Options traders make stunning bets on rising prices

Small traders are pushing their luck in a major way.

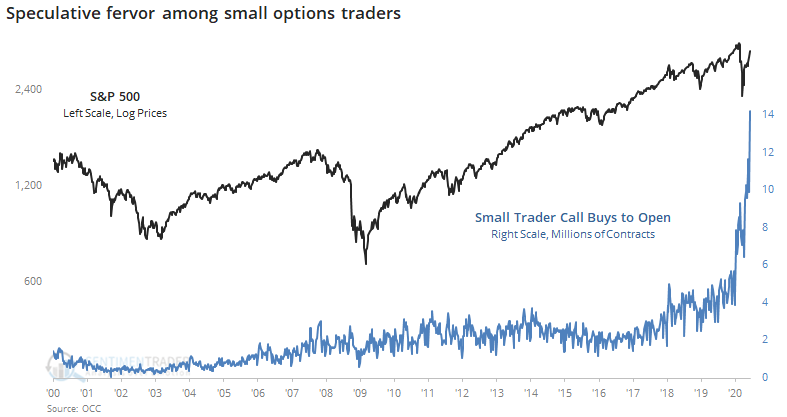

Several times in recent weeks, we've looked at the behavior of the smallest of options traders, and how they were establishing positions that rivaled some of their most speculative in at least 20 years. The steady rally has only boldened their views, and they're pushing their positions even more.

At the peak of speculative fervor in February, the smallest of traders, with volume of 10 contracts or less, bought to open 7.5 million call options on equities. This past week, they blew past that by buying a stunning 12.1 million contracts. If we include ETFs in the figures, then it's about the same scale, jumping from 9.3 million call buys in February to 14.2 million contracts last week.

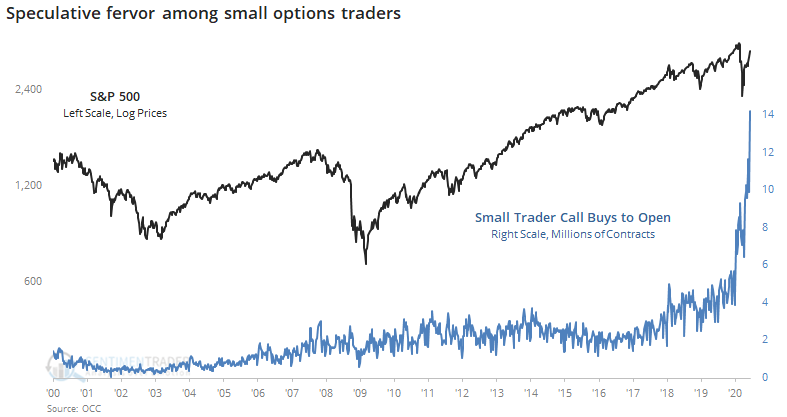

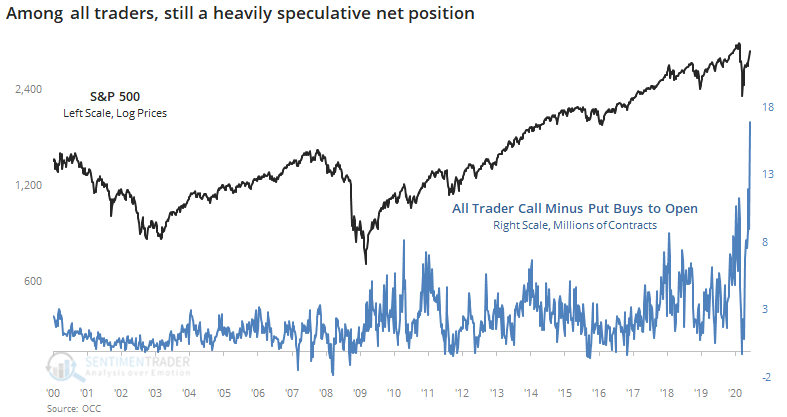

It's not just small traders. Pretty much everyone wants in on the party. Including all sizes of traders, speculative call buying jumped to 35.6 million contracts last week from a peak of 28.7 million in February.

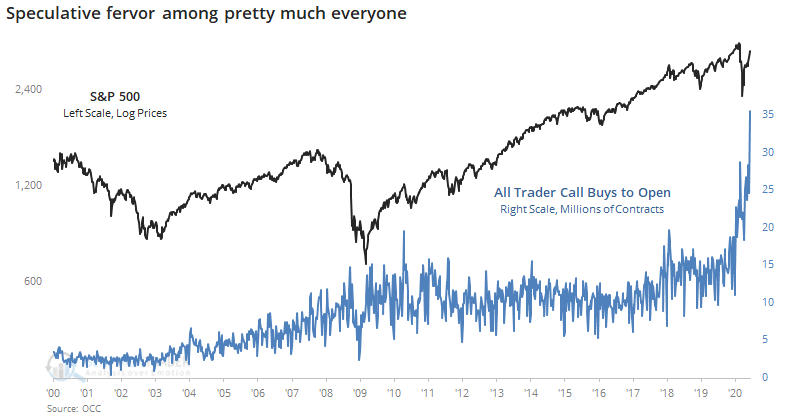

A completely fair question to ask is, "What about puts?" If traders are buying a lot of speculative calls, but also buying a lot of protective puts as a hedge, then maybe their overall position isn't that optimistic. That's not the case, in fact it becomes even more egregious.

Last week, they bought 14.2 million calls and 5.9 million puts for a net 8.3 million contracts. We can see how much more speculative this is than other times in the past 20 years.

Among all traders, we can still see a dramatic shift toward speculation last week.

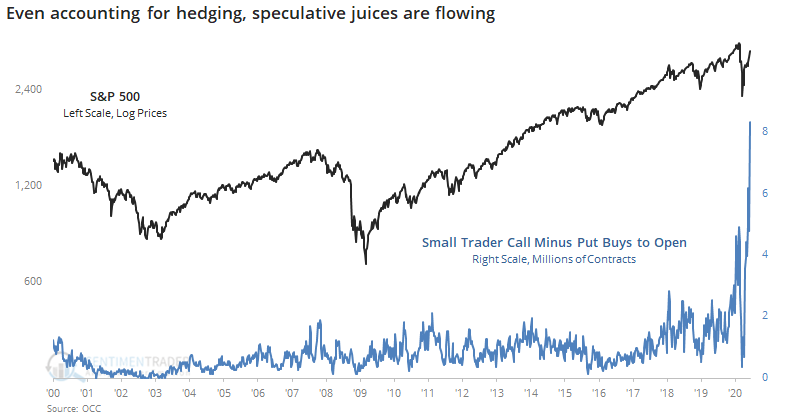

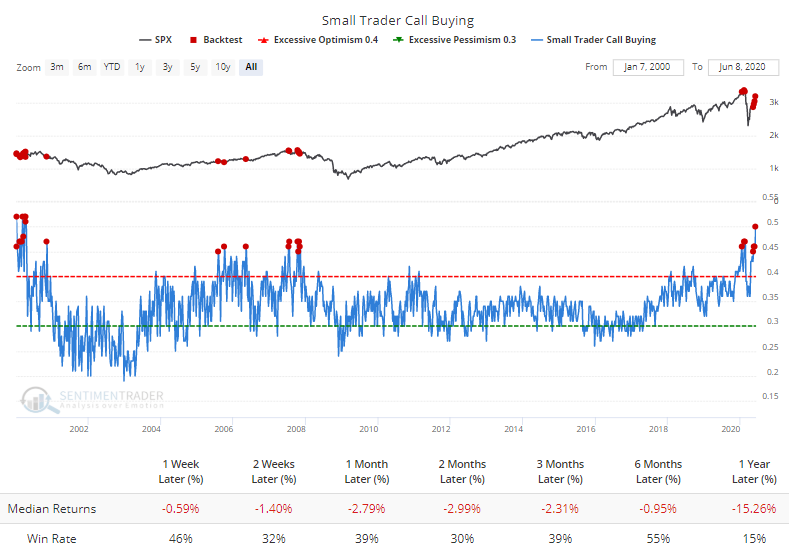

If we look at percentages instead of the absolute number of contracts traded, then we can see that small trader call buying made up more than 50% of their total volume. That's only been exceeded by a few weeks in the year 2000. The Backtest Engine shows that even when it's 45% or higher, forward returns were very poor.

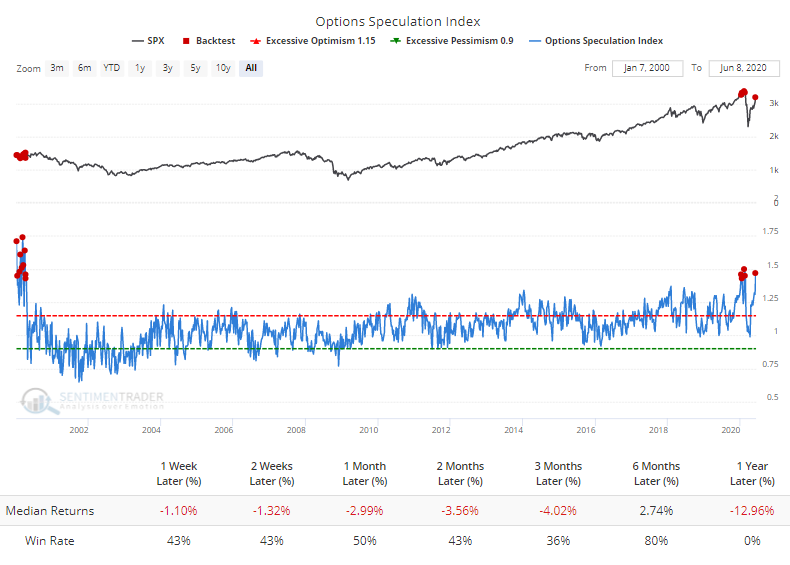

Overall options activity shows that traders spent 47% more volume on speculative strategies than hedging strategies, among the most ever. Again, forward returns were poor with few precedents.

This kind of activity has a strong tendency to lead to negative returns in the S&P 500 and other indexes over a multi-week to multi-month time frame. That was the case even a couple of weeks ago, and yet here we are, so there has been no impact yet.

And there are other factors, like the recovery and thrusts among most stocks. That can't be ignored, especially on a longer time frame. On a shorter time frame, though, it seems increasingly risky to try to chase this rally along with traders who have traditionally been extremely reliable contrary indicators.