No need to hedge when stocks only go up

In recent weeks, we've had occasion to yet again focus on the behavior of options traders. Depending on the metric, we're currently seeing a record or near-record level of speculation, with very little hedging.

Nothing much has changed. Among all strategies and all traders, the focus on strategies that only pay out if stocks rise continues to hover near record highs, with our Option Speculation Index showing that bullish volume is significantly higher than bearish volume.

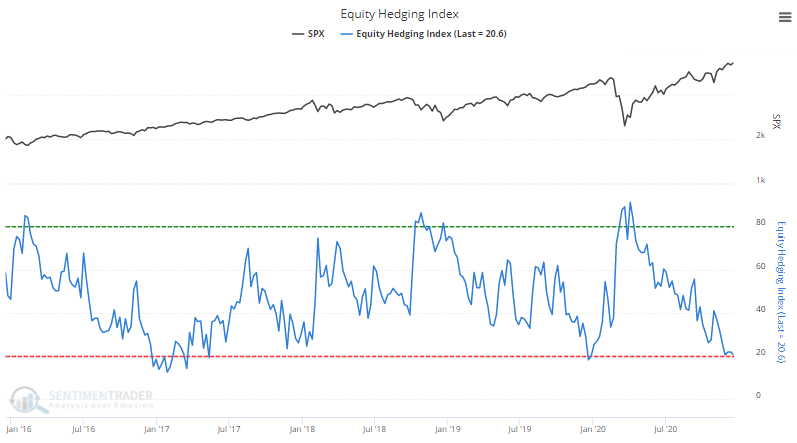

Adding to the concern is that hedging activity, in the options market or elsewhere, has become scarce. The Equity Hedging Index (EHI) is now in the lowest 6% of all readings since 1986.

The EHI looks at the most common ways an investor would hedge their portfolio. The more each indicator shows hedging activity, the higher the Equity Hedging Index will be; the lower the EHI, the less hedging is happening.

Since 1986, when the EHI is below 21, the S&P 500's annualized return has been -2.4% versus +49.8% when the EHI is above 85, suggesting a higher probability of lower returns now given the current reading of the indicator.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- A more in-depth look at last weeks' options trading relative to the past 20 years

- Two other option indicators suggest that institutional investors are, however, establishing some hedges

- What happens when those 2 metrics have been high for weeks on end

| Stat Box Some wild trading on Monday led to the VIX "fear gauge" spiking more than 40% intraday and then dropping more than 20% into the close. In the past 30 years, it has engineered such severe whiplash only 4 other times, all of which ended up leading to an even lower VIX in the weeks ahead. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

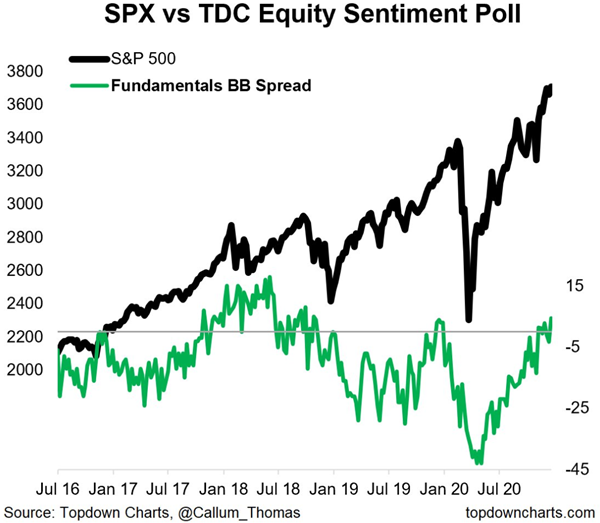

1. As stocks have risen, investors have become even more optimistic on its fundamental underpinnings. That's the nature of sentiment - the crowd reacts to momentum more than economics, and will pay increasing prices for something simply because it's going up. [Topdown Charts]

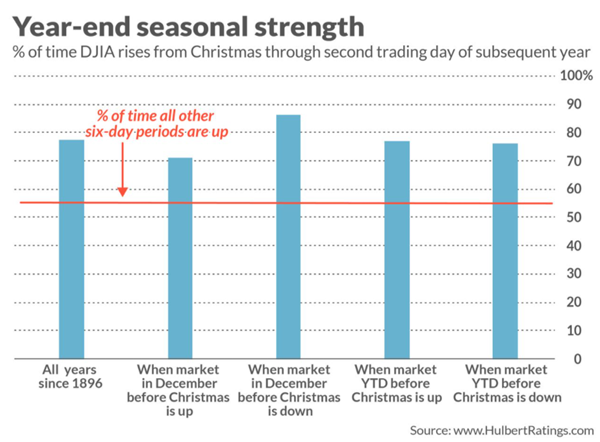

2. They may say they're betting on improving fundamentals to sound smart, but really they're betting that good tidings will persist even after Santa leaves town. Stocks have a better-than-random chance of rising into the New Year. [MarketWatch]

3. Futures traders (at one brokerage, anyway) aren't really buying into this idea. They're less than 40% net long, on the lower end of their range for the past few months. [DailyFX]