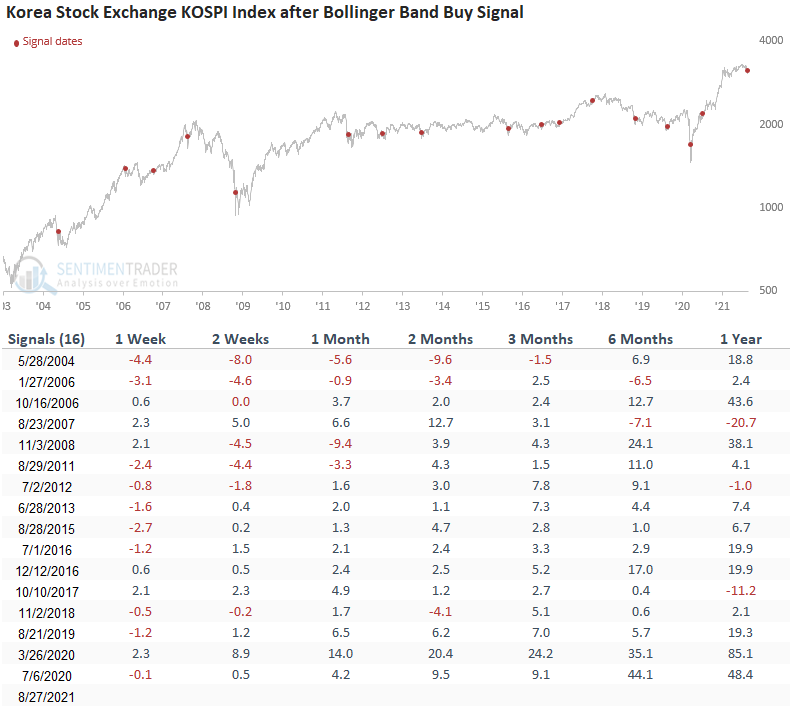

Korea Stock Exchange KOSPI Index Bollinger Band Buy Signal

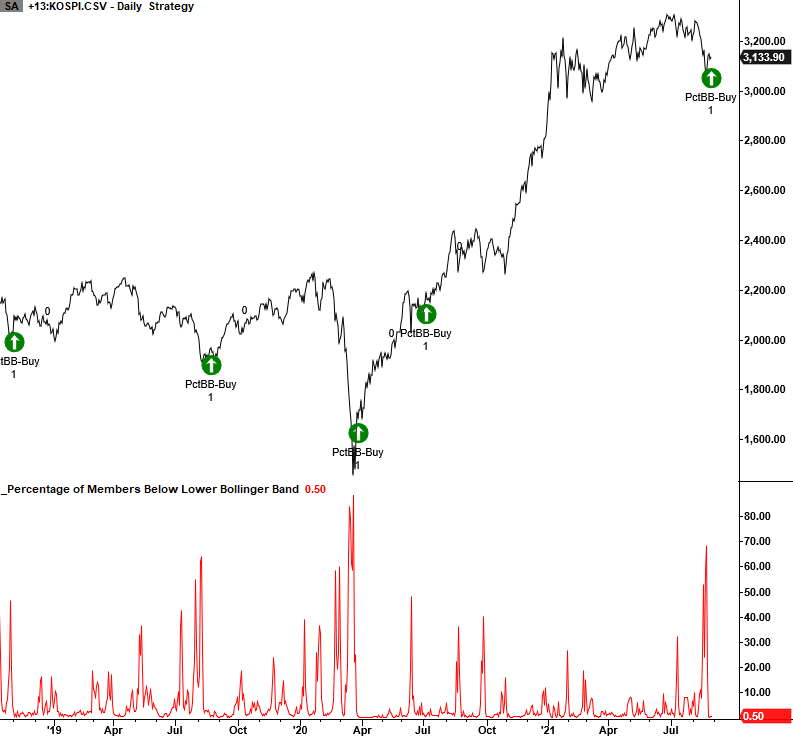

The percentage of Korea Stock Exchange KOSPI Index members trading below their respective lower Bollinger Band registered a mean reversion buy signal at the close of trading on 8/27/21.

Last week, I shared a study that showed unfavorable results for the MSCI Asia Pacific Index on an intermediate to long-term basis. However, the same study also showed the potential for a short-term mean-reversion bounce. With South Korea joining Taiwan, we now have two countries in the Asia Pacific region on a Bollinger band signal.

PERCENT BELOW LOWER BOLLINGER BAND BUY SIGNAL

The Bollinger Band signal seeks to identify when the percentage of Index members trading below their respective lower Bollinger Band cycles from a high to a low level, and Index momentum turns positive. The model will issue an alert based upon the following conditions.

SIGNAL CRITERIA

- Percentage of members cross above 41%. i.e., the reset

- Percentage of members cross below 0.6%

- If Condition1 and 2, start days since true count

- If Days since true count <= 10, and the KOSPI Index 5-day rate of change is >= 1.25%, then buy.

Data Source: Bloomberg

Let's take a look at the current chart and historical signal performance.

CURRENT DAY CHART

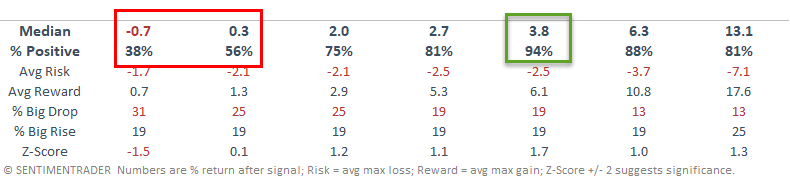

HOW THE SIGNALS PERFORMED

The 1-2 week results look weak. That's not a surprise, as mean reversion signals can be accompanied by choppy conditions when a market is in the process of bottoming. Results on an intermediate to long-term basis look solid. I would also add that the 3-month period has registered 15 consecutive winning trades.