Sentiment has recovered out of deep pessimism

Sentiment is starting to recover. Rising optimism is a good thing, until it gets to the point where it's extreme, and we're a long way from that point.

But rising optimism in a bull market is different from during a bear market, and this is where it gets tricky. During bull markets, extreme pessimism tends to find buyers almost immediately. We started to see pessimistic extremes as early as the end of February, and really by mid-March, yet stocks continued to sink. It wasn't a complete failure, but the subsequent drawdown was larger than we normally see after bull market panics.

Now stocks have rebounded as sentiment relaxes from its extreme. During unhealthy markets, this is where the initial rebound starts to find trouble.

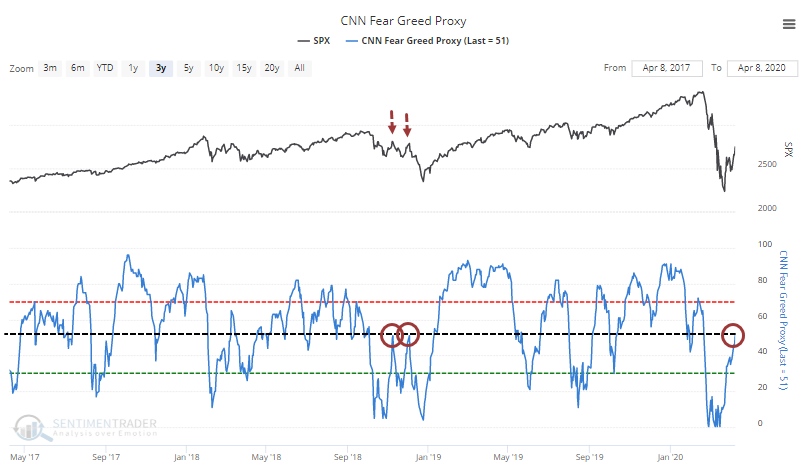

Our proxy of the CNN Fear & Greed model just hit neutral territory above 50% after an extended period with record-low readings. Bull markets typically don't see bouts of such extended pessimism, so that's worry #1. Worry #2 is that the pessimism is now gone. When this happened in the fall of 2018, the rallies immediately fell apart.

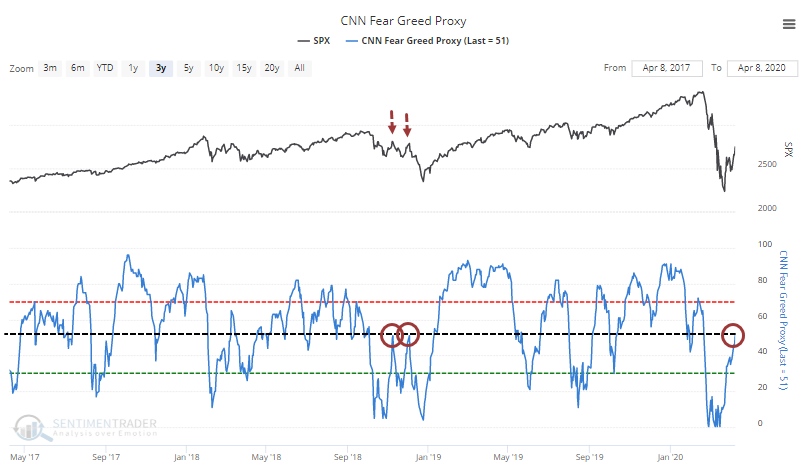

Going back to 1998, when the model had been showing pessimism for at least 30 days, including at least one day with a true extreme below 5%, then recovered above 50%, it led to some rocky returns.

Either one or two weeks later, every signal showed a negative return. That's not totally unexpected. What's less appetizing is the 3-month performance, which was solidly negative. The only time stocks managed to shoot higher virtually without interruption was in 2016.

The others saw either losses or tepid gains over the next three months. Because these were recoveries from deep and protracted pessimism, though, the 1-year returns were mostly good. It just took a lot of risk to get there.

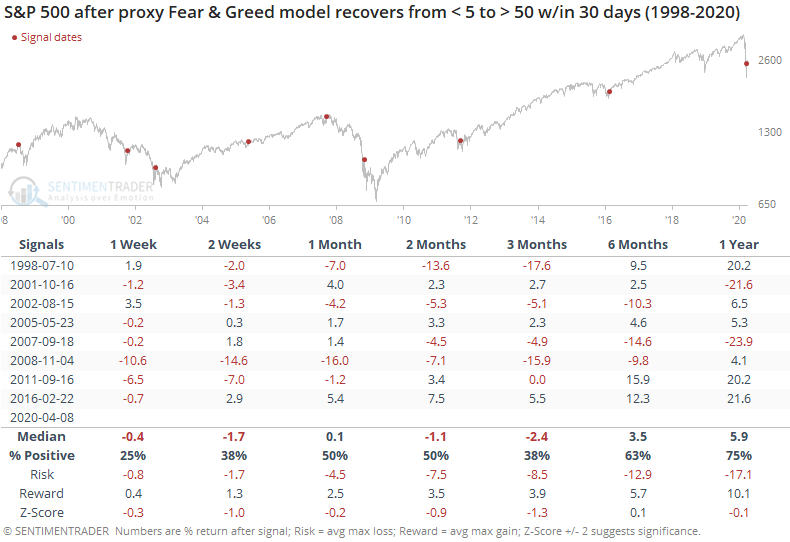

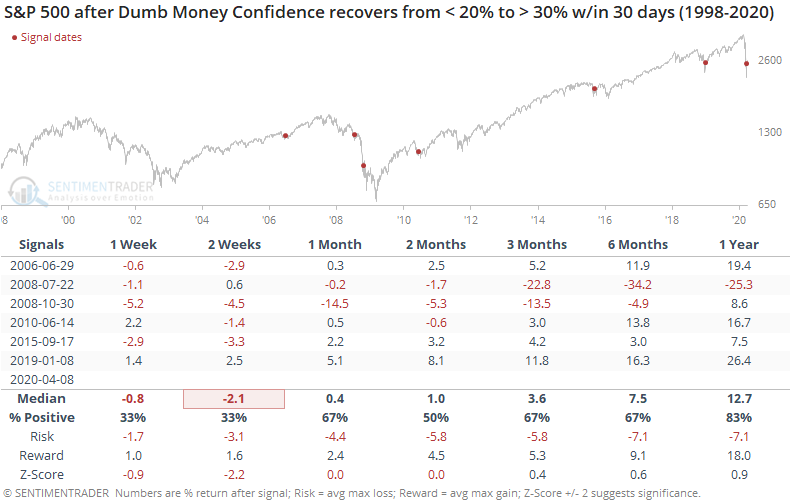

If we look at Dumb Money Confidence, we're seeing a similar thing but not to the same magnitude. It has recovered to 30% after several weeks of deep pessimism.

Several of these dates overlap with the Fear & Greed model, and the short-term implications were the same.

These had less of a tendency to see medium-term failures, with only the ones from July and October 2008 showing a negative return.

So, here's the test. Is the combination of unprecedented fiscal and monetary stimulus, combined with a record surge in buying pressure and retracement of the decline, enough to offset the idea (probably more like fact at this point) that we're in the midst of a recessionary bear market?

If we focus on objective clues, so far the answer is yes. We've had excellent follow-through from the good signs that started to emerge in late March. Now that sentiment is becoming more neutral, price action becomes even more important. Bull markets take it in stride. Bear markets usually roll right over.