Orange juice likely racing towards a blow-off top

Key points

- Orange juice futures have been in a major - some would call it "parabolic" - advance

- History strongly suggests that once this rally runs its course, the reversal will be swift and severe

- Both sentiment and seasonality are already issuing warning signs

Orange Juice races higher

Due primarily to the threat of frost to an already hurricane-depleted crop in Florida, orange juice futures have witnessed an unprecedented rally. The reality is that this doesn't really affect many traders, as trading volume in orange juice futures is minimal. Still, the situation - a commodity racing higher on fundamental news - is not new and tends to always end the same - with the commodity crashing to earth once the rally runs its course (Lumber in 2020 comes to mind as a recent example). It can be worthwhile to learn the signs. So, let's take a closer look.

The chart below shows the latest spike in the price of OJ (courtesy of Barchart.com).

To put the latest rally into historical perspective, the chart below displays orange juice futures fluctuations back to 1970. To say that we are in "nosebleed" territory is an understatement. The other key thing to note is that swift and severe declines eventually followed all previous tops above 180.

OJ bulls coming out of the woodwork - unsurprisingly

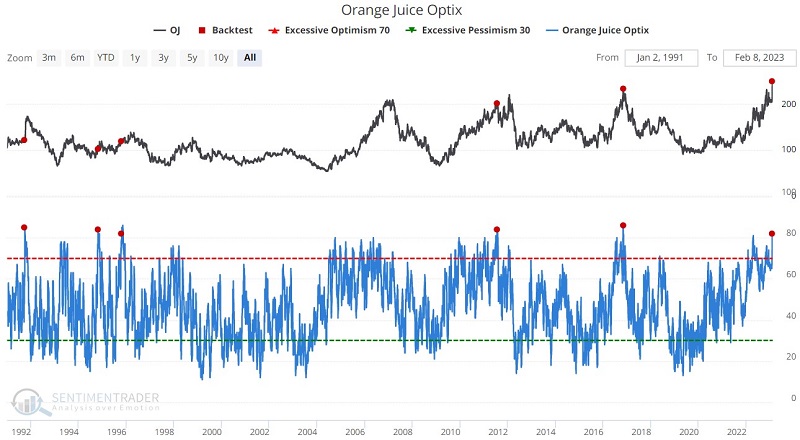

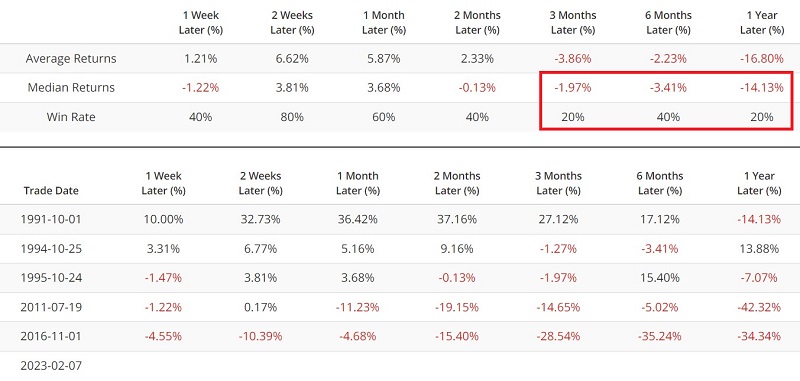

As is usually the case, investor sentiment soars as a market shoots higher. The chart below displays our Optix for OJ, and red dotes denote when Optix rose above 82 for the first time in six months. The table below the chart summarizes performance.

The results remind us there is no way to know how far and long the current rally can run. But they also suggest that the ensuing decline will likely be swift and severe once OJ does top out.

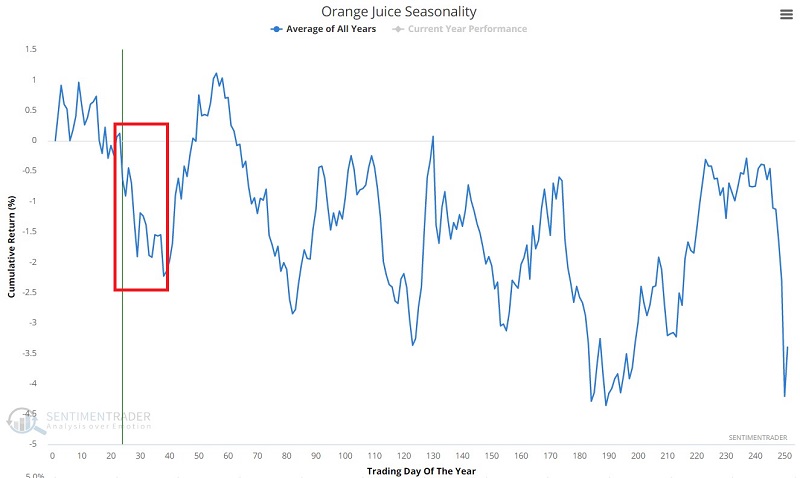

OJ is a highly seasonal market

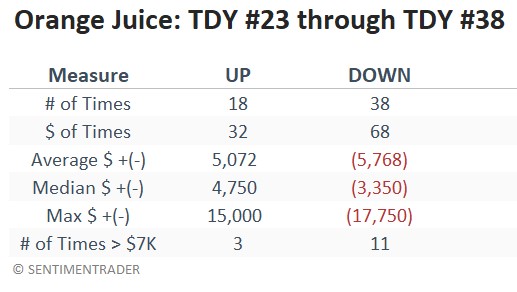

The chart below displays the annual seasonal trend for orange juice futures. Note that we are in the early stages of a typically unfavorable period that extends from the close on trading day of year (TDY) #23 through TDY #38. For 2023, this period extends from 2023-02-03 to 2023-02-27. So far, seasonality is dead wrong

The message from this chart is not that orange juice will suddenly reverse and head lower. The message is that traders should be prepared for that possibility and look to take advantage if the opportunity arises. In the meantime, it is typically best to avoid trying to sell short a rocket ship.

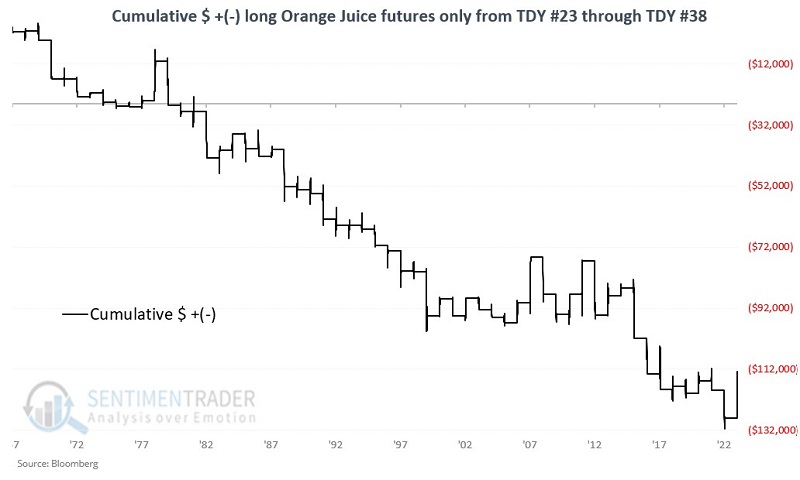

To illustrate how unusual it is for OJ to be rallying at this time, the chart below displays the cumulative dollar +(-) from holding a long position in OJ futures from TDY #23 through TDY #38 every year since 1967.

It is important to note that OJ has staged some significant rallies during this period (2007 and 2011), so the current action is not unprecedented. Nevertheless, the overall long-term bias is unmistakable and highlights why traders should pay close attention. The table below summarizes OJ performance during this seasonal window.

What the research tells us…

Parabolic advances offer both great profit potential and massive risk of loss. Parabolic advances run to the point where they seem like they will never end. But then, when the end comes, the reversal is almost invariably as swift and severe as the initial runup. Very few people actually trade orange juice futures, so the recent action - and whatever comes next - will affect a miniscule slice of the investing world and is mostly a curiosity. But paying close attention to OJ at this time can also help you hone your skills to help you maximize your potential the next time a more heavily traded market "goes to the moon."