Tech fund flows on track for a record year

There's nothing like an established market trend to spur demand for MOAR. And when fund companies see that demand from investors, they will do whatever they can to supply it.

We see this all the time. When a sector, or the market as a whole, does well, fund companies will create more ETFs, as we saw in the summer of 2015. Or the opposite - when a sector does poorly, then fund companies will quietly liquidate the funds or split the shares, like what happened with volatility ETFs in 2016.

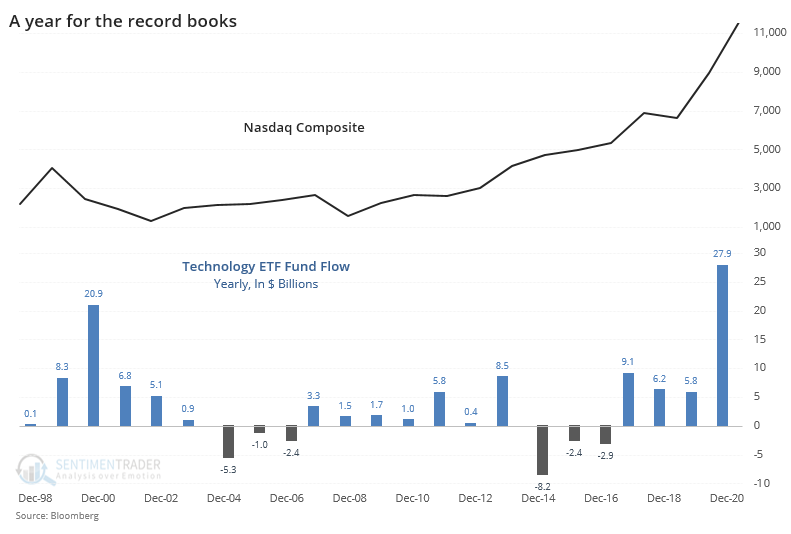

There has certainly been demand for anything tech-related. On a yearly basis, flows into ETFs with a technology focus have already surpassed 2000.

On a long-term basis, there has to be at least modest concern about the attention these stocks are getting. When any single sector becomes such a focus, there is usually something, at some point, that comes along to knock it down a peg.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A quarterly look at tech fund flows

- The creation of new technology ETFs has picked up, especially as a % of all new ETFs

- The financial sector is triggering a Golden Cross - what that's meant for the broader market

- Active investment managers are more than all-in