Seasonality has soured

According to Morgan Stanley (via the WSJ), stocks are about to enter a seasonally rough stretch.

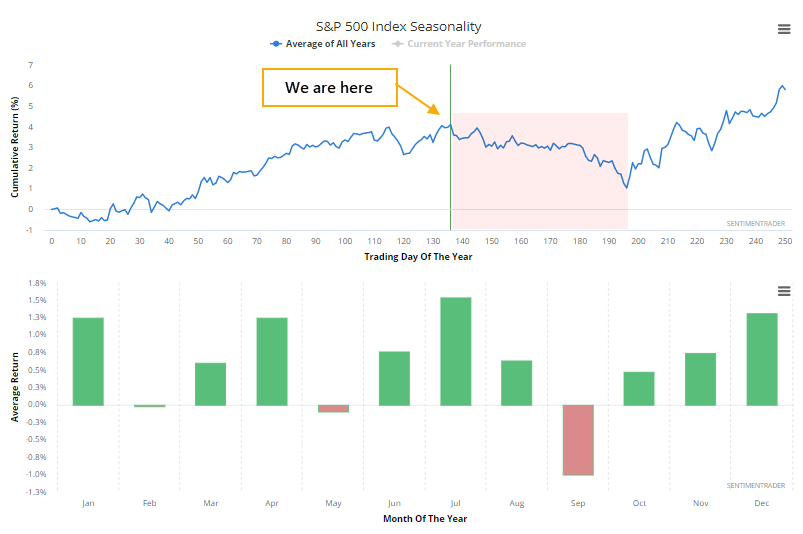

Indeed we are, based on seasonal calendar returns for the S&P 500. Seasonality in stocks is a tertiary factor even at its best and carries very little weight. It's still a headwind, though.

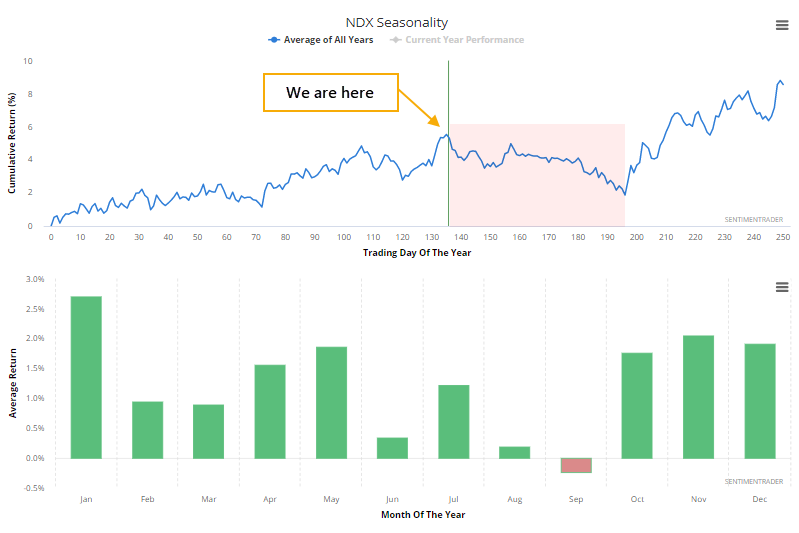

It's even worse for indexes like the Nasdaq 100, whose component stocks have helped to drive this rally. The NDX's seasonal peak is right now.

When focusing on just the main drivers, which are primarily the FANG stocks, we can see from the abbreviated history of the NYSE FANG+ index that even during the powerful trend over the past five or so years, those stocks have tended to take a breather right about now.

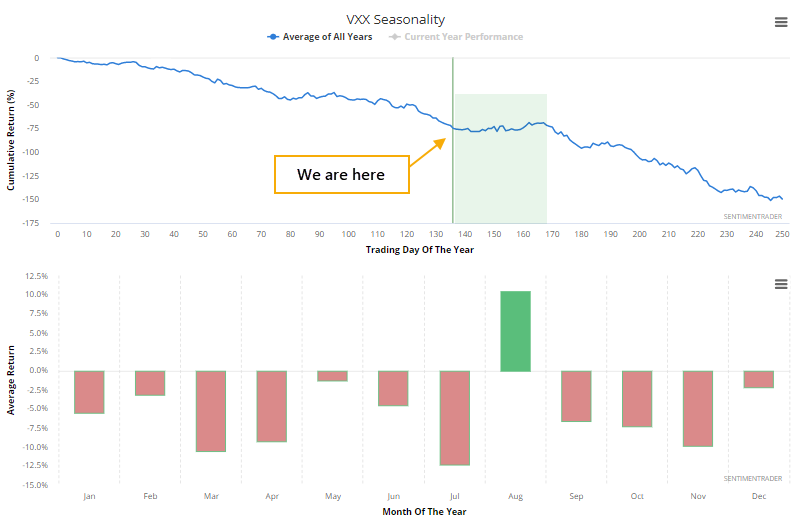

It's the same pattern if we look at ETFs for other indexes like DIA and IWM. Because riskier assets like stocks have stumbled right about now, funds like VXX have rallied, even though its long-term trend is almost relentlessly negative.

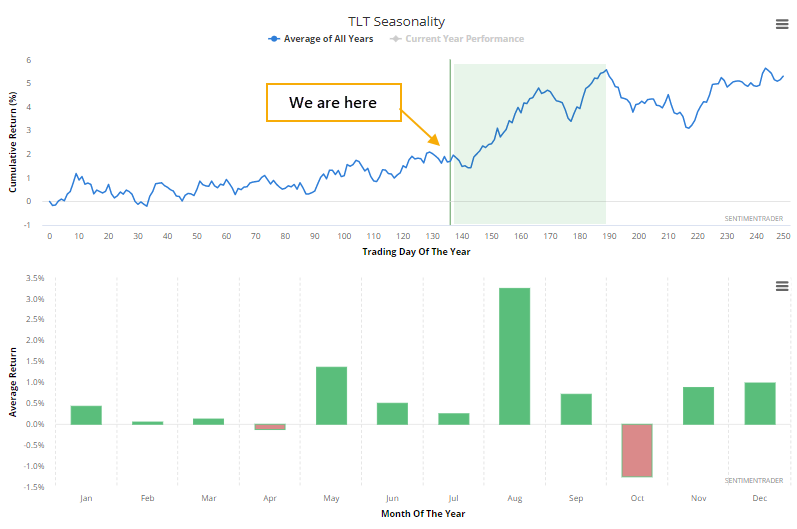

While there are some negatives right now for bonds, the summer seasonal swoon in stocks proved to usually be a tailwind for TLT.

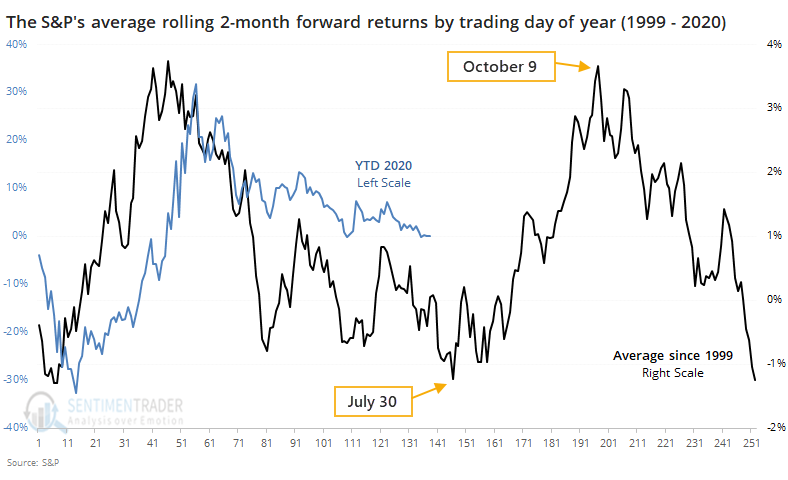

If we use the Morgan Stanley methodology to look at the S&P 500's forward rolling 2-month returns since 1999, then we can see a similar pattern, with the biggest dip occurring right about now.

What the black line on the chart shows us is the S&P's average two-month return over the next two months for every trading day of the year. We're at trading day #138 as of Monday, with late July being one of the very few windows where the S&P's average forward return is more than -1%. Contrast that to early October, when its average two-month return has been more than +3.5%.

Seasonality in stocks is a tertiary consideration at best, so we wouldn't weight this heavily. Still, it's a minor headwind as we head into the late summer.