Individuals are still being left out

We've touched on the AAII survey several times in recent months, noting how these investors were not buying into the rally. Far from it.

In the past, we've looked at the implied demographics of the survey, and it seems pretty clear that they skew heavily to the older end of the population. Maybe that's why a massive tech-led rally hasn't excited them as much as rallies in the past.

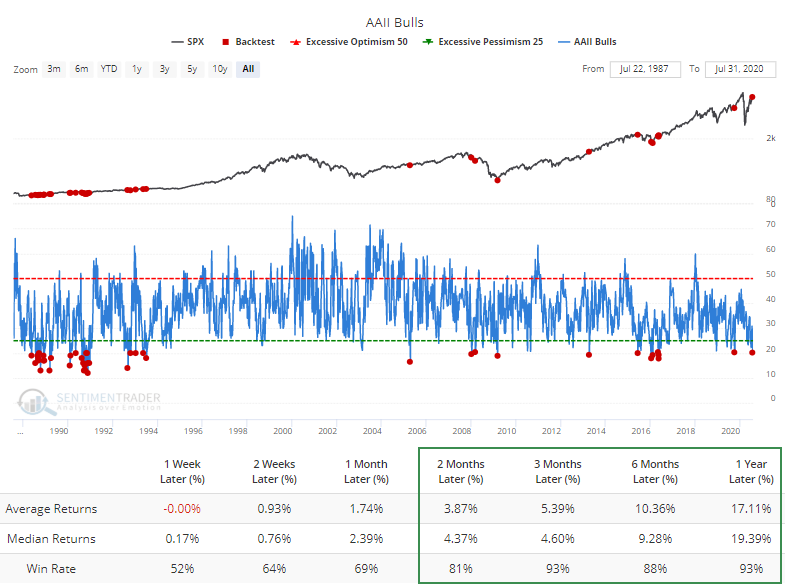

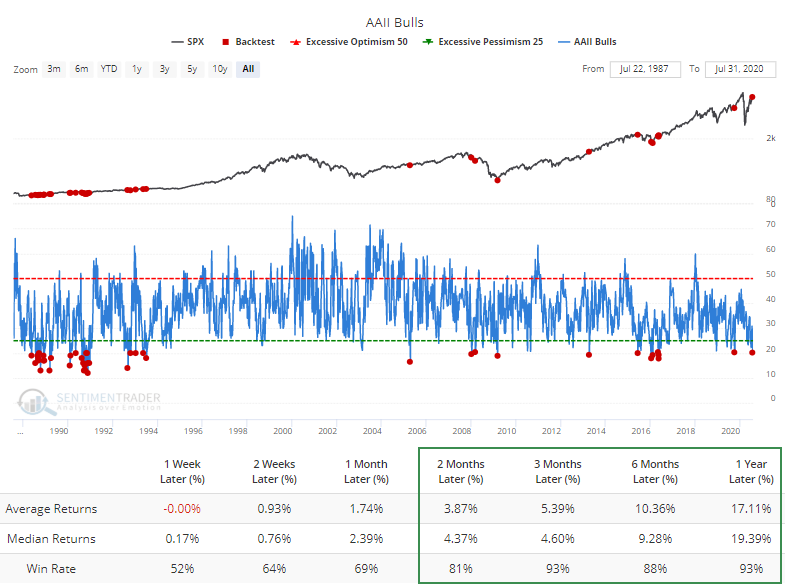

Whatever the reason, such a low level of optimism has rarely been to their benefit. The Backtest Engine shows that the S&P 500 has rallied 93% of the time over the next three months when fewer than 20.5% of respondents considered themselves bullish on the market.

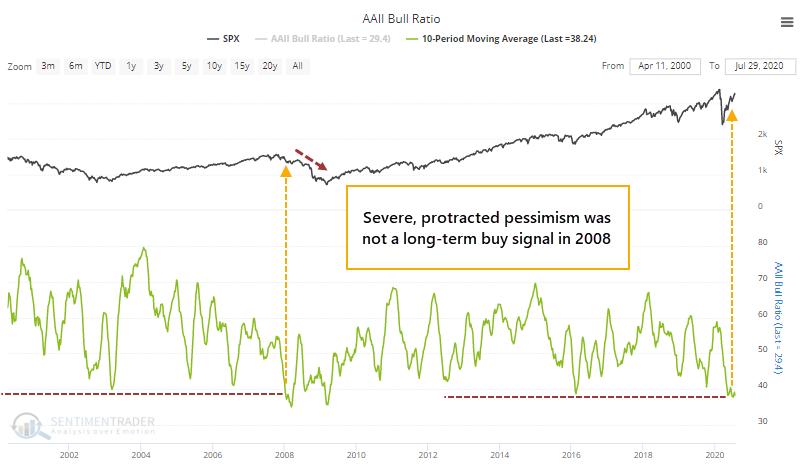

The biggest caveat about this data is that the last time these investors dropped to a decade-long bout of pessimism was in early 2008. While stocks bounced a bit in the shorter-term, it still preceded a loss of nearly 50% within the next year.

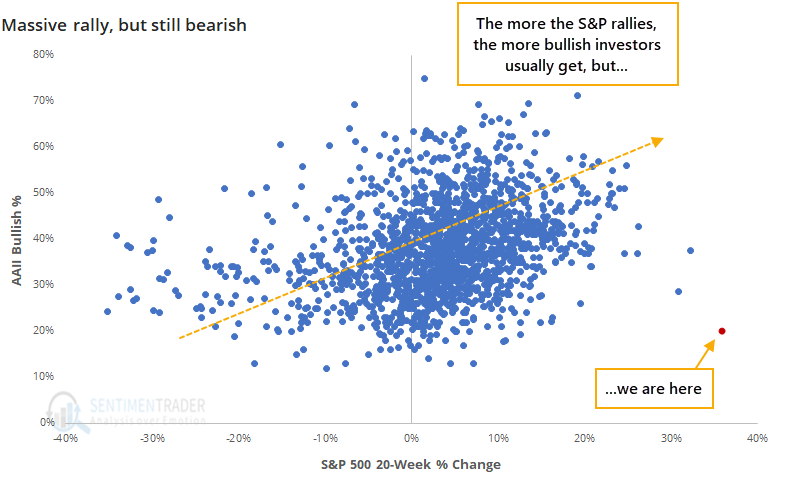

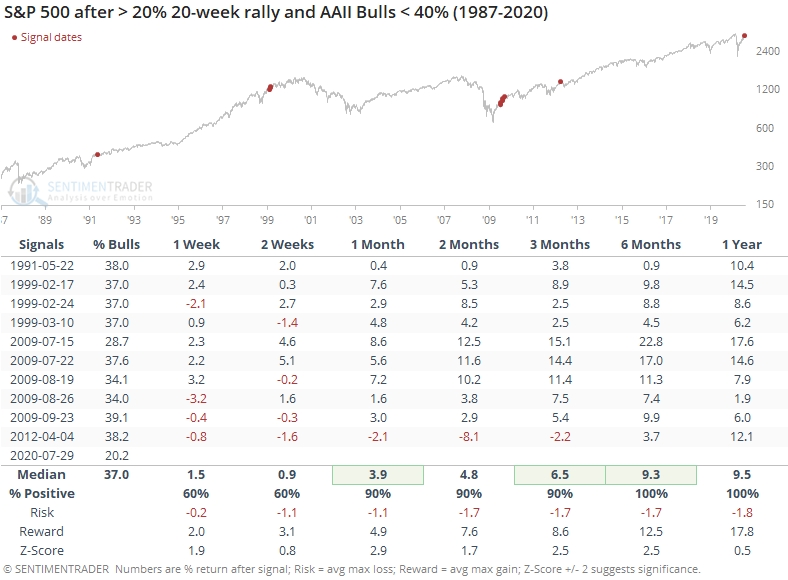

What's even more curious about what these folks are saying is we've never seen a rally this large, over this long of a period, and still had so few investors consider themselves bullish.

That red dot on the chart shows just how much of an outlier our current situation is. These investors have a strong tendency to become bullish after stocks rally, but they're clearly not doing so this year.

Historically, an unwillingness to buy into a big rally in stocks was a good sign for those rallies to continue.

The last time this happened, in early 2012, the S&P faltered over the next couple of months. That was also the worst signal, by far. All of the others showed a gain from one month and beyond, with a ridiculously positive risk/reward ratio. Many of the signals were clustered in the summer of 2009, also the only time when consumers, in general, were also betting that stocks would decline.

This is not an easy time to define "sentiment". If we use some isolated surveys, equity fund flows, and moves in safe-haven assets, we could assert that investors are overly pessimistic and stocks should keep adding to their gains. But the weight of the evidence would suggest that far more indicators are showing the opposite, and during what is still a prove-it kind of market environment. None of these suggest much about what the next few days could hold, but they do continue to argue that over a medium-term (1-3 month) time frame, risk is high.