The Closest 200-Day Comparisons

It's easy to look at a chart and cherry-pick dates to say, "Hey this looks just like that!" and make a conclusion. One of the common ones lately has been comparing the last 200 days to the initial thrust off past bear market bottoms.

Fair enough, but the past 200 sessions have been remarkable for their calm. Most other kick-offs have suffered at least some volatility along the way.

If we use the objective calculations we always do for analogs, then we can look at other 200-day periods in the S&P 500's history to see which ones have the highest correlation to the recent past. It turns out there were 18 other stretches with a very high correlation, when the S&P was also trading at a multi-year high at the time.

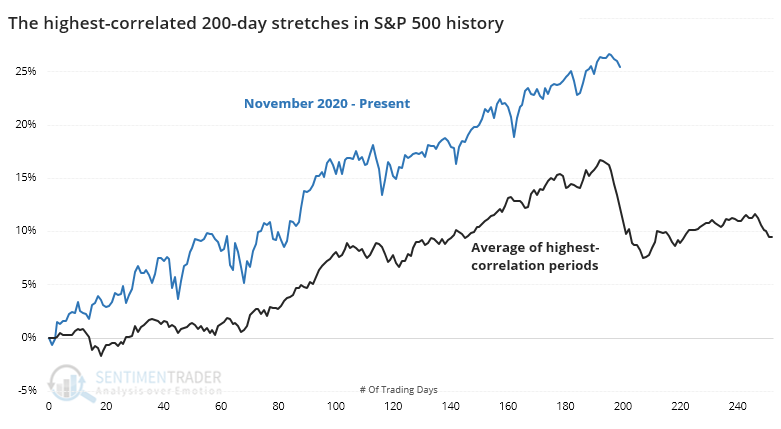

The chart below shows the last 200 days in the index (blue) along with an average of the 18 stretches with the highest correlation (black).

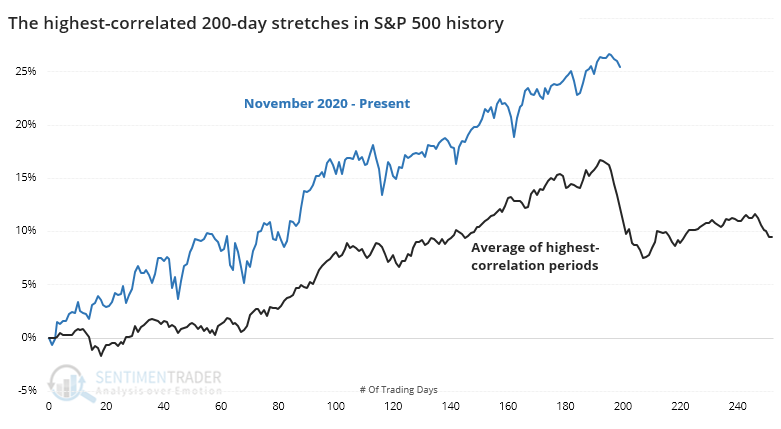

The chart shows that the average analog suffered a pullback right about now. When we look at thumbnails of the 10 most recent occurrences, we see how consistent that was.

A TENDENCY FOR SHORT-TERM DIPS

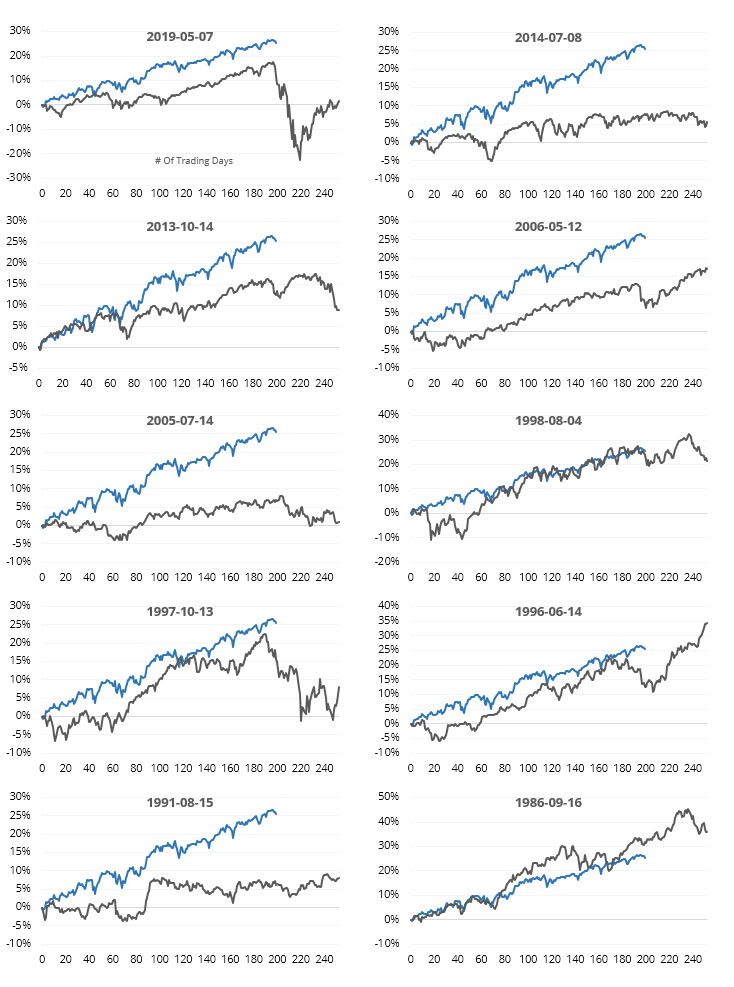

What we should be most interested in is future returns. If we look at the ends of the 200-day periods shown above, then we can see how the S&P fared going forward.

Shorter-term returns were not great, reflecting those pullbacks that we saw in the thumbnails. Across most time frames, the S&P's returns were below random, and the overall risk/reward was very poor.

One difference with our current market is just how strong the momentum and (mostly) breadth have been. The S&P just ended a historic streak with more than 75% of its members above their long-term trends, which showed that any shorter-term dips had a strong tendency to rebound in the months ahead. The current trend has been so calm, for so long, that an interruption would be par for the course but it would be rare for it to turn into a rout just yet.