Investors greatly favor safer stocks

Not all stocks are created equal.

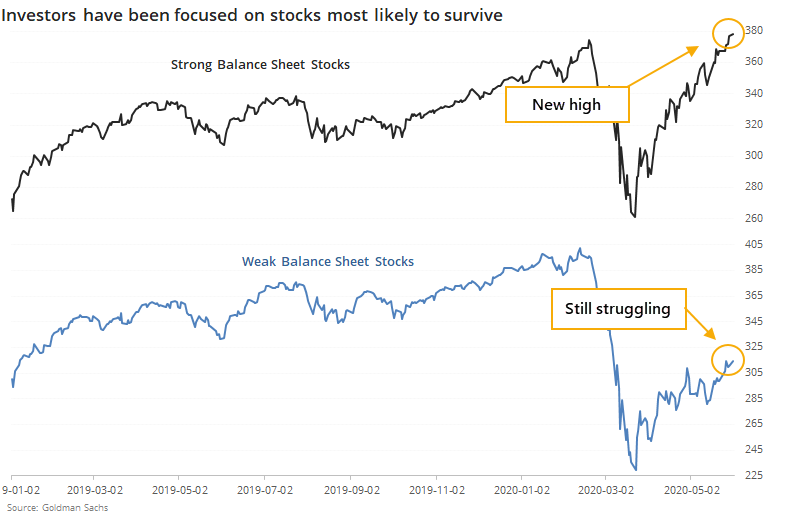

During this recovery, investors have been focused on those stocks most likely to survive the shakeout currently in progress. An index of stocks with strong balance sheets just hit a new high, fully recovering from the pandemic decline. Those with weak balance sheets are still struggling.

This isn't always the case. Sometimes, investors decide to take more risks (for more potential reward) by betting on companies that are in a weaker position now, but more likely a strong position later.

We can see the huge disparity between them below.

While it hasn't happened to this degree before, there have been a handful of times that strong balance sheet stocks led both weaker ones and the broader market to new highs.

We're limited by a small sample and limited history, but the recent preference for stocks with strong balance sheets looks to be a minor negative for the broader market over the medium-term, but that's about it.

By the time it has reached this stage, the strong balance sheet stocks have become stretched relative to their opposites, and the broader market, and had a tendency to underperform.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A detailed look at breakouts in strong balance sheet stocks vs others

- What happens when yet another breadth thrust triggers like it did on Monday

- More and more overseas markets are seeing stocks above their 50-day average, like the Nikkei and DAX

- Optimism is getting very high in overseas markets, too