Negative bets on energy are rolling off

Options traders are reversing negative energy bets

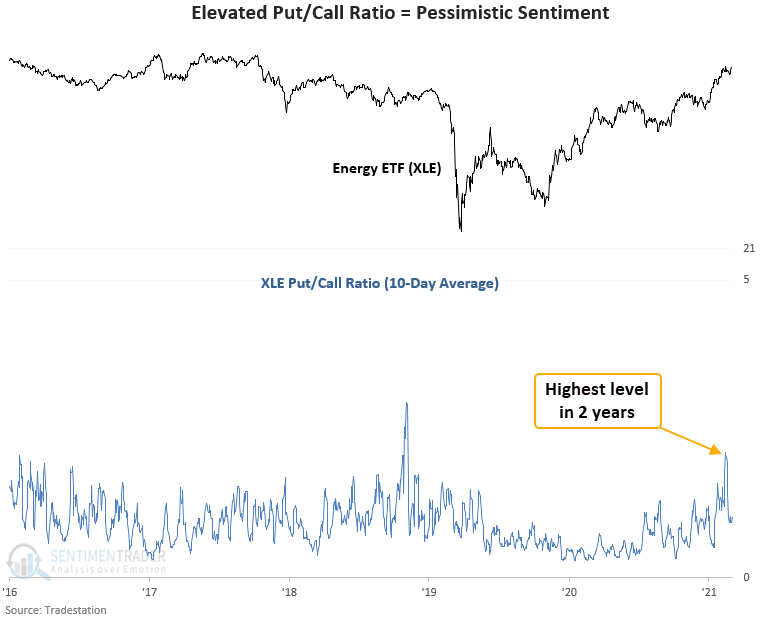

When investors are bullish on stocks, they buy call options to bet on rising prices. Conversely, when they are bearish on stocks, they purchase put options to bet on declining stocks. The put/call ratio can be used as a contrary indicator to identify an environment where sentiment has become too pessimistic on the future direction of stocks. When opinions become too bearish, stocks tend to rally.

Dean noted that this ratio recently reached a high level on the XLE energy fund and has started to reverse.

Similar signals have triggered 36 other times over the past 23 years. The signals had only 1 drawdown greater than 10% in the first month.

| Stat box Traders shoved more than $800 million into the GLD gold fund on Tuesday. The Backtest Engine shows that there have been 27 other days with a single-day inflow at least this large, leading to a positive 2-month return in GLD only 9 times. |

Stock risk has declined

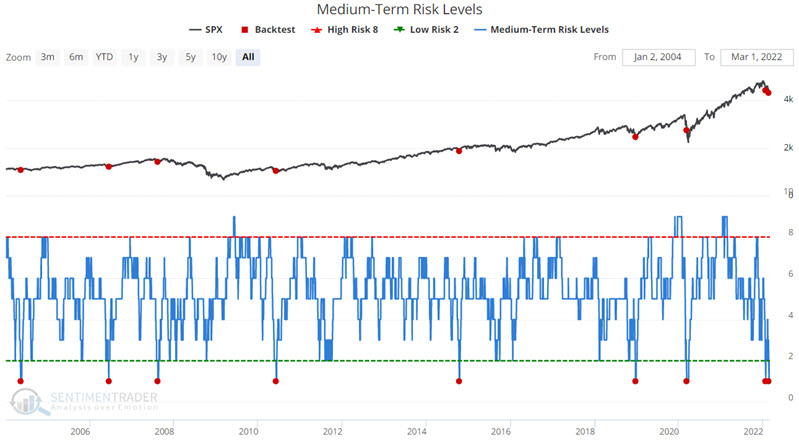

Medium Term Risk Levels (for stocks) recently hit it's lowest level for the second time in the past month. Jay showed that while the sample size is small, market performance following previous signals suggests the potential for a market rebound in the near-term.

The chart below displays all days when Medium-Term Risk Levels drops from 2 or higher down to 1. You can run this test in our Backtest Engine in a few seconds.

The good news is the consistently high Win Rate across all time periods - particularly two months - and the steadily increasing Average % Return across each time frame.