Sentiment and Seasonality converge in retailing

Key Points

- Investors abandoned retailing stocks in January

- Conventional wisdom argues that rising rates will slow the economy, which will be bad for the retail sector

- However, sentiment and seasonality make a different argument

XRT as a proxy for the retail sector

SPDR S&P Retail ETF (XRT) serves as an investment proxy for the retailing sector as a whole. In addition, XRT is not concentrated in just the biggest large-cap stocks (AMZN, WMT, etc.). The largest holding represents roughly 1.3% of the fund's assets, and the Top 10 holdings represent approximately 11.5% of the fund's assets.

The chart below (courtesy of StockCharts) displays the daily price action for XRT for the last year.

By itself, the chart above does not inspire great confidence. Many technical analysts will see this simply as a chart pattern that is "breaking down" with its longer-term moving averages beginning to roll over. And that view may turn out to be correct. However - as always in the markets - there is an "alternate point of view."

XRT Optix

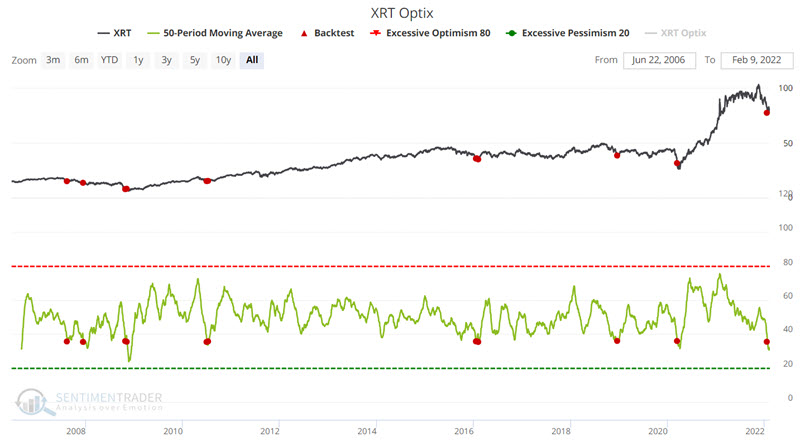

The chart below displays those times when the 50-day moving average for XRT Optix crossed below 36. This typically occurs after XRT has suffered a decline and investors have thrown in the towel on retailing. The latest signal occurred on 1/21/2022. You can run this test in the Backtest Engine.

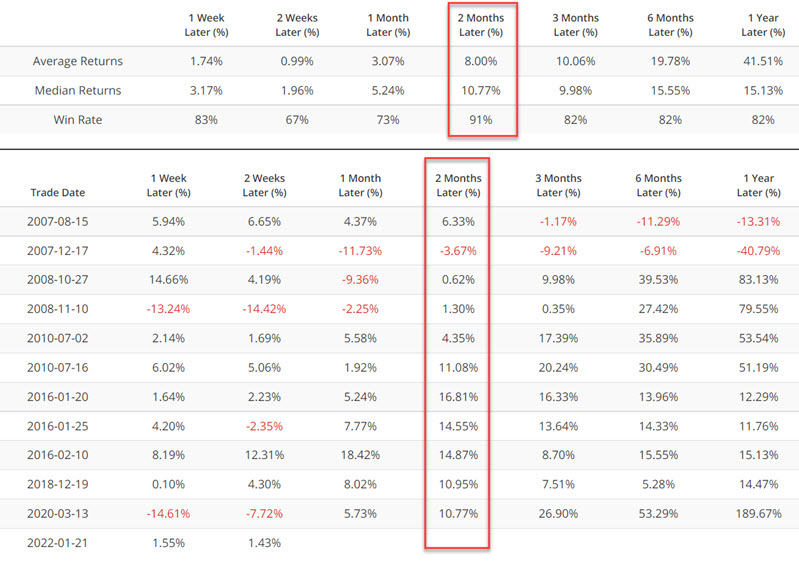

The table below displays a summary of XRT performance following previous signals. Of particular interest is the performance of XRT during the two months following a signal.

XRT Seasonality

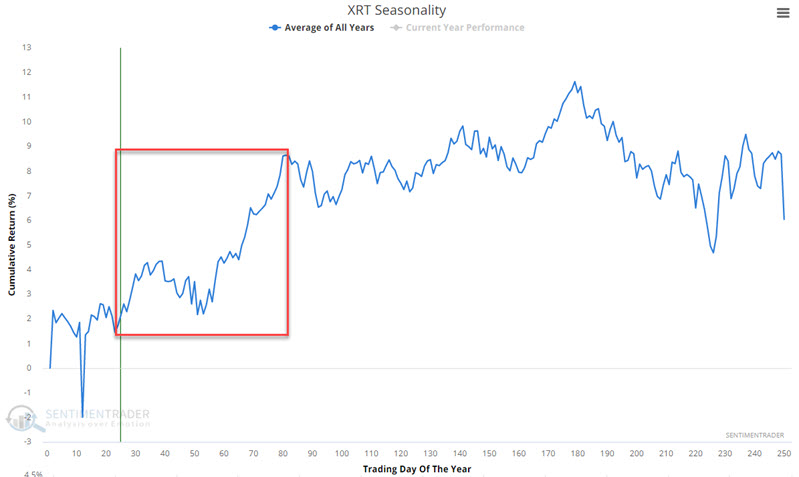

The chart below displays the annual seasonal chart for XRT. Note the highlighted period of strength that extends from Trading Day of the Year (TDY) #23 through TDY #81. This period of seasonal strength began at the close on 2/3/2022 and extends through the close on 4/28/2022.

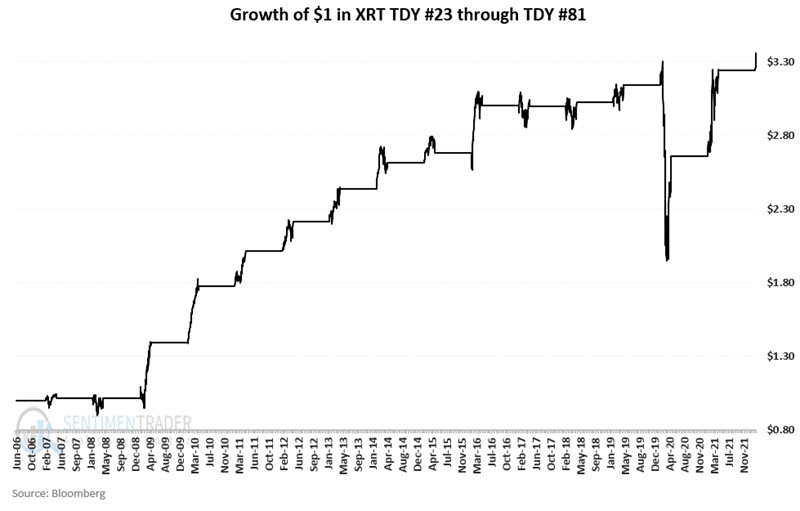

The chart below displays the growth of $1 invested in XRT only between TDY #23 and TDY #81 each year since XRT started trading. The Covid-panic selloff of 2020 was a black mark but also an aberration.

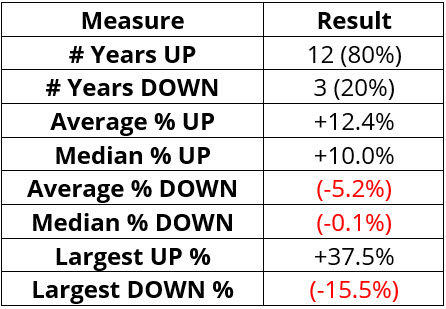

The table below displays a summary of XRT performance during this seasonally favorable period.

What the research tells us…

The conventional wisdom at the moment is something along the lines of, a) the Fed will raise rates and slow pumping money, b) as a result, the economy will slow, c) this confluence of actions will negatively impact retail sales, d) the retailing sector is in trouble.

It certainly sounds logical. But if there is one thing we have learned about conventional wisdom, it's that the market doesn't always pay attention. We have also learned that when sentiment and seasonality align, good things often - though notably, not always - follow.