Short-term optimism has spiked

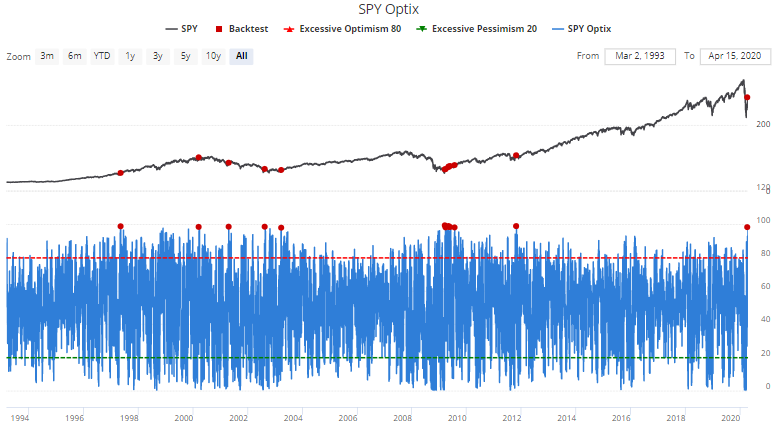

The S&P 500's rally of 27% from its closing bottom in March has pushed many of our Optimism Index (Optix) indicators for ETFs to excessive optimism territory.

This is typically a short-term bearish factor for stocks, but over the longer-term isn't really a concern. For example, SPY's Optix is at 98 as of Tuesday's close:

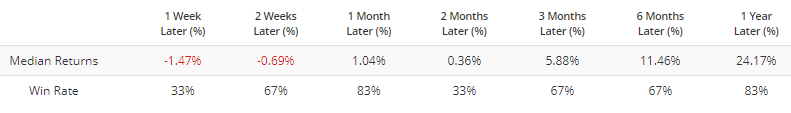

When this happened in the past, SPY faced mild weakness over the next 1-2 weeks, though it wasn't bearish after that. If we isolate for historical cases that occurred while the S&P 500 was under its 200 dma (i.e. still in a long term downtrend), SPY's 1 week forward returns were more negative according to our Backtest Engine:

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A look at the Optix values for other indexes, including overseas

- Stocks have enjoyed a huge number of Point & Figure buy signals

- We barely missed triggering multiple versions of Wayne Whaley's breadth thrusts

- What happens when the VIX drops below its 50-day average after a spike

- The Nasdaq's breadth has been "weak" (yes, that's in quotes)