Low Insider Buy/Sell ratio

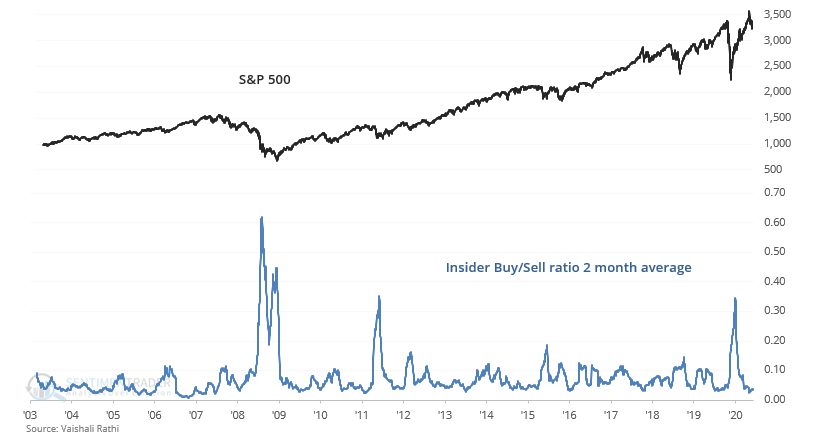

The academic literature has proven that corporate insider trading data can be extremely useful for trading individual stocks. And taken as an aggregate, Insider Buy/Sell ratios can be useful for timing the broader market. For example, the massive spike in insider buying in March/April resembled past spikes during major market panics. But after a massive rally from April - August, the corporate insider ratio's 2 month average has dipped significantly:

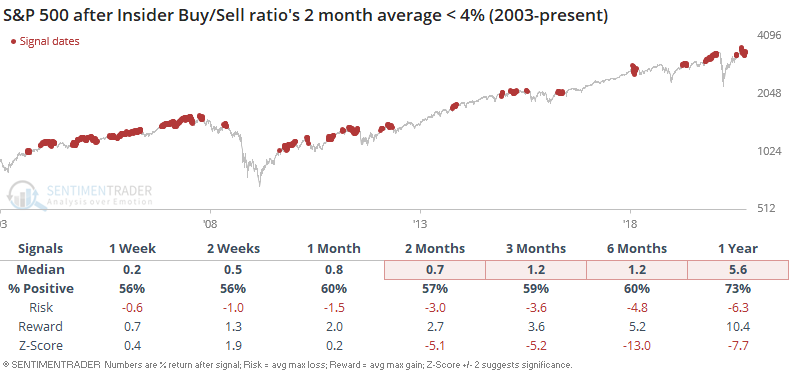

There have been 1010 days from 2003-present in which the Insider Buy/Sell ratio's 2 month average was below 4% (e.g. right now). When this happened in the past, the S&P 500's returns over the next 2-6 months were consistently more bearish than random:

Taking a closer look over the past 2 years, this happened from January-February 2018 (followed by a correction), April-May 2019 (followed by a pullback), October 2019 - January 2020 (early, but followed by a massive crash), and July 2020 - present.

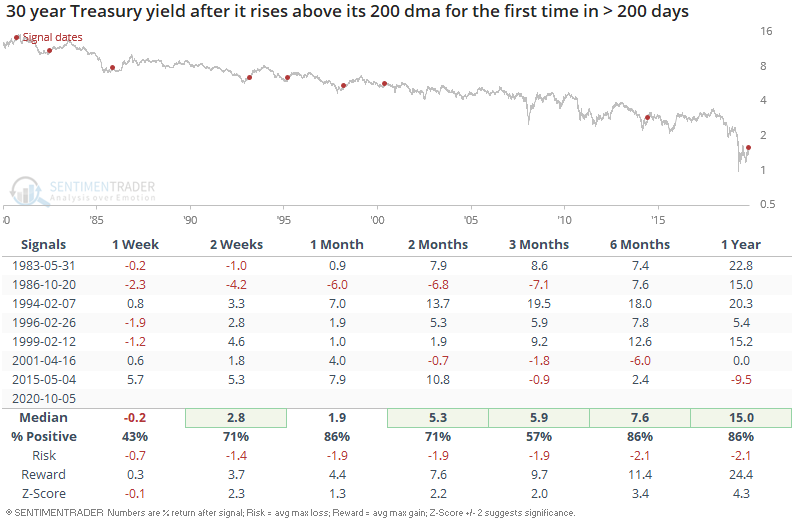

In un-related news, Andrew Thrasher and The Chart Report noted that the 30 year Treasury yield rallied above its 200 dma for the first time in more than 200 days. In the past, this usually led to a continued rebound in the 30 year Treasury yield.