"Just a bear market rally"

"Just a bear market rally"

One of the most popular knocks about the rally over the past couple of weeks is that it's "Just another bear market rally." There was an avalanche of notes about how the biggest rallies occur in bear markets. That's a given because volatility is higher during downtrends.

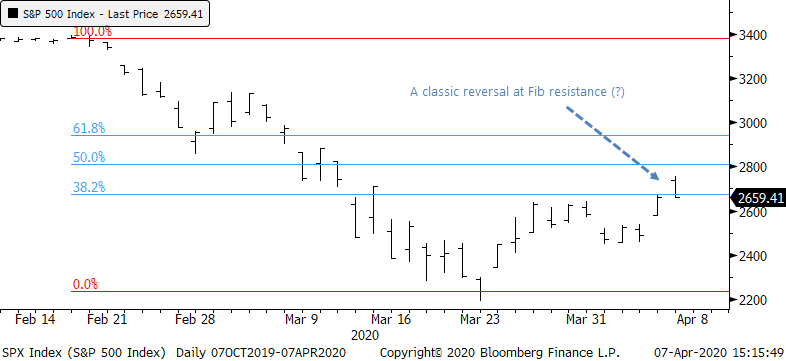

But this has been the most impressive recovery in history, even after Tuesday's intraday reversal. Classic technicians will be all over the idea that stocks suffered an intraday reversal at the "classic" 38.2% Fibonacci resistance level.

While it's common knowledge that stocks enjoyed multiple large rallies during prior bear markets, at no point during the rallies in the 1930s or 2008 did stocks manage to claw back as much of the losses as quickly as they've done this time.

The S&P 500 bottomed 11 days ago. In that short span, it's retraced nearly 37% of its decline. Looking at all historical instances of the S&P clawing back more than 30% of its decline after 11 days, not a single one was was "just a bear market rally."

Divvie dive

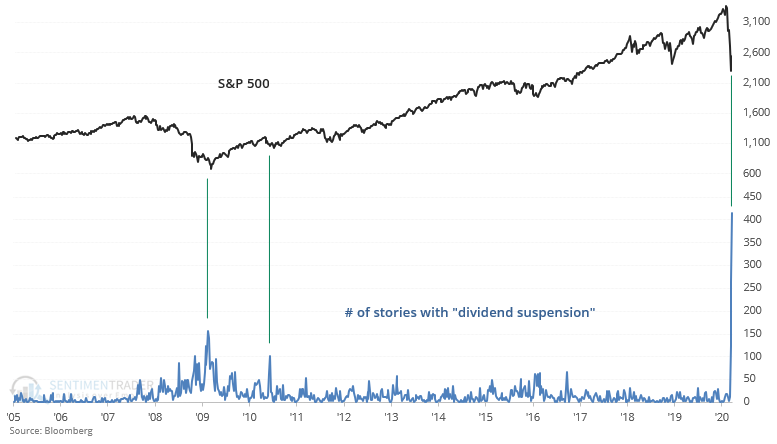

Media headlines continue to shower readers with more bad news while governments around the world aim for multiple rounds of stimulus to save their economies. One of the latest pieces of bad news relates to dividends.

Bloomberg demonstrates that the number of media stories with "dividend suspension" has soared. The previous high was in late-February 2009, just 2 weeks before stocks bottomed and began a decade long bull market.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- We take a deeper dive into the rallies that saw a big retracement of the previous decline, versus "just bear market rallies"

- Almost half the days over the past month have seen a breadth thrust

- No Fidelity fund managers have beaten the return on cash for months

- Despite a down day on Tuesday, breadth was good

- Recession articles are peaking

- Small business confidence has suffered a record reversal