More evidence of eager buyers amid breadth thrusts

Key points:

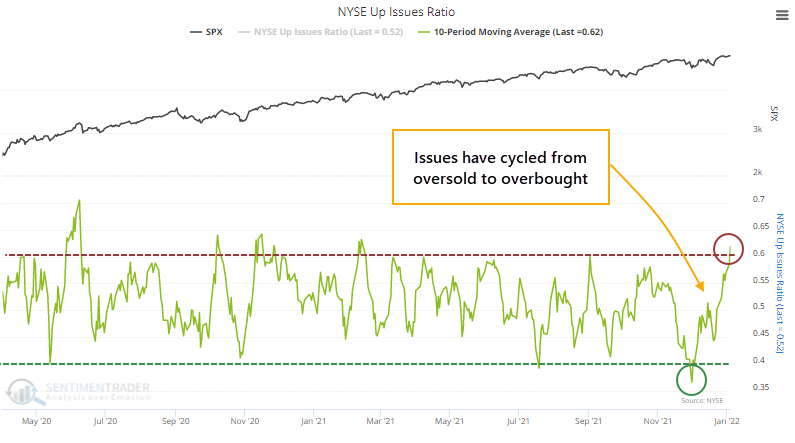

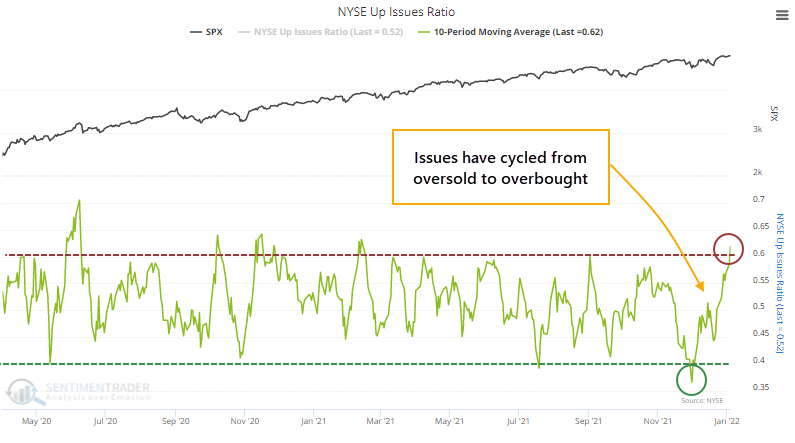

- Over the past 10 days, there has been an impressive thrust in Up Issues and Up Volume

- That's the case for stocks in the S&P 500 and NYSE securities generally

- Similar thrusts had a consistent record of preceding further gains

It's been a "thrusty" couple of weeks

Over the past couple of weeks, Dean and I have outlined several breadth thrusts in the broader market and some individual sectors. The relatively broad-based nature of the recent rise has also triggered a thrust in NYSE Up Issues. Over the past 2 weeks, an average day has witnessed 62% of securities advancing.

More than 63% of volume has been focused on those advancing securities, also triggering a thrust in NYSE Up Volume.

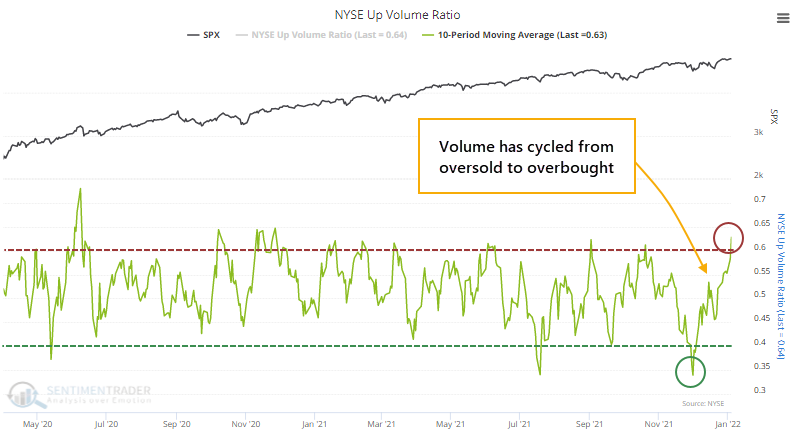

Thrusts have had a good short-term (and long-term) track record

There are an infinite number of ways to measure breadth and thrusts. We don't subscribe to the idea that there are official rules for either. We test them from many different perspectives with the sole purpose of trying to discover whether investors are eager to own stocks or not and what that might suggest for how they'll behave going forward.

When both the 10-day Up Issues and Up Volume ratios cycle from below 40% to above 60% within 30 days, it suggested that investors will keep buying, especially when the S&P 500 was within correction territory of less than a 10% drawdown from a multi-year high.

Over the next 2 weeks, the S&P continued to rally after 19 out of 21 signals. Because these also indicated overbought conditions, the index had a habit of settling back over the next few months, but losses tended to be relatively minor. Over the next year, all but 2 of the signals showed a profit, with an excellent risk/reward ratio.

S&P 500 stocks have been just as impressive

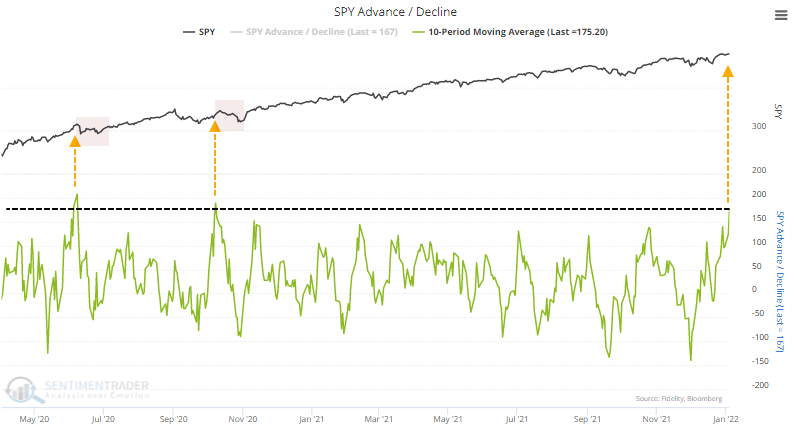

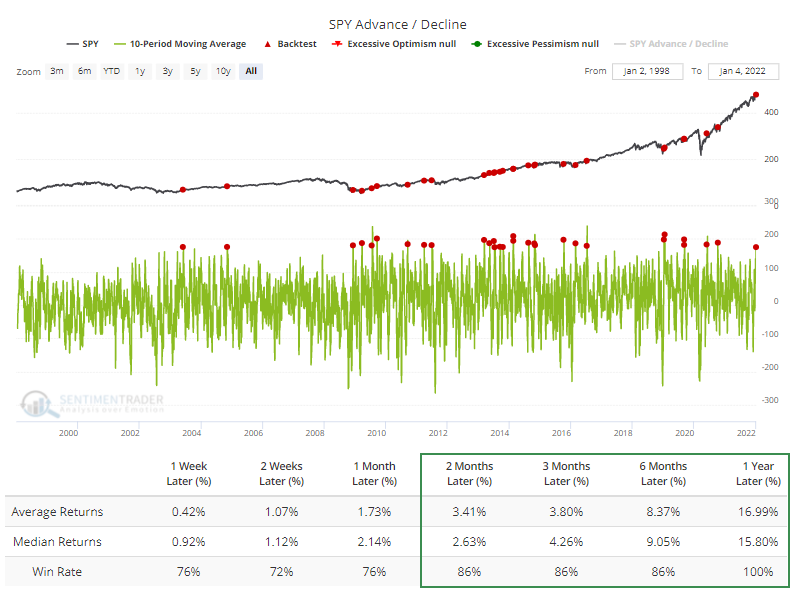

Within just the S&P 500 itself, over the past 10 sessions, there have been an average of 175 more advancing stocks than declining ones. The only two times this has happened in recent years, it preceded pullbacks.

But the Backtest Engine shows that such impressive buying interest has preceded gains in the months ahead with consistency, and a year later, all 29 signals showed a positive return.

What the research tells us...

We tend to place more weight on thrust signals that occur after a protracted downtrend. Those have a historical success rate that's hard to beat. It's a bit scary to rely on them when stocks are trading at/near all-time highs because it also suggests overbought conditions and the possibility of a blow-off peak. While stocks have pulled back in the months after several similar signals to what we're seeing now, they have tended to be relatively minor and short-lived. None of them preceded an imminent bear market.