Monday's small-cap surge

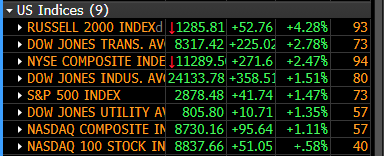

It was kind of a weird day in equity land on Monday. Perhaps due to traders becoming optimistic about smaller businesses starting to open up again, the small-cap Russell 2000 soared and left other indexes far behind.

Source: Bloomberg

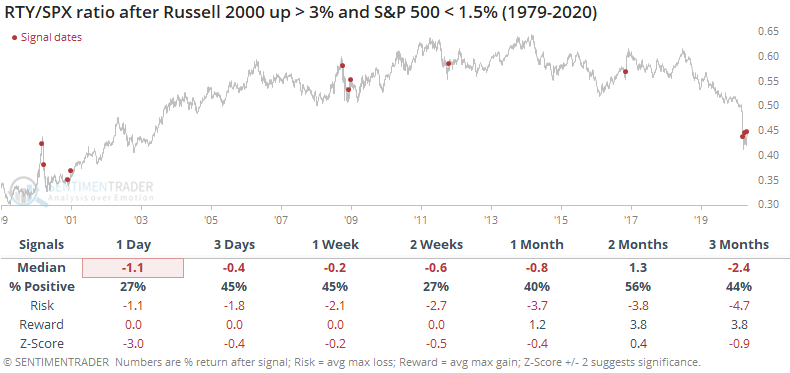

The Russell doubling the return on the S&P hasn't happened many times since 1979. All of them have triggered since the year 2000.

The S&P managed to rise over the next few sessions every time but once. For the Russell, returns were worse. That means the ratio between them usually suffered.

Bulls are mostly hoping that small-cap outperformance can continue. It's trying to turn up after a plunge, and it should be a good sign going forward. Historically, though, it's been tough to do so after such a big difference in returns like we saw on Monday.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- More than 95% of energy stocks are above their 10-day moving averages, but few are above their 200-day averages

- The Barrons' Big Money poll showed an uptick in optimism among money managers, but it's still historically low

- More and more indexes are recovering above their 50-day averages

- Internet companies have surged

- Our Optimism Indexes for IBB, XLV, and XOP have reached near-record highs