Most gains come when traders are sleeping

It seems like every day, stocks jump overnight, only to see gains evaporate, or at least moderate, during the day session. That's frustrating for many traders who can't take advantage of overnight hours.

It's not a new phenomenon, though. Most of the gains in the S&P 500 SPDR (SPY) since its inception have come while domestic traders are sleeping.

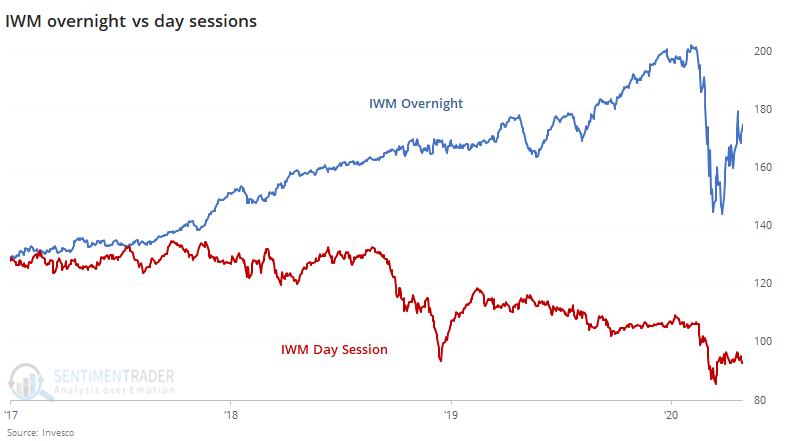

This is not a new thing, and it's not just SPY. The overnight session has driven most of the gains in the big-tech QQQ fund, too. And it's been especially prevalent in the small-cap IWM fund.

From this tweet, we can see how huge of a difference it has been since IWM's inception.

Every time stocks gap up big in the morning and then sell off, there is a round of conspiracy talk about who's fleecing whom. No doubt, some of it is due to games being played by large market participants, taking advantage of a pattern when they can. It's not a new thing; it's been going on for decades.

As to whether it means anything, that's not clear. There is a bit of evidence that rallies off a low that saw much of the gains driven by overnight trading were more likely to fall back in the months ahead than were the rallies driven more by "natural" gains during the day session.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A detailed look at rallies driven by overnight gains vs day session

- The Nasdaq Composite turned positive year-to-date - what's that meant in the past for performance-chasing

- The QQQ fund joins the $100 billion club - what other funds have done when hitting that threshold

- The VIX has dropped below its lower Bollinger Band for the first time in months

- Most stocks on the Nasdaq are above their 50-day averages

- Tech stocks have consistently outperformed emerging market stocks

- Semi stocks keep rising by more than 1%