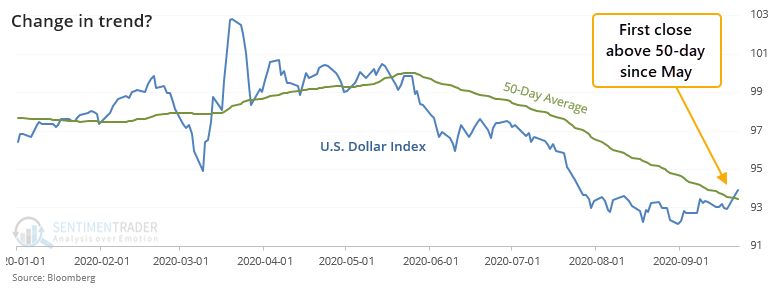

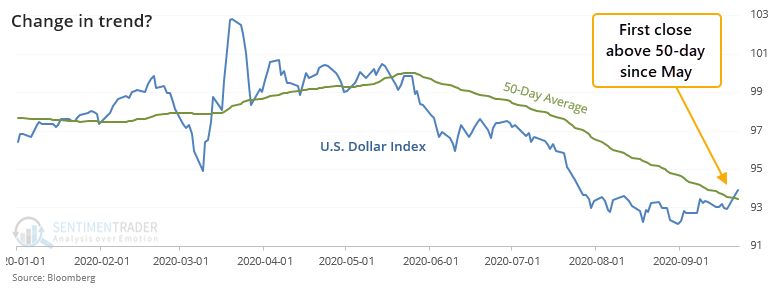

It's interesting how trends and streaks in one market closely are closely overlapping those in others. For example, the S&P 500 just slid below its 50-day moving average for the first time in months and then on Tuesday the U.S. dollar just rose above its own 50-day for the first time since May.

That ended a streak of 90 sessions that the dollar had been below its medium-term average, ranking among the longest streaks since 1975.

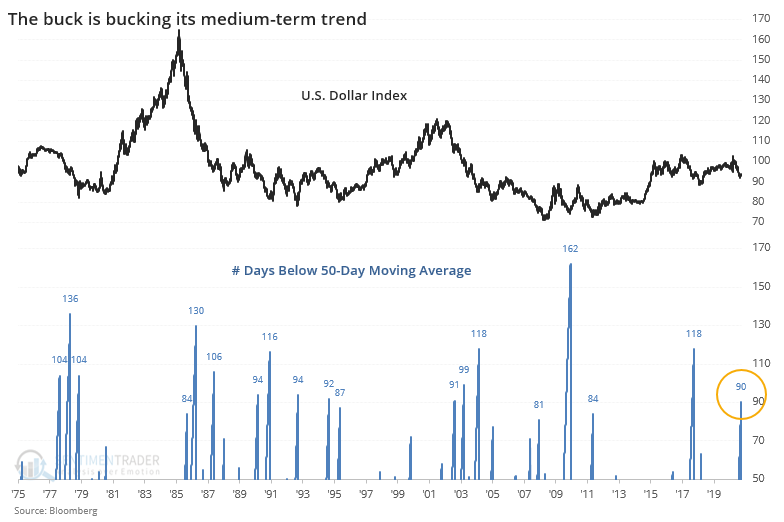

As we've seen in past studies, it's been hard for the dollar to hold any kind of positive momentum when sentiment toward the currency is poor. That's no different after those times it ended a streak of at least 3 months below its 50-day average. The table below is filtered to only include signals when the dollar was also at least 3% below its 200-day moving average at the time.

Returns over the medium-term of 2-3 months were very poor, and the risk/reward skew was negative up to a year later. Out of the 19 signals, 16 of them saw a negative return at some point during the next 1 - 3 months.

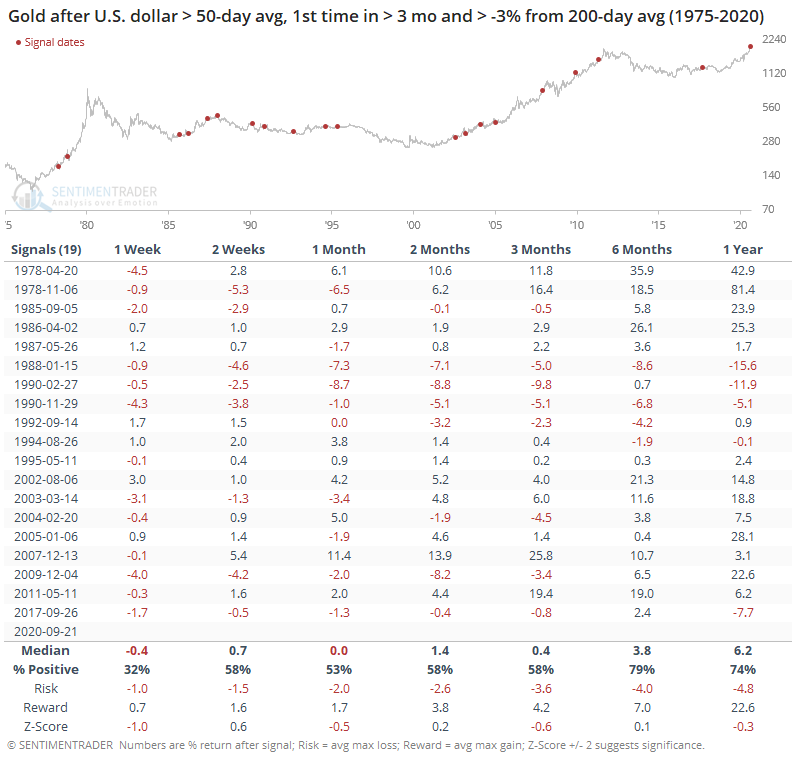

If the dollar did poorly, then gold should have done well. That was kinda-sorta the case but it was not a strong edge.

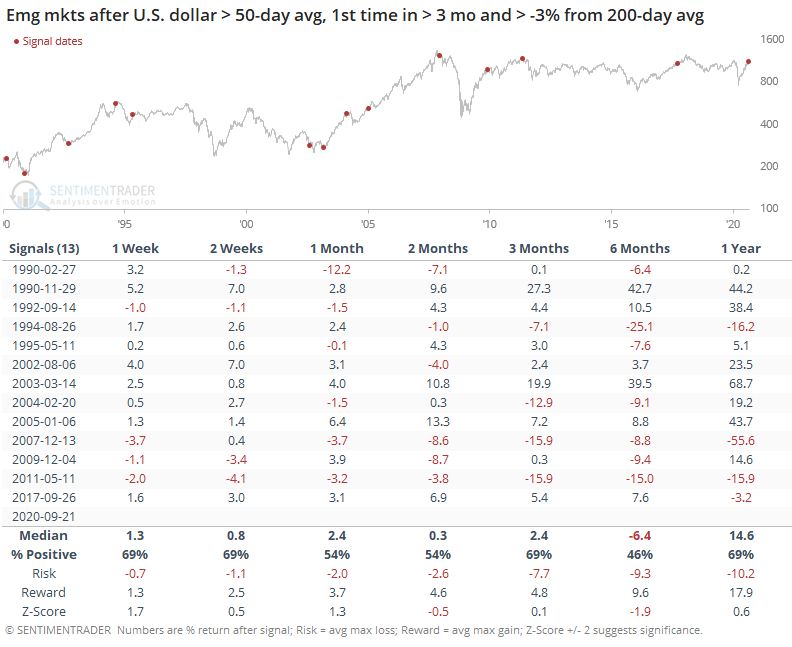

Same goes for emerging market stocks, using the MSCI Emerging Markets Index.

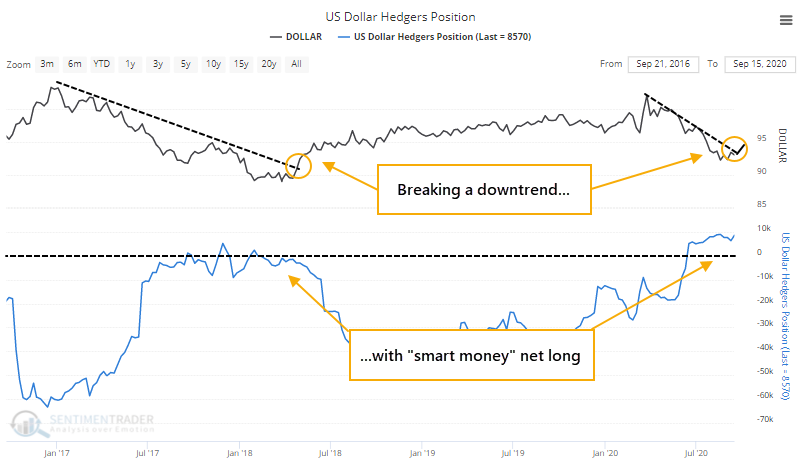

The "smart money" is net long

Sentiment toward the dollar in the media, both traditional and social, seems to have quickly shifted. Two of the major factors cited are that speculators are heavily short and it's breaking a multi-month downtrend line. Because commercial hedgers by definition take the other side of both large and small speculators, this means that "smart money" hedgers are net long.

When hedgers were long in 2018 and the dollar broke its downtrend, it went on a nice bull run. There are two problems with this:

- Trendlines are entirely subjective and prior failures are always ignored, and

- Hedgers have been long for months already with no effect

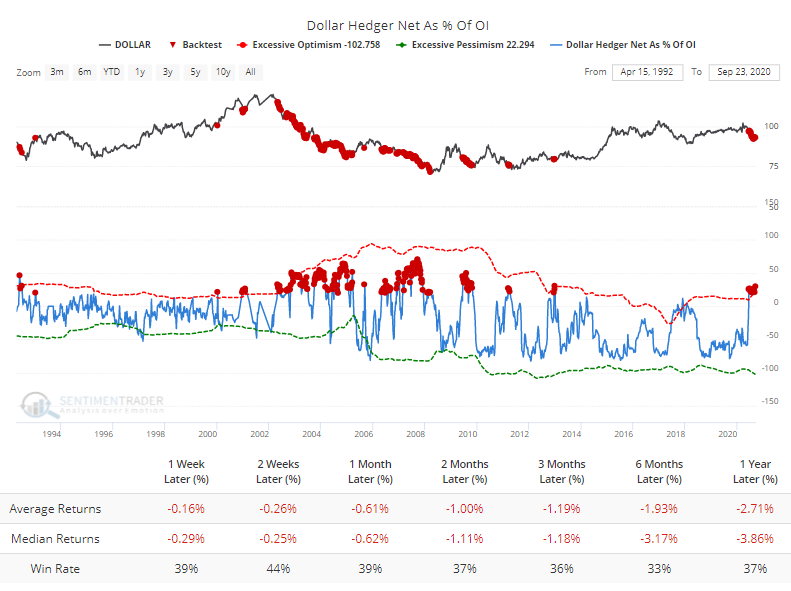

Hedgers are net long more than 20% of the open interest in the dollar. Using the Backtest Engine, we can objectively see how the dollar has performed going forward.

Unlike most contracts, the dollar hasn't responded well to extremes in this data. Currencies are "trendier" than most and when a long-term trend takes hold, it's tough to turn it on sentiment alone.

Sentiment has been extremely poor

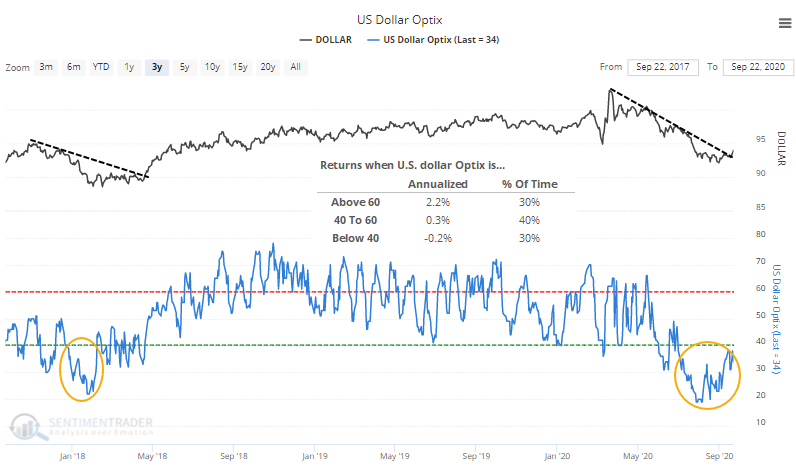

And there's no doubt that sentiment has been sour. The Optimism Index (Optix) hasn't been above 40 for nearly 60 days.

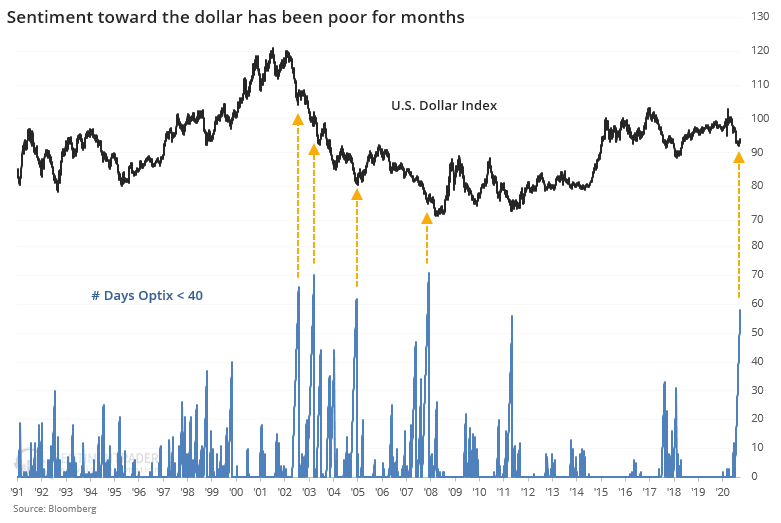

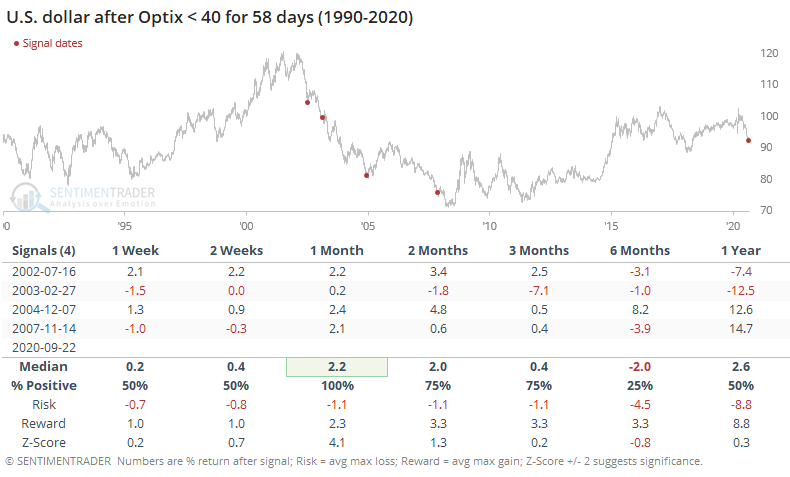

Over the past 30 years, there have been only 4 other times when we've gone this long without a reading above 40. That's nearing an all-time record, just surpassing another long streak in 2011 that coincided with the end of the long bear market.

The others weren't so positive for the dollar. By the time optimism had been this low for this long, the buck did bounce over the next month each time, but fell back in the months ahead after 3 of them.

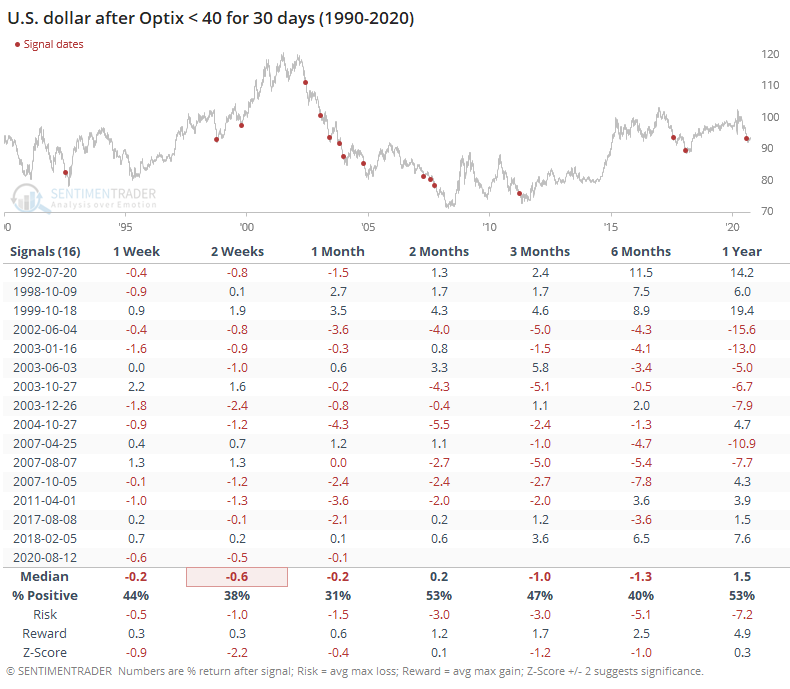

The sample size is small so if we look at streaks of 30 days with an Optix below 40, we get quite a few more precedents.

The earlier chart showing the Optix for the dollar over the past few years shows that when optimism is below 40, the dollar's annualized return is -0.2%; when the Optix is above 60, its return is +2.2%. The dollar is one of those very few markets where sentiment extremes often work less as a contrary indicator and more as a confirming one. As long as the Optimism Index consistently hangs below 50, we'd be more inclined to disbelieve short-term rally attempts.

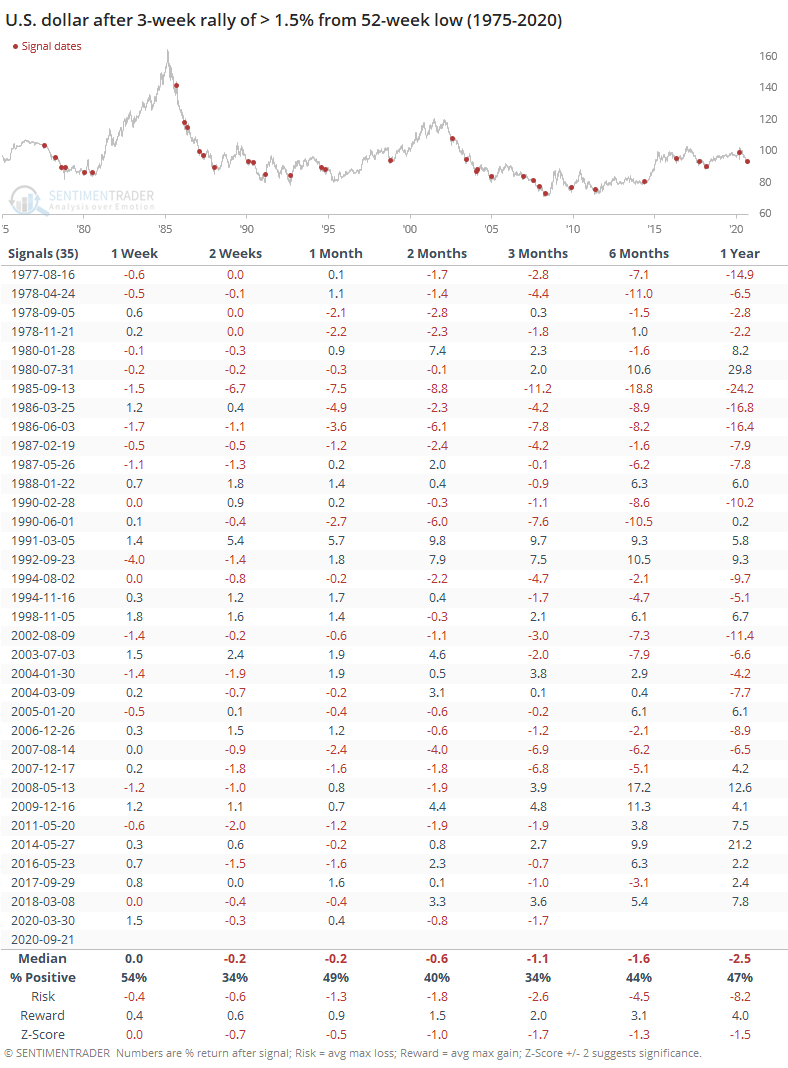

A 3-week rally from the low

The dollar bottomed 3 weeks ago and has rallied more than 1.5% since then. Maybe that's enough to qualify for "this time is different" as other counter-trend rallies tended to peter out sooner, or so it seems. If we go back to 1975 and look for all rallies of 15 days from a 52-week low, with gains of at least 1.5%, then we get the following.

Most of them added to gains over the next week, then quickly fell apart. Remarkably, 30 out of the 35 signals saw a negative return at some point between the next 1-3 months.

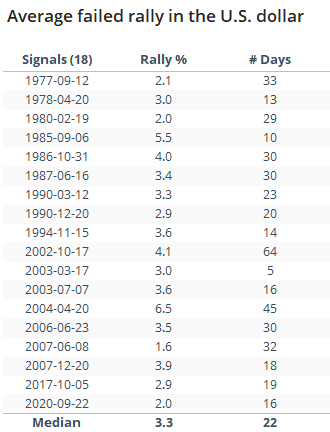

Below, we can see how far the average failed rally in the dollar tended to go. These are times when the buck hit a 52-week low, then rallied to at least a 2-month high, then fell to a new 52-week low at some point within the next 6 months.

On average, these rallies lasted 22 days, gaining 3.3% from the low. So far (using intraday data through Wednesday), this rally has gone 16 days with about a 2% gain. So, if this were to match the typical counter-trend failed rally, it would go about another week and about another 1% before failing.

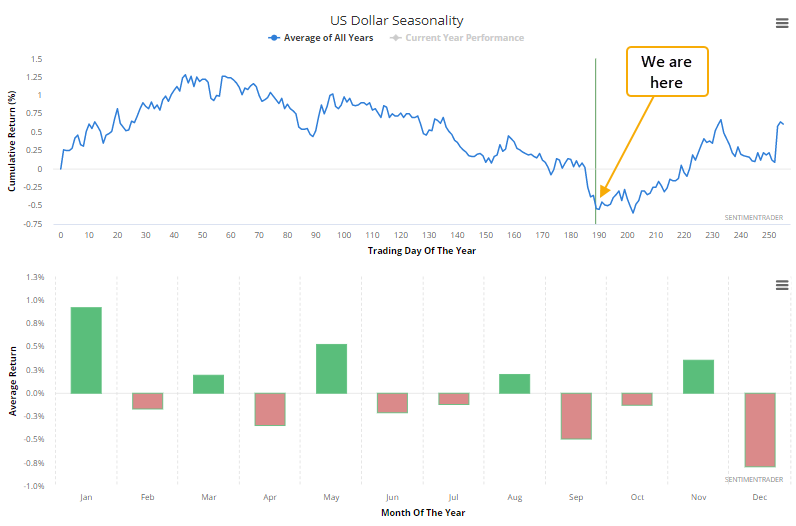

Breakout, mean-reversion, and seasonality

If we only go back a few years, then the combination of a potential trendline break, short-covering potential, and positive seasonality seems to work toward a further recovery in the dollar.

The main problem with this argument is that it's shortsighted and we'd have to put almost all of our weight on 2018 as a template for a recovery. Going back further shows us that this has not been a reliable combination for a sustained dollar rally, so we'd have to see sentiment improve, and stay buoyant, before the risk/reward firmly changes to the positive.