Retail traders rush to buy protection as Dumb Money Confidence craters

Retail options traders rush for protection

Last week's reversal was one for the record books. While reversals always look impressive on a chart, generating a bevy of excited chatter and headlines, they are unreliable patterns. And retail traders aren't buying into the hype.

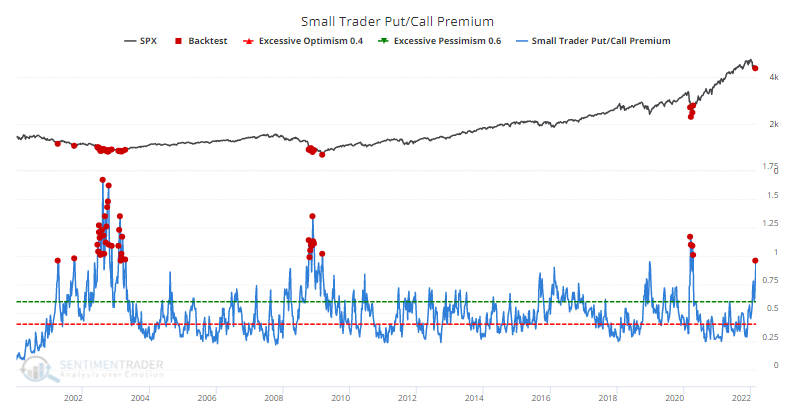

Two weeks ago, small options traders spent a tremendous amount of their volume on protective put options. They took a mild break after markets initially rebounded but now are at it again. Last week, they spent 29% of their volume on buying put options to open, among the highest levels in 22 years.

Last week, the smallest of options traders bought $4.3 billion worth of put options and $4.5 billion worth of call options. So, their spending on hedges was 96% of their spending on speculation, one of the highest ratios in 22 years.

Our Backtest Engine shows only modestly positive medium-term returns but excellent long-term ones. That's because this kind of behavior only occurred during the depths of the worst declines of the past two decades.

| Stat box Over the past 5 days, traders have put an average of $525 million per day into the LQD corporate bond fund. Outside of volatile swings during the pandemic, this is the largest 5-day inflow in the fund's history. |

Dumb Money Confidence plummets

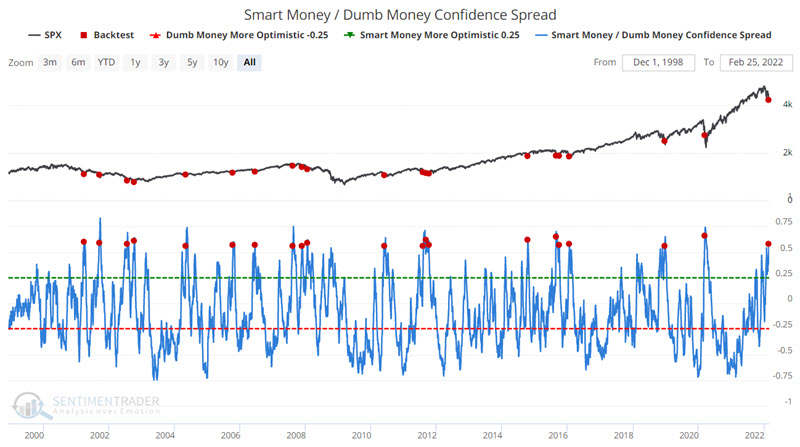

Jay noted that Dumb Money Confidence in a stock market rally has plunged, while Smart Money Confidence remains relatively high.

The chart below displays those days when the Smart Money / Dumb Money Confidence Spread crossed above 55 for the first time in a month. You can run this test in our Backtest Engine.

Let's consider the following approach to using these signals:

- Each time the spread exceeds 55 for the first time in a month, we will hold the S&P 500 Index for 42 trading days.

- If a new signal occurs while an existing signal is active, the holding period is extended for another 42 trading days.

- So, if only one signal occurs, the holding period will be 42 trading days (i.e., roughly two months); If there are overlapping signals, the holding period will be longer.

Of the previous signals, 15 of 16 (94%) have shown a gain, averaging 6.9%.