Tech's streak is historic, beating every other sector by more than 5% this year

We just finished 120 trading sessions of 2020, and one pattern is clear. It's no surprise - tech rules the kingdom.

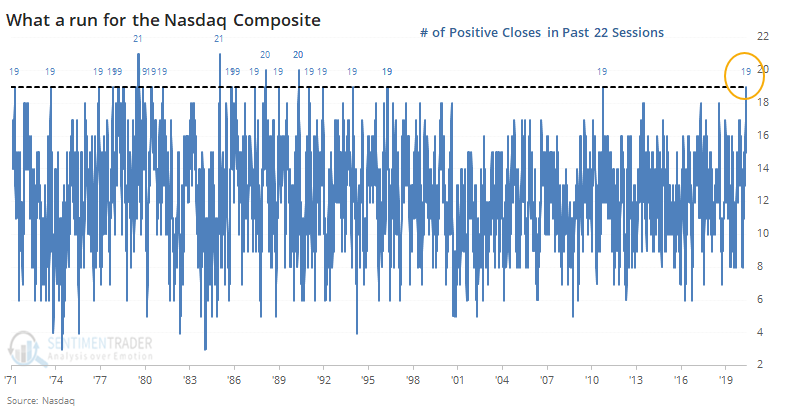

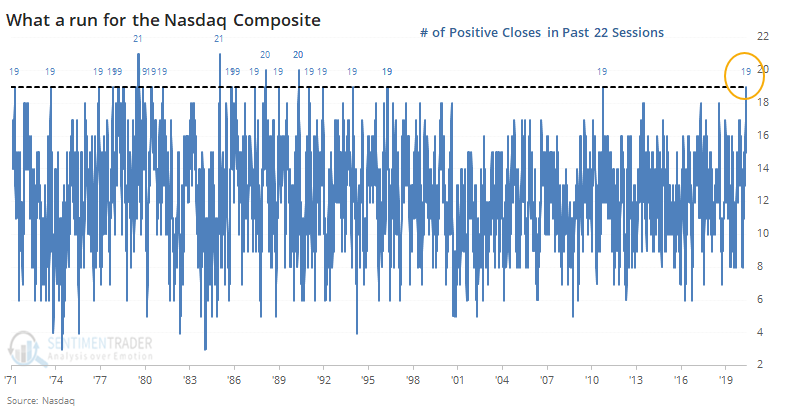

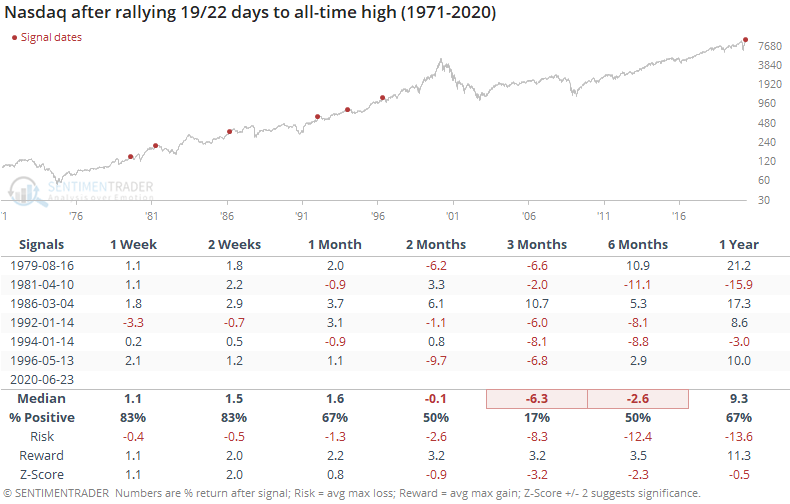

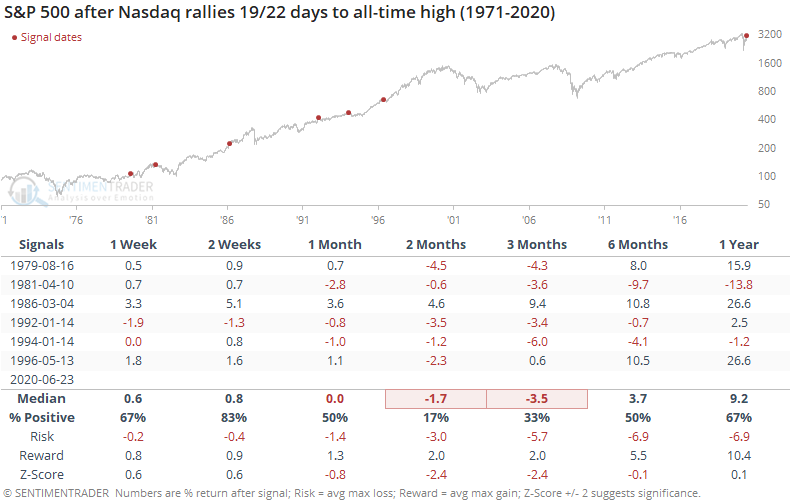

The Nasdaq Composite rallied 19 out of 22 days heading into Wednesday. That's a tie for the best streak in almost 25 years.

It also notched an all-time high for good measure. It hasn't enjoyed this kind of a run since the 1990s.

The only time the tech-heavy index managed to escape unscathed (for a while) from this kind of buying spurt was in March 1986. All the others showed lower prices over the next three months.

It was also negative for the S&P 500, with the losses occurring quicker than they did for the Nasdaq (a reflection of momentum persistency).

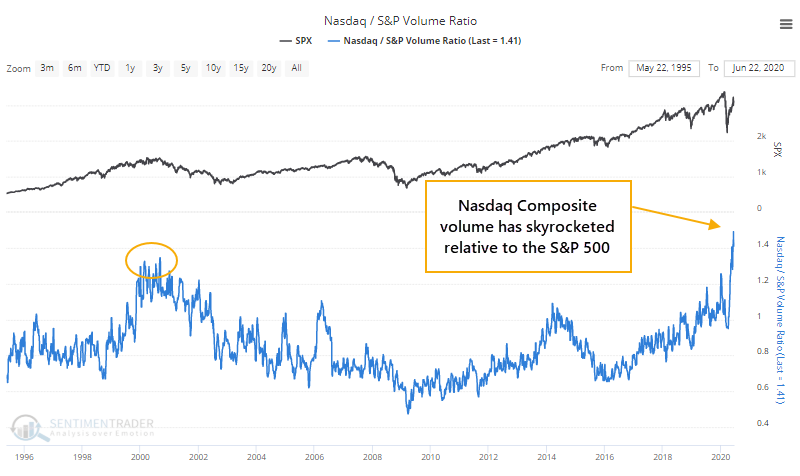

As Troy noted earlier, volume has been jumping in Nasdaq stocks relative to other parts of the market. The version we show on the site compares a 10-day average of Nasdaq Composite volume to S&P 500 volume. It just curled down from an all-time high.

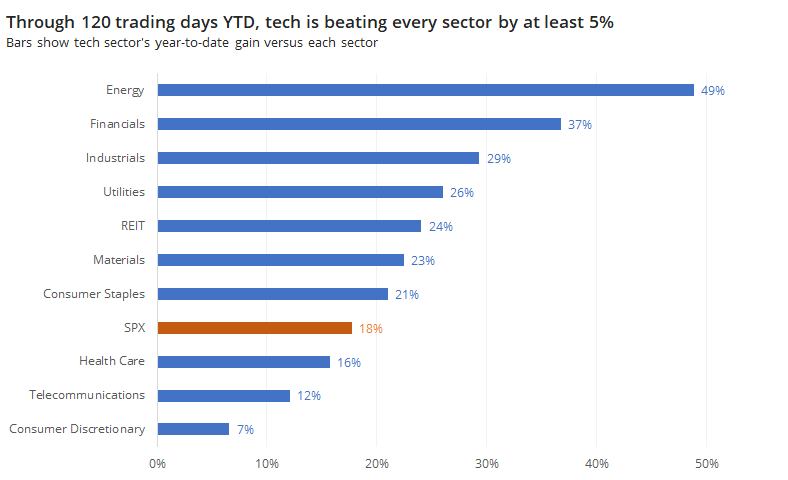

Year-to-date, the technology sector is beating every major sector by more than 5%. Its lead over energy is a whopping 49%, while the sector closest on its heels is consumer discretionary, and even that is lagging by 7%.

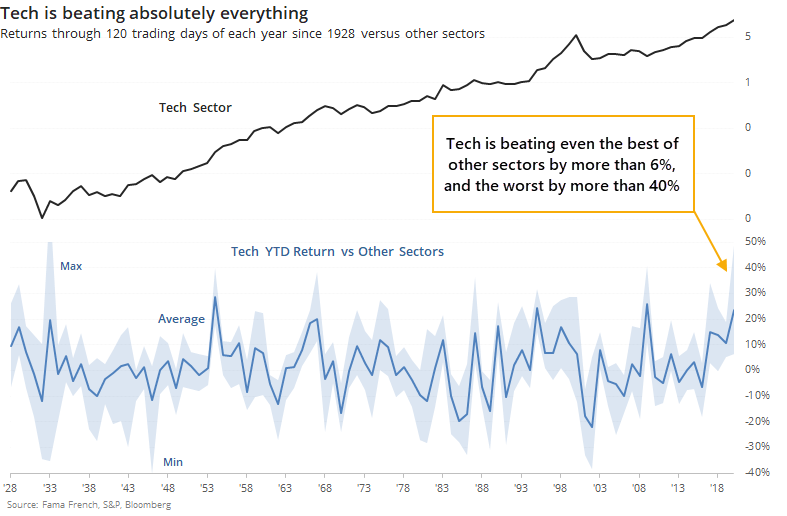

Going back to 1928, there haven't been too many years when tech has been such a winner.

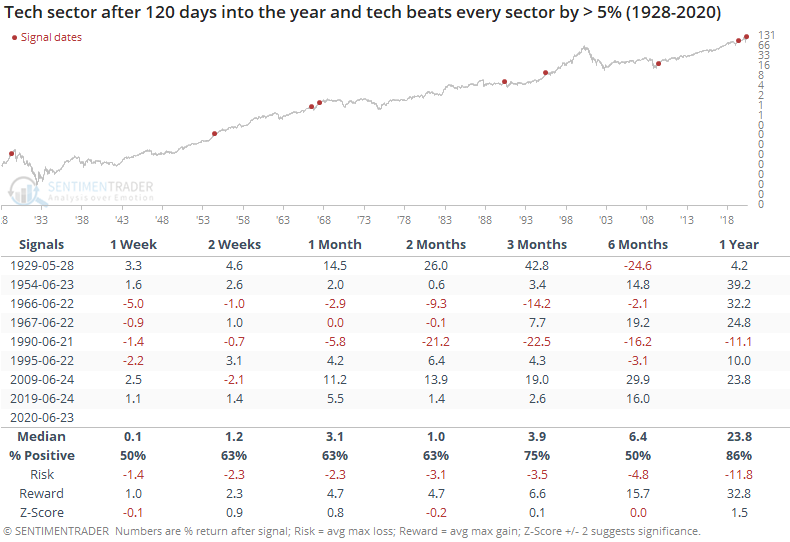

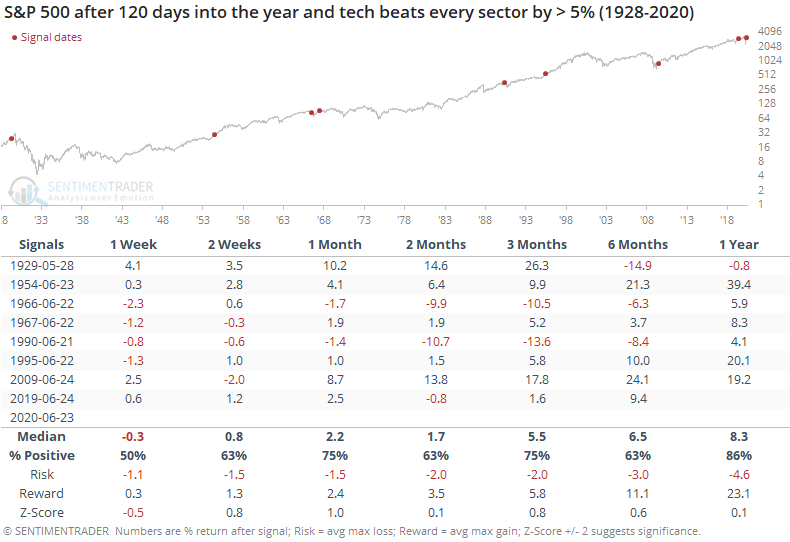

The table below shows returns in the tech sector after every year since 1928 when the sector was beating all other sectors by at least 5% through 120 trading days of a year.

Returns weren't bad, but not great, either. Tech's returns were about in line with random across most time frames. For the S&P, it was about the same, but a bit more positive.

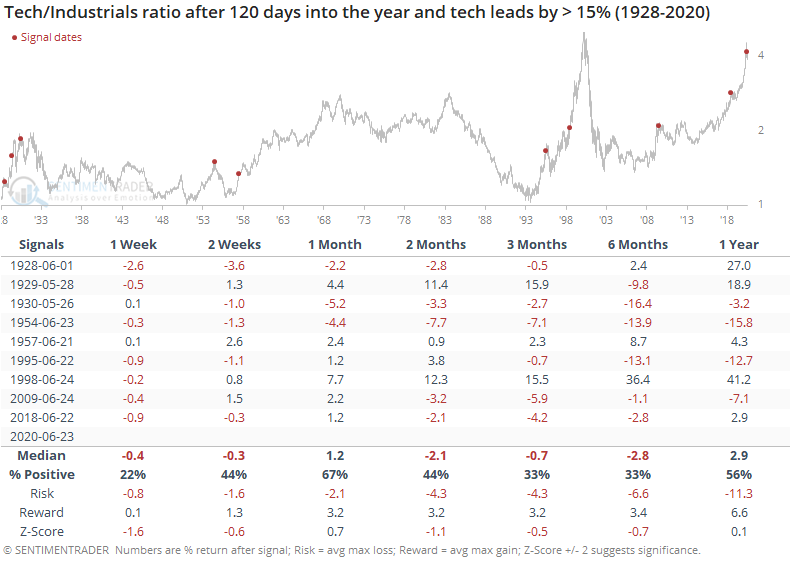

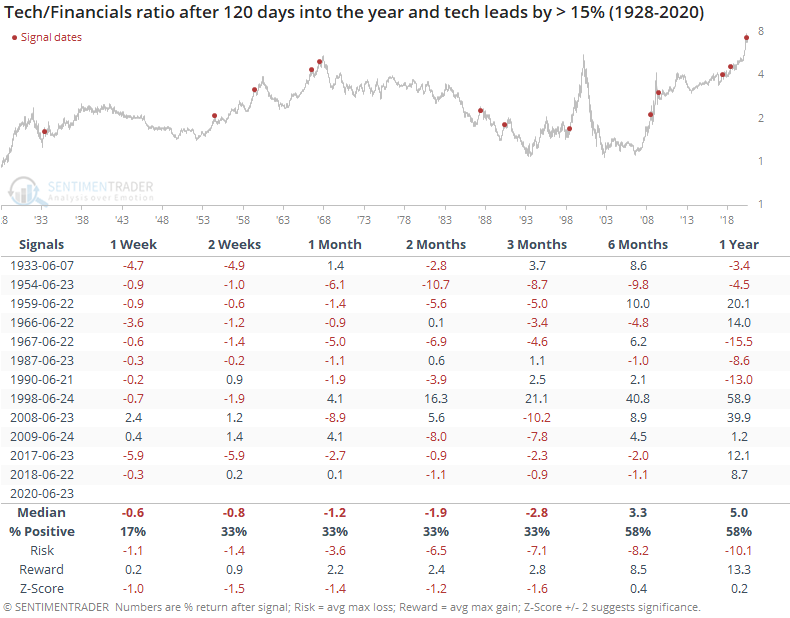

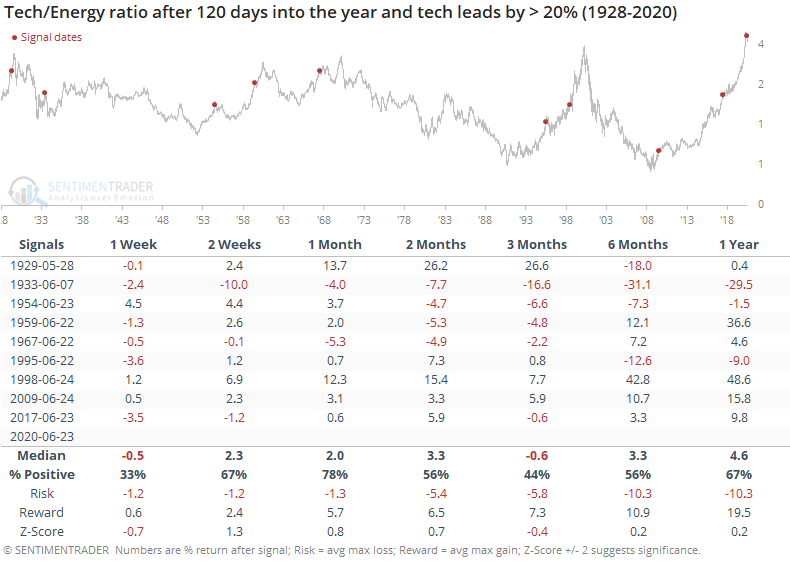

Among sectors, this year's tech outperformance is especially notable against industrials, financials, and energy stocks. Tech's outperformance this year ranks as the most extreme, or nearly so, versus each of those sectors.

We already saw that its weight in the S&P is approaching 30-year extremes versus industrials and financials, and it's just as extreme when going back much further.

Tech is beating industrial stocks by more than 29% so far this year. Only 2009 saw a greater spread between the two, and that just barely. Other times tech beat this sector by more than 15% through the approximate half-way point of the year, it tended to relatively struggle over the next 3-6 months.

Tech is beating the financial sector by more than 36%, the most ever. The next most extreme outperformance through 120 days was 29% in 2009. Other times it was beating financial stocks by more than 15%, tech had a strong tendency to give back some relative performance.

It's beating energy by more than 48%, also the most ever. The next most extreme was 34% in 2017. Those stocks had less of a tendency to rebound against tech, though.

Maybe there is a signal in the fact that only the first half of 2009 saw technology stocks lead other sectors by this much, in particular industrials and financials. Even then, and supported by lesser extremes, tech stocks started to become exhausted versus the other sectors.

It's a suggestion that while excuses could be made why 2020 is different, historically tech stocks have started to give back some relative performance against more meat-and-potatoes sectors after leading by this much through this part of the year.