Looking south for long-term opportunities

Internal momentum in Brazil is turning positive

The long-suffering investors in Brazil have finally gotten a reprieve, and it may last a while.

Last October, we showed how sellers were piling on Brazil. Stocks in the Ibovespa index were suffering a historic avalanche of selling pressure that subsided soon after. The Ibovespa chopped around until about a month ago and has been on a steady march higher ever since.

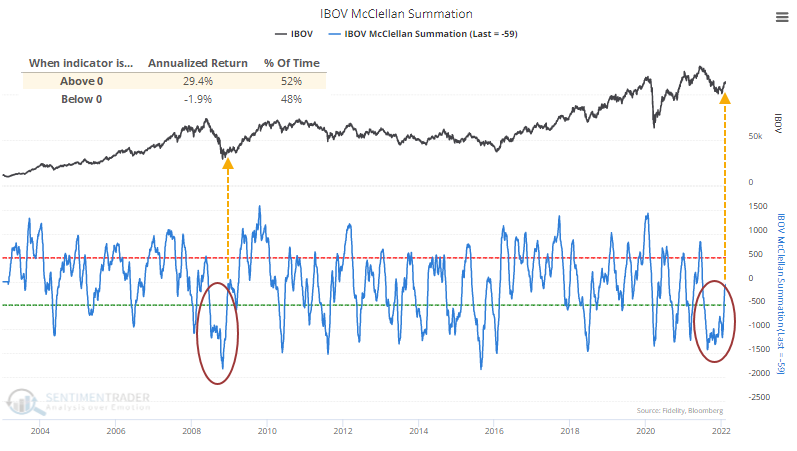

One of the guides we looked at was the McClellan Summation Index. It had been persistently and heavily negative for months. According to the Backtest Engine, the test we ran in October triggered a buy signal on January 21. It's now on the cusp of turning positive for the first time in more than 6 months.

The Ibovespa has shown an extreme difference in performance depending on the position of the Summation Index. When it was above zero, the Ibovespa showed an annualized return of +29.4% since 1997. When the Summation Index was below zero, its annualized return plummeted to -1.9%.

The recovery above zero will end the longest-ever streak in negative territory dating back to at least 1997.

| Stat box With the recent rally in gold, 100% of gold mining stocks are above their 10-day moving averages. Per our Backtest Engine, this has happened on 62 other days over the past 30 years, leading to an average 2-month return of -2.6%. |

Using seasonality and trend in leveraged loans

Jay looked at a seasonality- and trend-based system for trading leveraged loans.

The Invesco Senior Loan ETF (Fund) is based on the S&P/LSTA U.S. Leveraged Loan 100 Index (Index). The Fund will typically invest at least 80% of its total assets in the component securities that comprise the Index. The Index is designed to track the market-weighted performance of the largest institutional leveraged loans based on market weightings, spreads, and interest payments.

Leveraged loan performance is tied to the ability of the borrowers to repay the loans. This performance is linked to the state of the overall economy. One of the best guides to overall economic strength or weakness is the stock market itself.

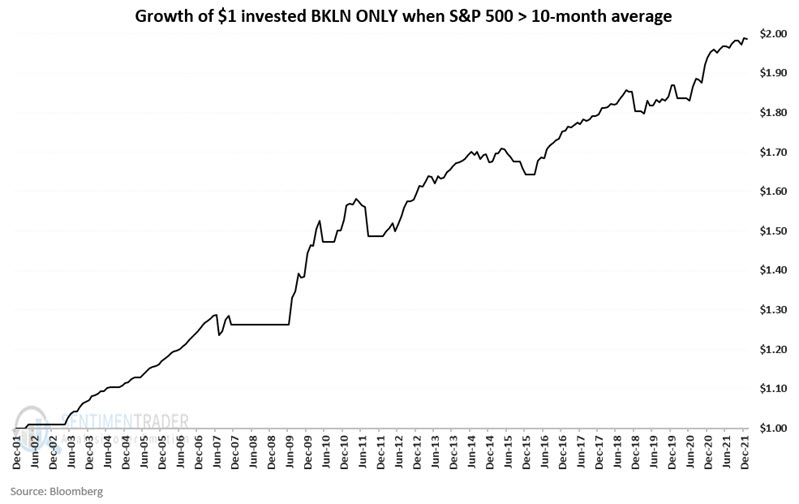

The chart below displays the growth of $1 invested in BKLN only when the S&P 500 closed the previous month above its 10-month simple moving average.

This performance is significantly better than when the trend is negative. When adding a seasonality layer, returns become even more impressive.