Once again, options traders show no fear as losses mount

The smallest of options traders are not to be deterred.

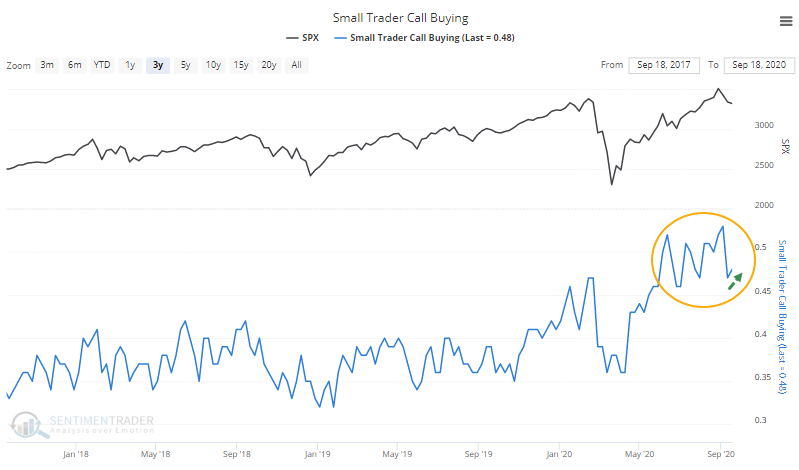

Even after what were likely catastrophic losses over the past two weeks, since most of the options activity was concentrated in the large tech stocks that have suffered large losses, retail volume for 10 contracts or fewer increased its speculative tilt last week. They spent 48% of all their volume buying call options to open, a naked bet on rising prices.

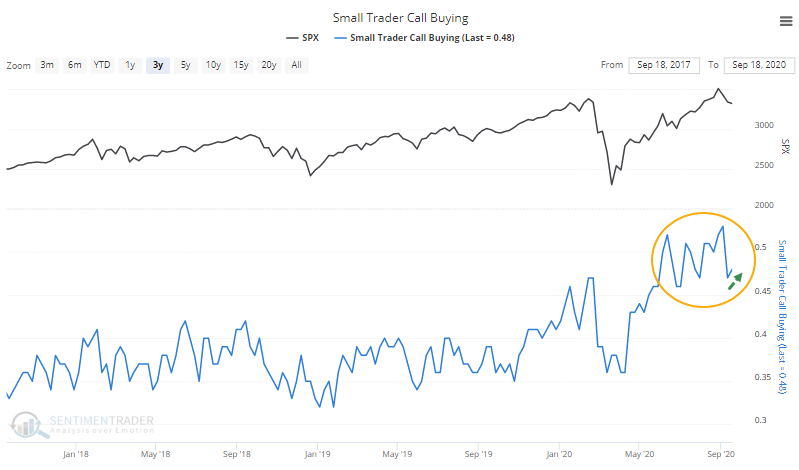

The ratio of opening call premiums to put premiums declined, ranking among the lowest in 20 years. This is even after the S&P 500 slipped below its 10-week moving average. According to the Backtest Engine, that has not been a good combination.

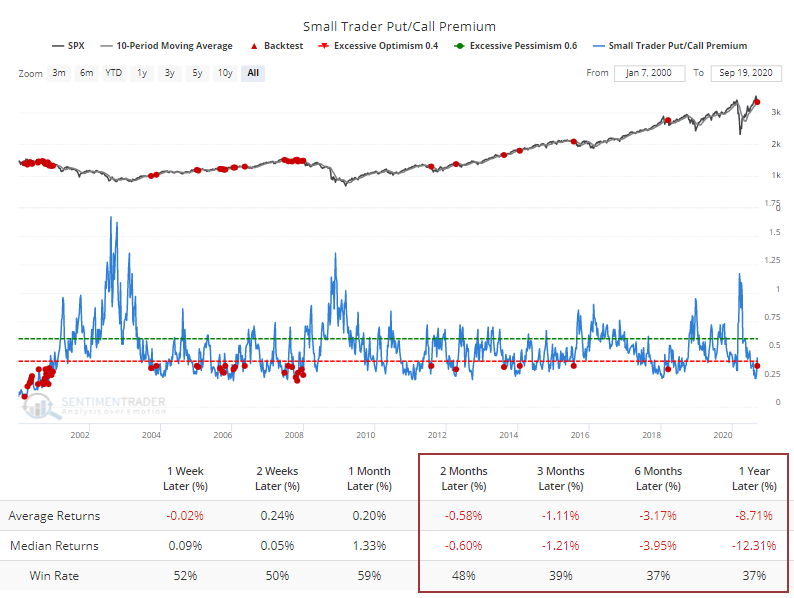

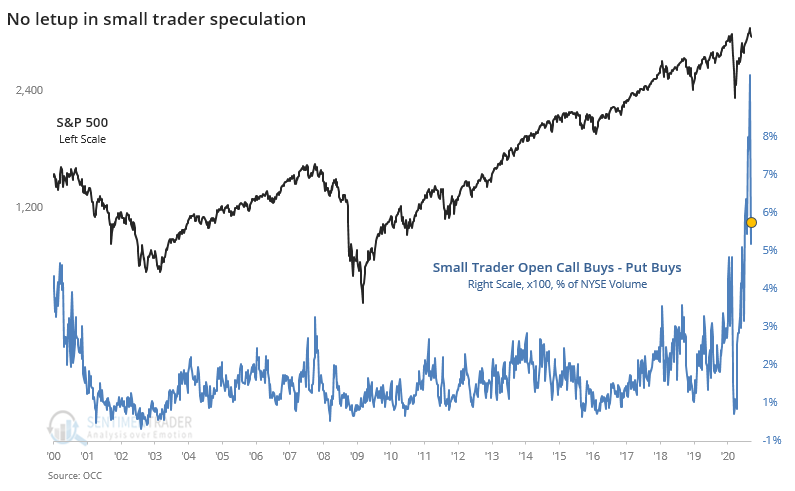

If we step back and look at the data similar to how we did last week, we can see that the number of opening call transactions minus puts, relative to NYSE volume, also ticked up.

Over the past 20 years, it's the repetition of what we've harped on for weeks on end - there is still no comparison and recent losses have not deterred excessive options speculation.

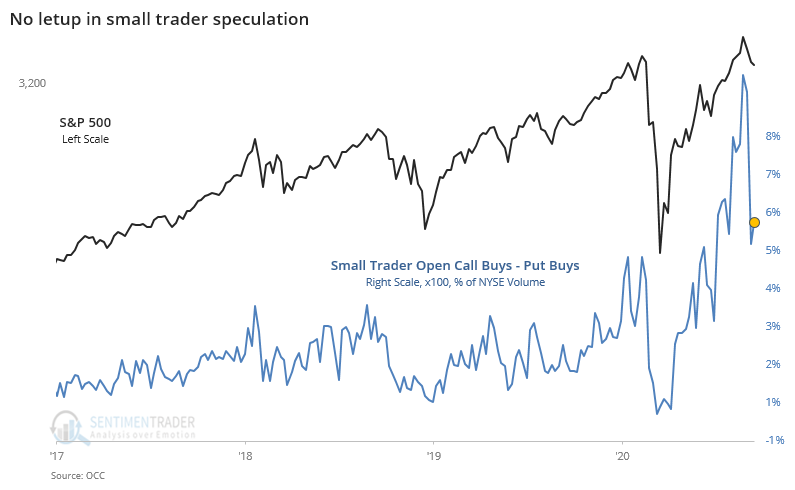

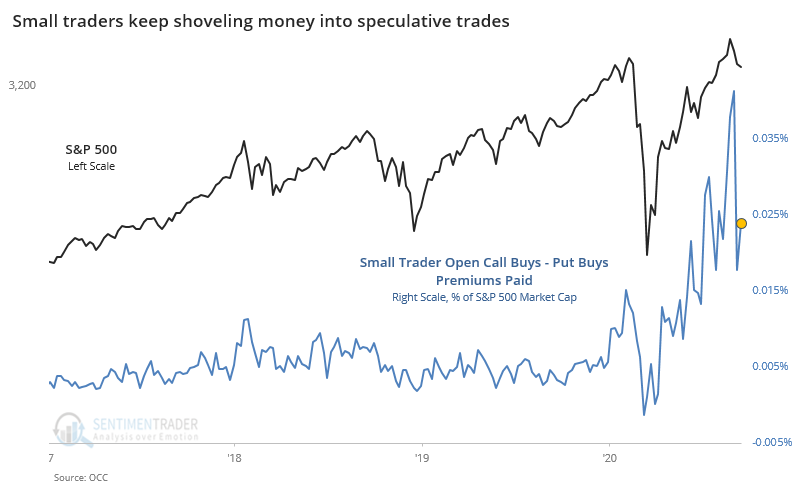

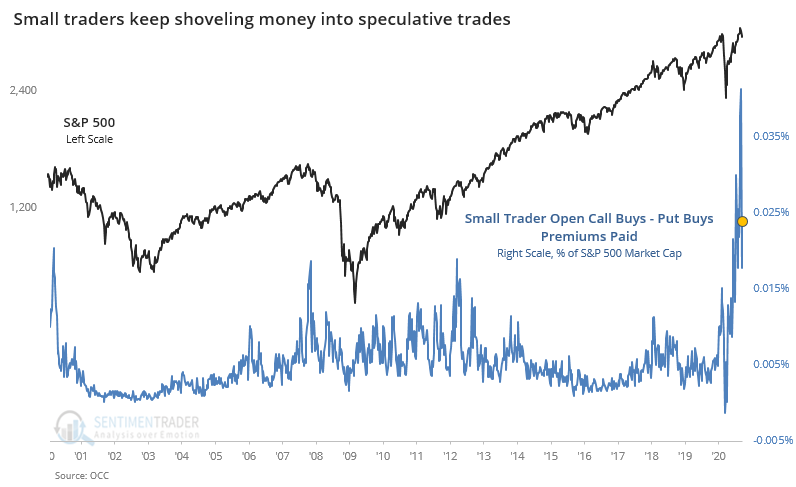

The same goes when looking at speculative premiums paid relative to the S&P 500's market capitalization.

Again, historically, there is no precedent.

There is no way to spin this in a positive light.

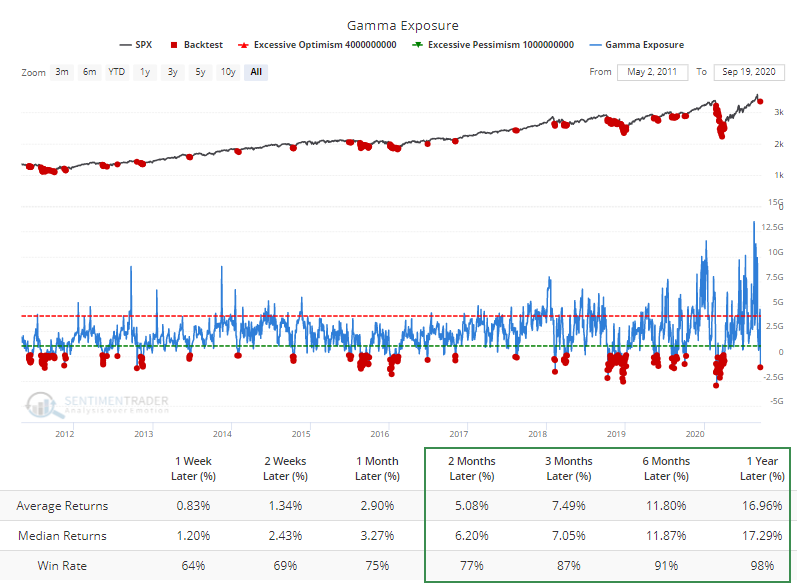

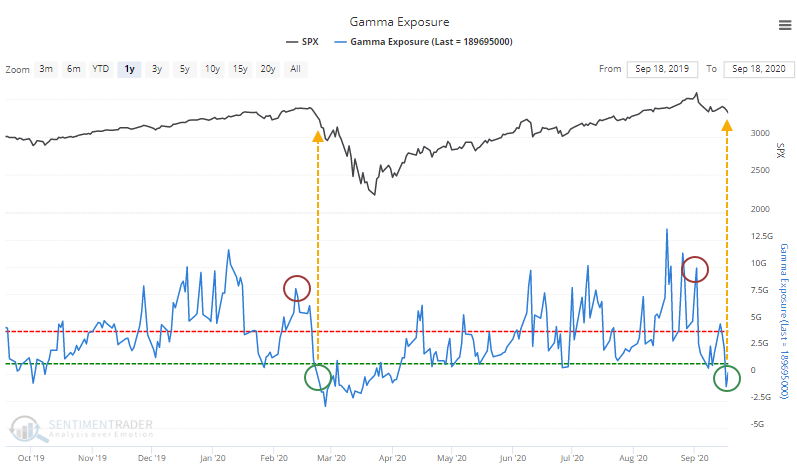

One of the big worries in late August and early September was that although stocks were rising, so was implied volatility. Traders were chasing stocks higher via options, which caused dealers to scramble to buy the underlying stock as a hedge. When this happens quickly, in short-dated options, we sometimes get the "gamma explosion" shown in the chart from the September 8 note.

While any estimate of market-wide gamma exposure is a guesstimate, according to SqueezeMetrics, Gamma Exposure had spiked in August, verifying the whole "gamma explosion" concept.

As dealers adjusted, some of the trades dropped off, and stocks fell, Gamma Exposure dropped into negative territory on Thursday before rising a bit on Friday. Whenever it has been below the lower threshold, the Backtest Engine shows that forward returns were good.

That should be a good sign, potentially dimming the negative implications from the still-excessive amount of call buying among retail traders. The biggest caveat here is that the last time Gamma Exposure cycled from above $7.5 billion to negative territory, the selloff was just getting started.

We'd continue to put the most weight on the behavior of options traders versus estimates of gamma exposure. While a drastic reduction in the latter seems to be a good sign, it still seems like there is a lot of overhead supply that needs to be worked off, many of the stocks with the heaviest options activity continue to act heavy, and there has been an increase in new bets on a rising market. Sentiment tends to swing from one extreme to the other, and this particular cycle has barely begun.