High-yield bonds are showing more breakouts than breakdowns

Key points:

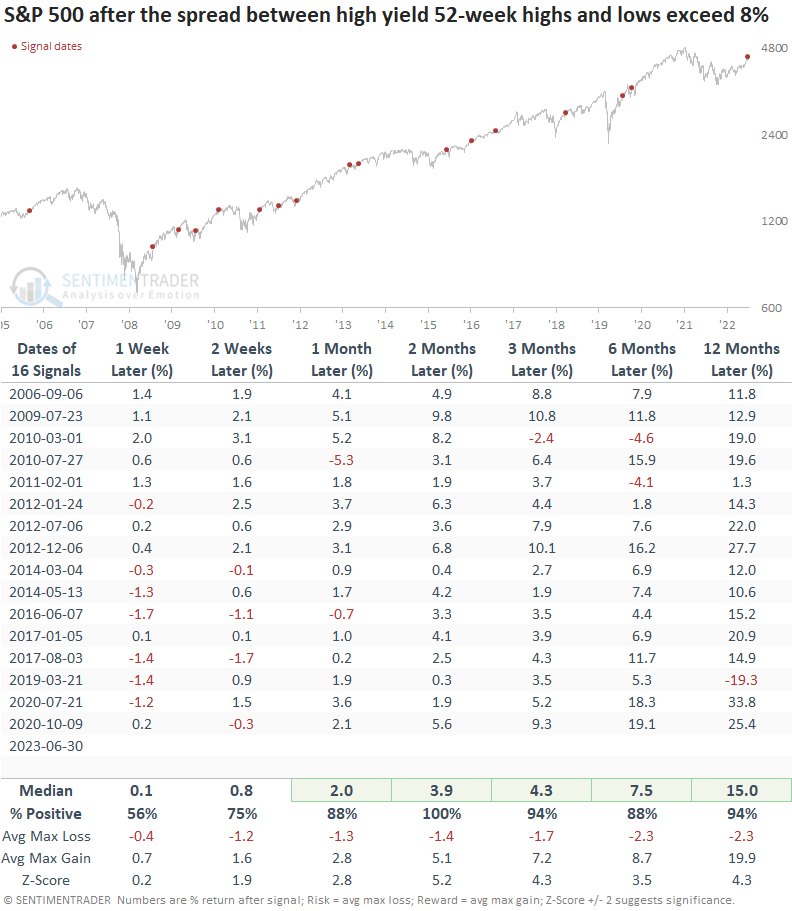

- The spread between 52-week highs and lows as a percentage of issues for high-yield bonds exceeded 8%

- Similar spread levels produced excellent returns for a high-yield bond index and the S&P 500

- A 52-week high-low spread of 8% or more has never been observed during a recession or bear market

A bullish market breadth signal from high-yield bonds

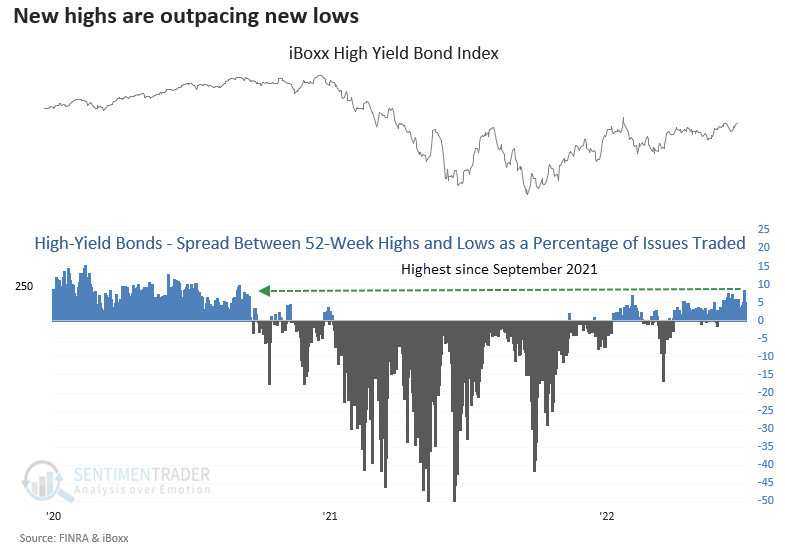

Following an extended period during which the number of 52-week lows for high-yield bonds surpassed 52-week highs by a considerable margin, the situation has now reversed. Last week, the spread between 52-week highs and lows as a percentage of issues traded crossed the 8% mark for the first time since September 2021.

The recent surge in the spread to an 18th-month high is an interesting development, especially in light of rising Treasury yields and the growing chorus of recession and credit crunch predictions. It begs the question: What implications can we draw from the behavior of corporate bonds that exhibit heightened sensitivity to fluctuations in the business cycle?

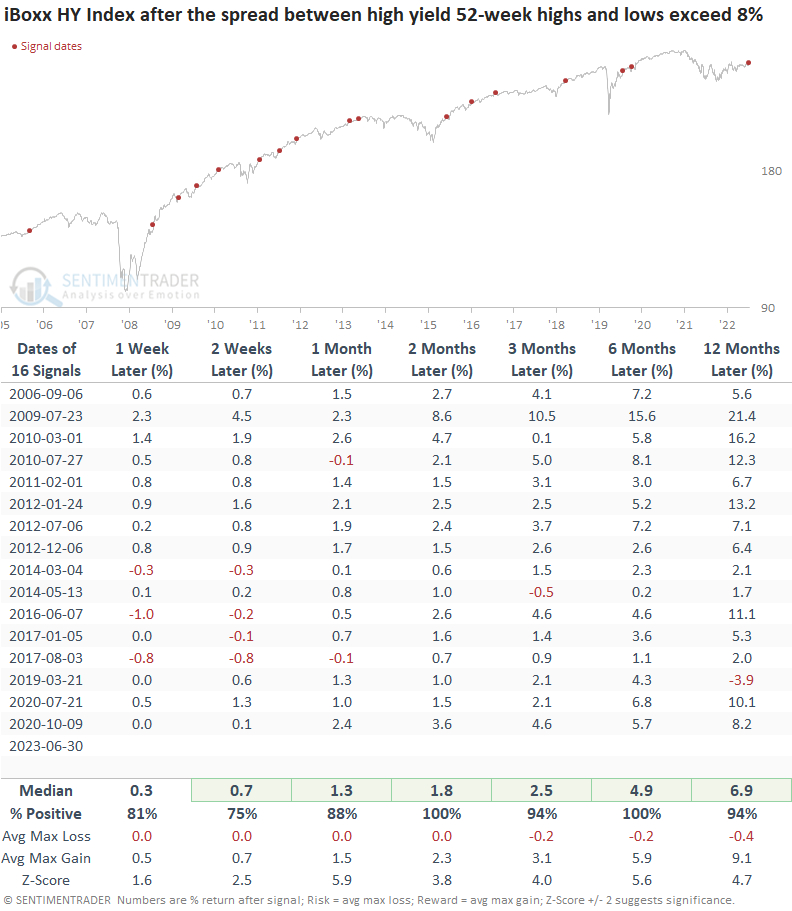

Similar 52-week high-low spread conditions preceded excellent returns

When the spread between 52-week highs and lows as a percentage of issues traded exceeds 8%, the iBoxx high-yield bond index has risen in the months ahead every time. Although the study takes into account only a few recessions and bear markets, the spread has never reached the current level during those volatile periods.

I screened out repeats by requiring the spread to fall below 0% before a new signal could occur again.

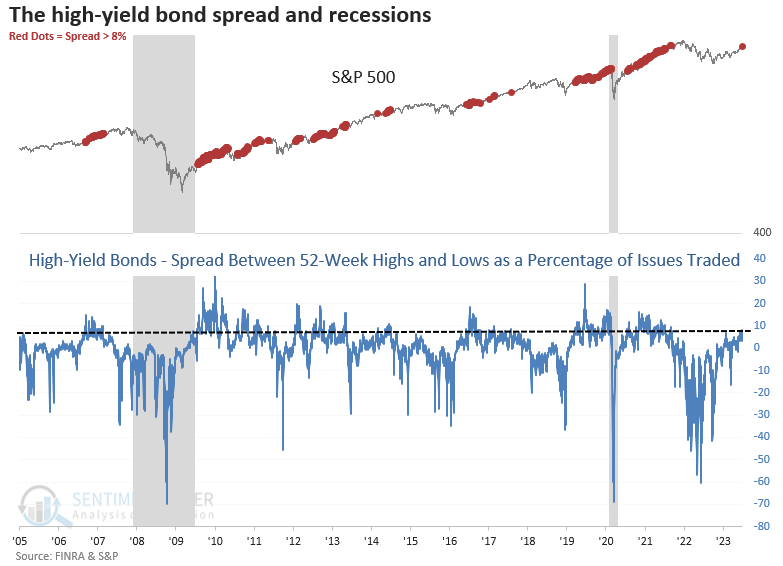

A visual perspective on recessions and bear markets

When the economy goes through a downturn, high-yield bonds bear the brunt of it, leading to more 52-week lows than highs. So, the spread rarely goes above 0%, let alone 8%.

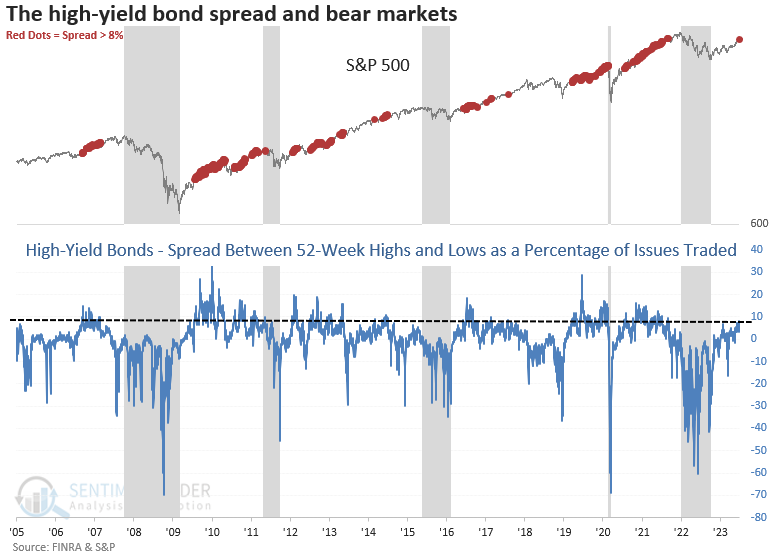

High-yield bonds often endure a similar fate to equities when bear markets emerge. Consequently, the spread remains consistently below 8%.

Stocks tend to thrive when high-yield bond breadth is bullish

High-yield bonds are known for their correlation with stocks, meaning they tend to rise and fall together. So, when market breadth indicators such as the 52-week high-low spread signal a bullish trend for high-yield bonds, it also suggests a bullish outlook for stocks.

What the research tells us...

Whether equities or now high-yield bonds, the message from the market suggests the economy is not as bad as some would have us believe. Could that change down the road? Absolutely. With more high-yield bonds registering 52-week highs versus lows, the outlook for a high-yield bond index and the S&P 500 looks bright over a medium and long-term horizon. Historically, similar spread levels are a strong deterrent against an imminent recession or bear market.