Stocks End Historic Trend of Long Term Positive Trends

It was quite a run, but the dip in stocks last week did a bit of damage.

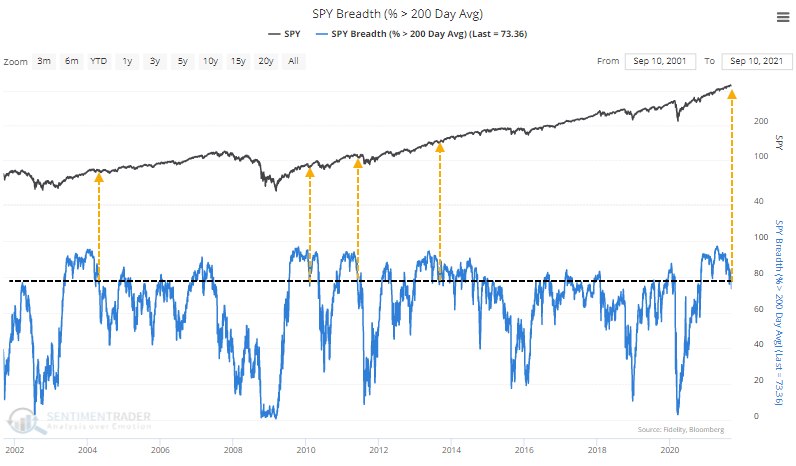

We've seen from multiple perspectives just how much of an outlier 2021 has been in terms of sentiment, breadth, and momentum. At various points since January, momentum ebbed, or negative breadth divergences triggered, then buyers came in immediately.

Yet, at no time did fewer than 75% of S&P stocks close below their long-term averages until the end of last week. For the first time in 10 months, fewer than 3 out of every 4 stocks in the S&P 500 closed above their 200-day moving averages.

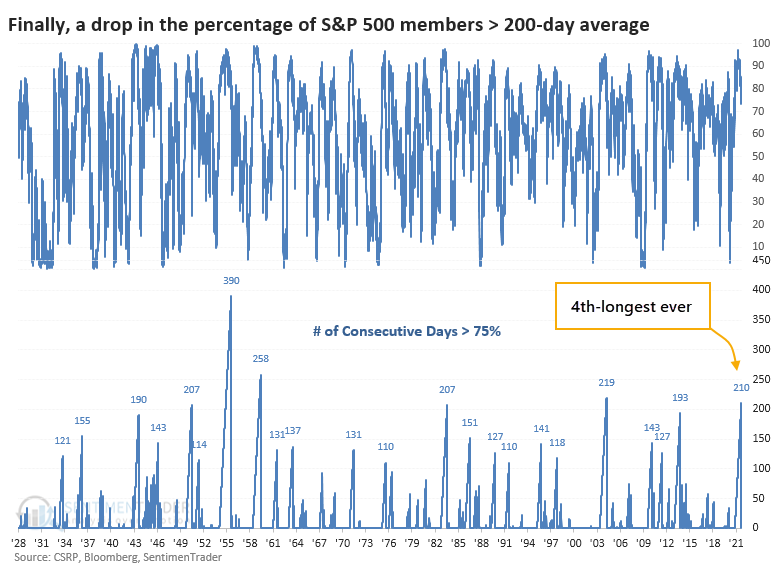

That ends the 4th-longest streak since at least 1928.

A DECENT MEDIUM-TERM SIGN

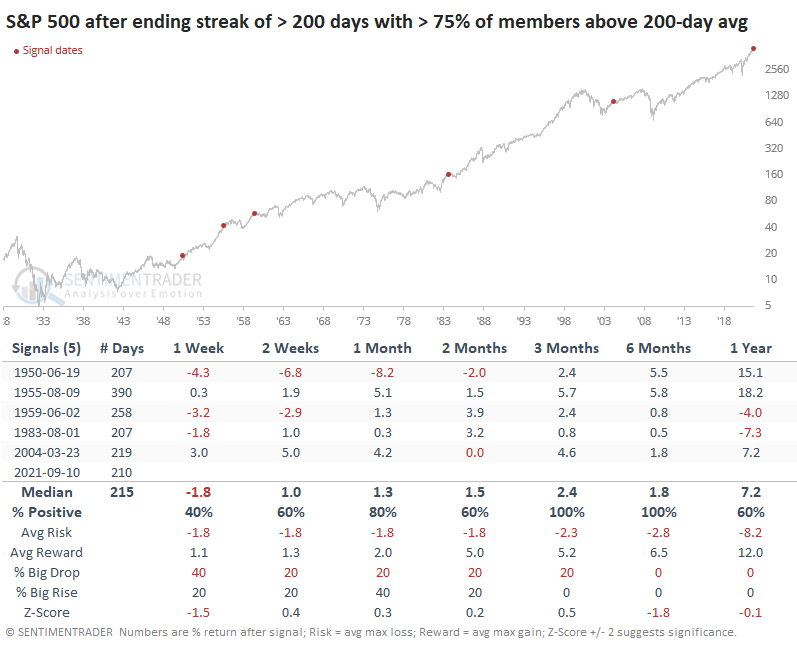

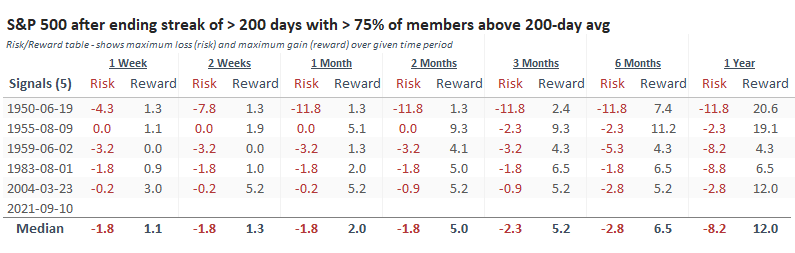

In over 90 years of history, there have only been 5 other streaks of at least 200 consecutive days. Like we see with many momentum types of data, forward returns were good, even after the streaks ended. While it did precede a big dip in 1950, the others saw minimal losses or gains over the following months.

The Risk/Reward Table highlights the positive skew, with 1950 being the clear outlier. About the only negative is that risk exceeded reward over the next 2-4 weeks after three of the five precedents.

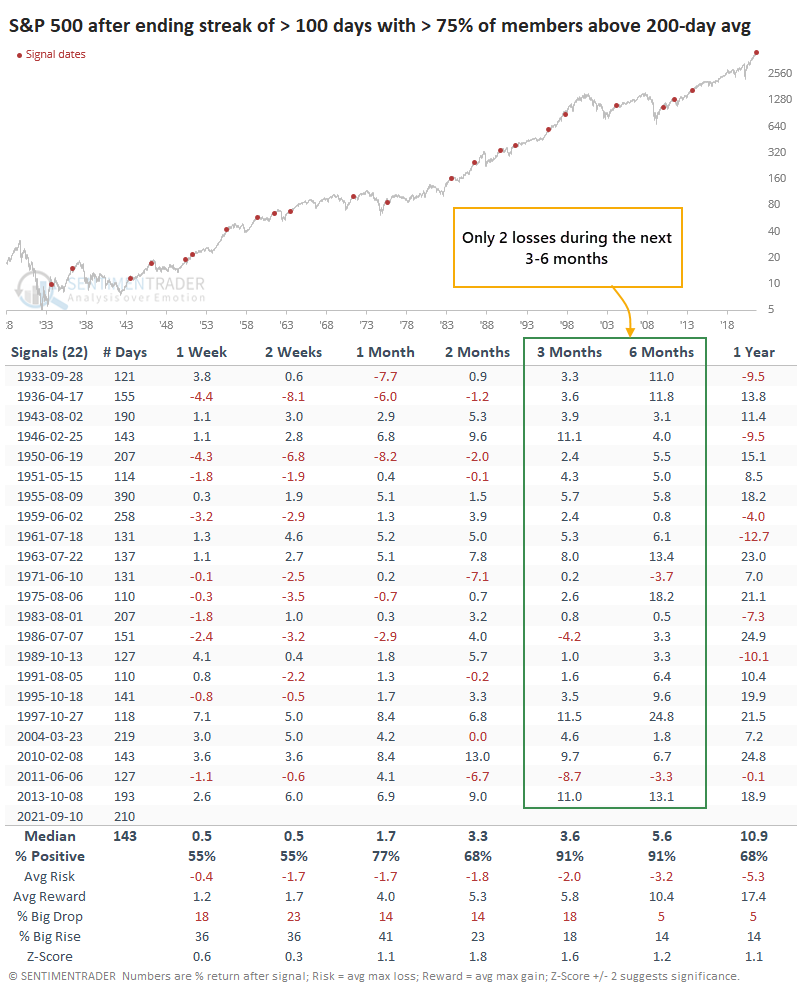

LOOKING AT A BIGGER SAMPLE

A bigger sample size is usually better, so if we relax the parameters to look for the ends of streaks of at least 100 days, shorter-term returns were mediocre, but medium- to long-term ones were very good. The consistency was impressive, with only 2 losses out of 22 signals over the next 3-6 months.

Impressive momentum has been a feature of this market since the initial thrusts off of the 2020 low. It's hard (impossible) to reconcile it against other worries like deteriorating macro conditions combined with a rising bear market probability. No worries have mattered for nearly a year, so counting on them to matter now is like tilting at windmills.

There are compelling worries out there, and there are some signs of deteriorating momentum. However, the simple fact that it has lasted so long suggests that any declines should be relatively mild and relatively brief. The longer-term worries will have more imminent respect when (or if) we see more, and longer-lasting, deterioration in the stock and corporate bond market.