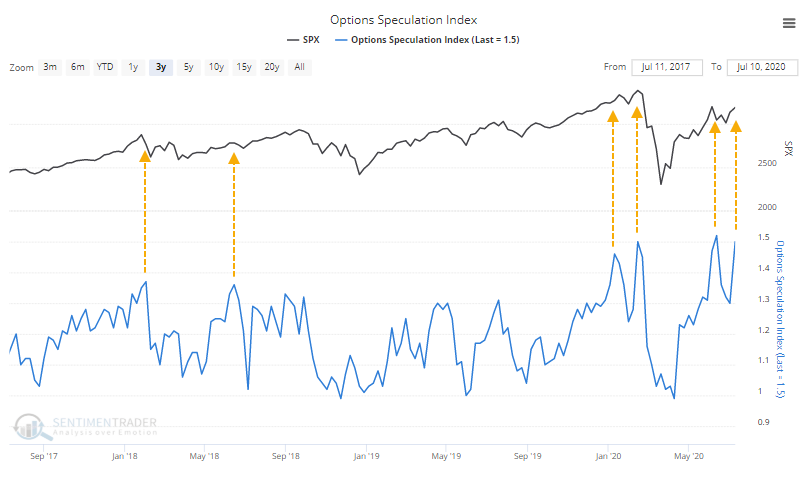

Options traders set new speculative record

In mid-February, we saw that options traders were speculating heavily, a disturbing wrinkle in the positive momentum that markets were enjoying at the time. The pandemic slapped that speculation out of them. For a while.

This past week they returned in force. Behavior among the smallest of traders was enough to push our ROBO Put/Call Ratio to the lowest level since November 2007. The lower the ratio, the less hedging (and more speculative) activity they're opening.

Among all traders, the Options Speculation Index gives us a very good view of the distribution of speculative versus hedging activity on all U.S. exchanges. Once again, it's above 50%, meaning that they opened 50% more bullish contracts than bearish ones.

We put a lot of weight on options data because it ticks all the boxes:

- It reflects real money, not surveys

- There is little to no delay in the data

- We know (pretty much) who is doing (pretty much) what

- They are leveraged, expiring contracts, which increases emotional responses

Given these factors, this new speculative record is once again a primary concern for the short- to medium-term.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A look at how small options traders are positioned

- A stunning view of the amount of premiums small traders are spending on speculative options

- What happens when the financial sector is down more than 10% heading into Q2 earnings reporting season

- A lot more Nasdaq 100 stocks are in uptrends than broader Nasdaq stocks

- The Nasdaq 100 is enjoying a near-record run vs the S&P 500 over the past 30 days

- Nasdaq volume is continuing to explode higher