Mom and pop finally turn optimistic

We might as well get this out of the way. Bullishness in a weekly survey of individual investors has spiked to the highest level in years, and that's causing concern that optimism is out of control.

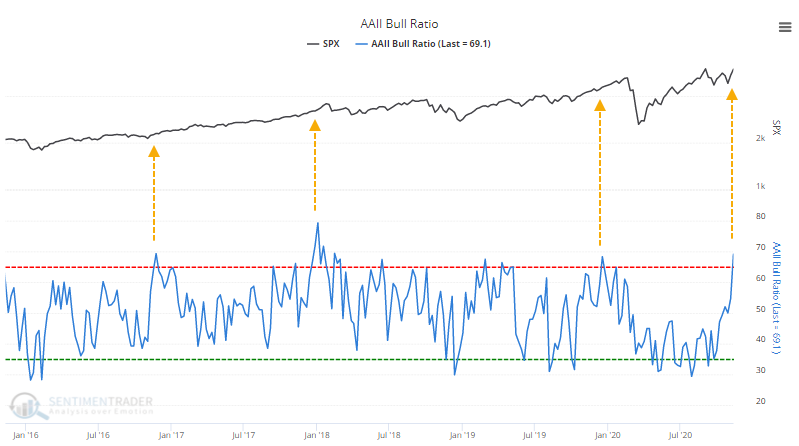

The percentage of bulls in the American Association of Individual Investors (AAII) survey rose to 55.8% while bears dropped to 24.9%, pushing the Bull Ratio, a more accurate measure of optimism, above 69%. The last 2 times it got this high, stocks ended up running into trouble eventually.

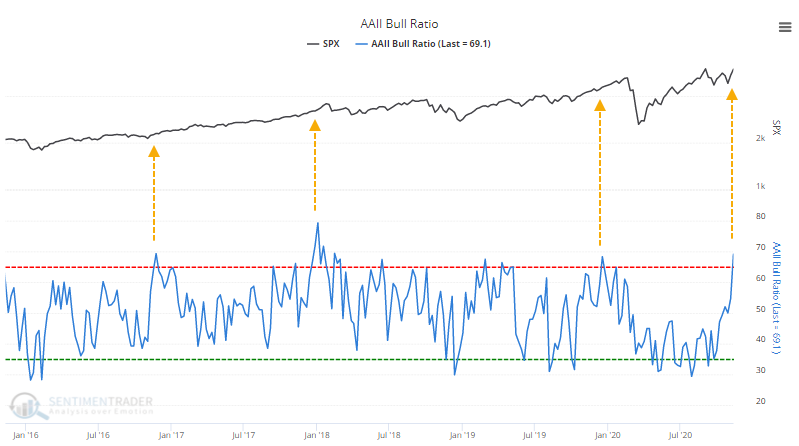

If we take about 15 seconds of our time to see what this has objectively meant in the past, then the Backtest Engine shows that over the past decade, a reading this high led to above-average returns for the S&P 500 in the months ahead. Over the next 26 weeks, the S&P 500 showed a positive return after 25 out of 27 signals.

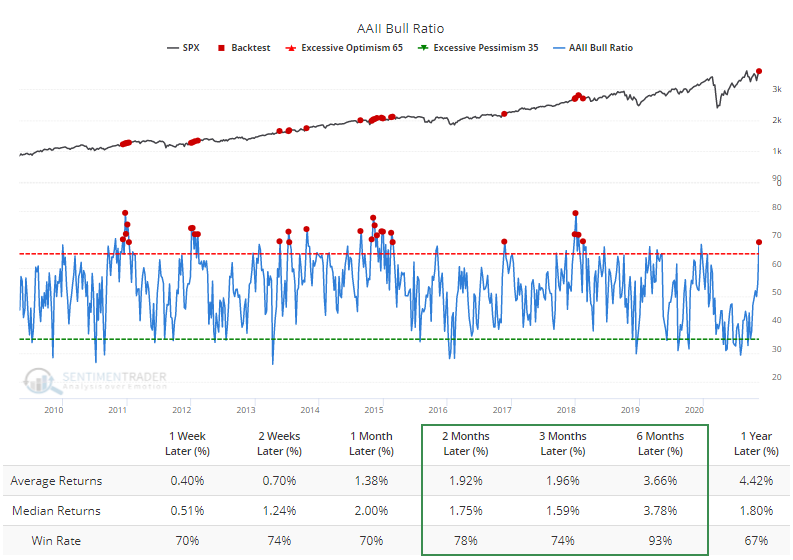

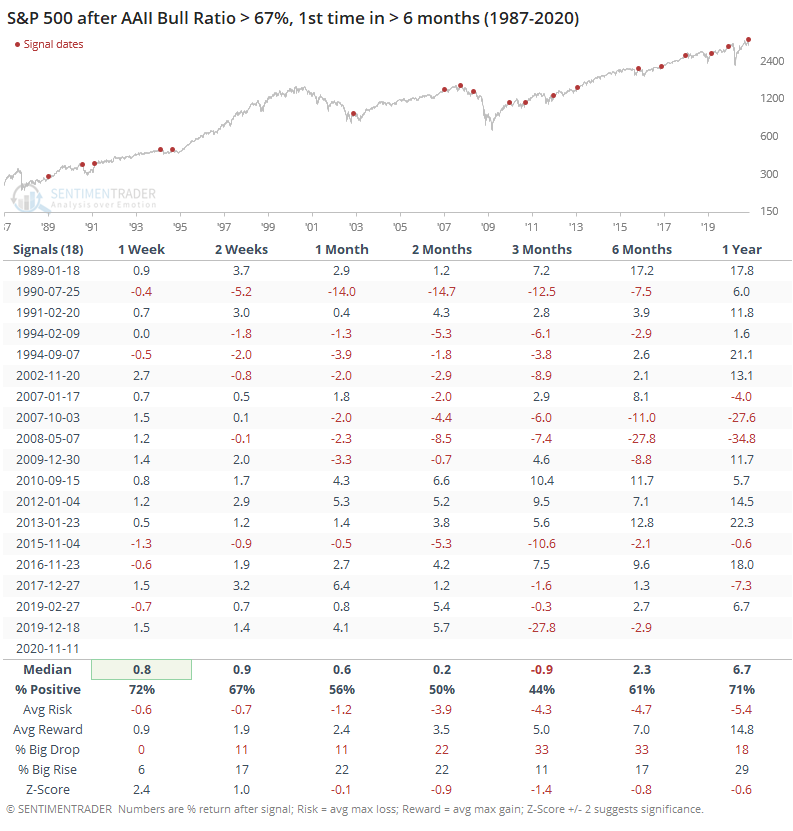

Context is important, and so let's look at those times when the survey showed more than 2 bulls out of every 3 investors for the 1st time in more than 9 months.

Again, not much to suggest a major worry here, though the last signal clearly resulted in some heartburn after an initial large rally through the beginning of this year.

The results are skewed by a large number of occurrences in the past decade, which was dominated by a momentum-driven bull market. If we relax the parameters, then we can get more samples from earlier time periods.

Here, results weren't so pristine. Prior to the last decade, the S&P most often showed a loss over the next 1-3 months, so that's a bit of a concern.

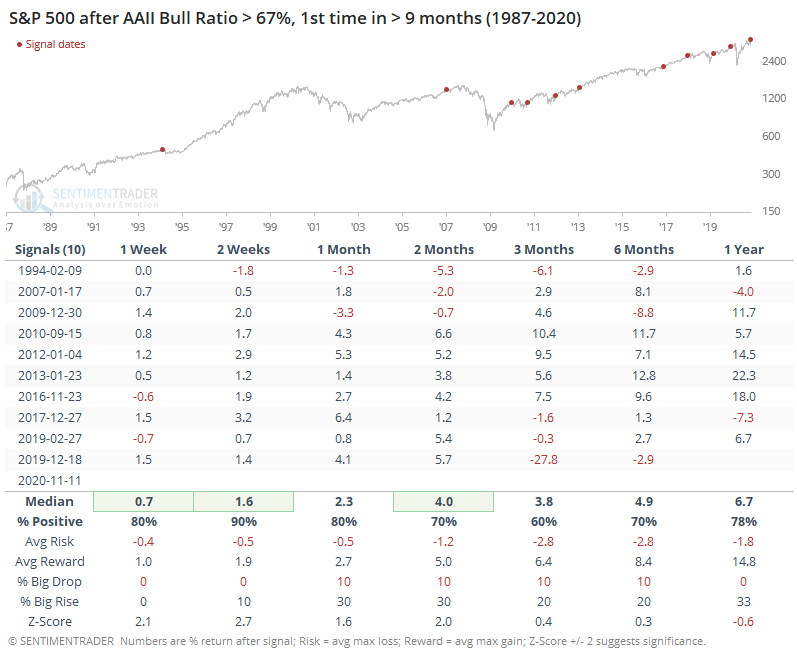

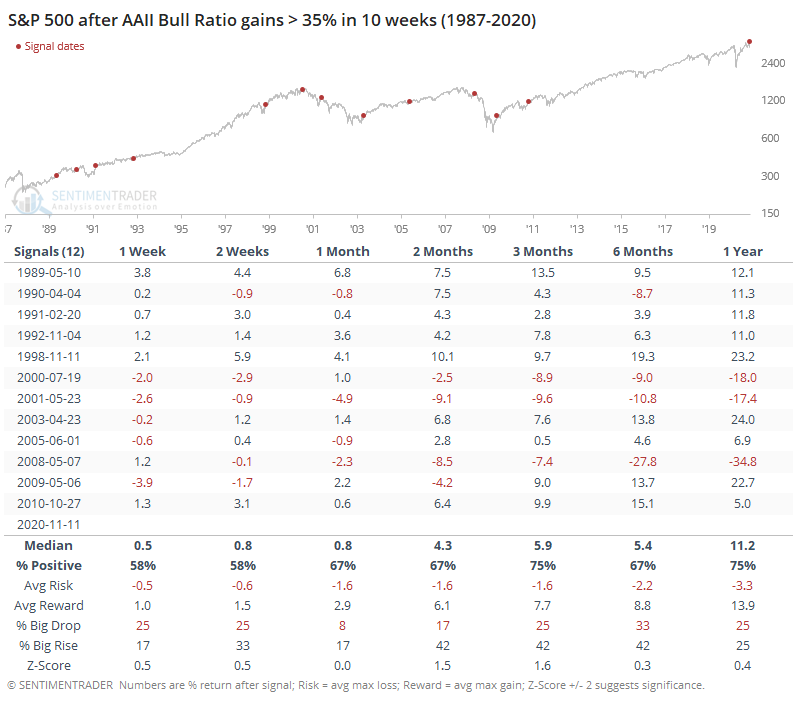

Another way to see the current extreme is the rate of change. The Bull Ratio has increased by more than 35% over the past 10 weeks, one of the largest changes going back to 1987.

This, too, wasn't a consistent sell signal. While 3 of them led to very large losses over the next 6-12 months, those were the clear exceptions, with an overall risk/reward ratio that was heavily skewed to the upside.

The rapid rise in optimism in this survey, which is now to a high level, should not be a major worry. Some large declines began weeks after behavior like this, but those were the exceptions. Historically, these kinds of readings have led to above-average returns, and consistently higher prices. The biggest concern is that prior to the last decade or so, the next 1-3 months showed mostly moderate losses.