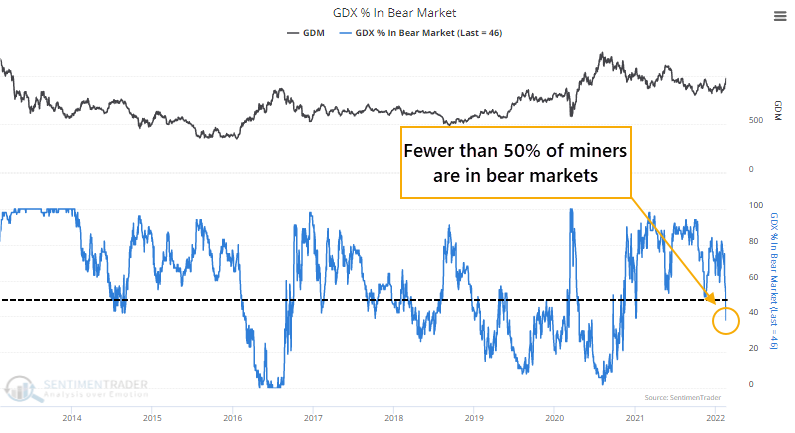

Gold mining stocks haven't done this for more than a year

Finally, fewer than half of gold miners are in bear markets

It always seems like gold mining stocks have something to prove. With recent geopolitical and inflationary scares, gold and the companies that mine it are having a moment. They still have to get over the hump.

Gold bugs are getting excited because, for the first time in over a year, fewer than half of mining stocks are mired in a bear market. That's a pretty good dividing line between secular bull and bear markets in gold mining indexes. When more than half of the stocks are down 20% or more, stay out. Bull markets tend to see this figure stay below 50%, which should be a good sign for the current move.

We'd gone more than a year with more than half of miners in a bear market. This ends one of the longest streaks in 40 years.

Again, this should be a good sign, but historically it was not. Miners struggled mightily over the next 1-4 weeks to hold onto those gains. While gold bugs tend to be passionate investors, it's been a tough sell to attract mainstream investment dollars even when (or especially when) momentum turns positive.

Other measures of gold miner breadth show why now they have a lot to prove, and why this time may be different from recent history.

| Stat box The S&P 500's drawdown of more than 10% from its recent high ended its 11th-longest streak of holding within 10% of a high since 1928. |

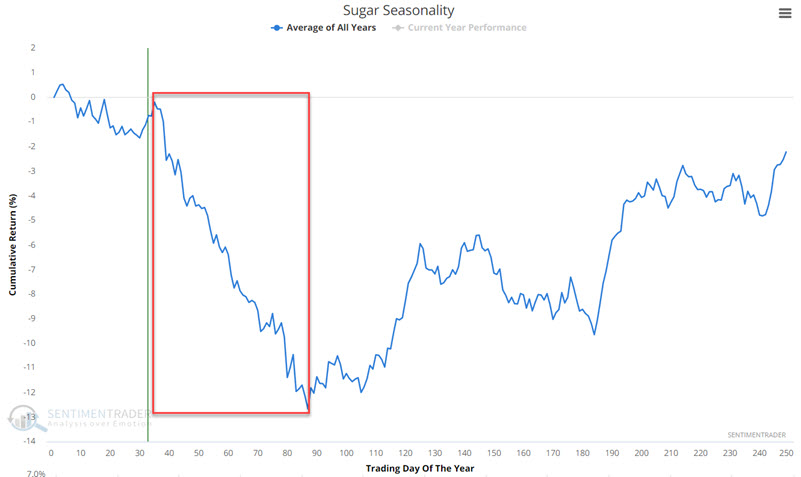

Sugar seasonality is not so sweet

Many commodities exhibit strong seasonal tendencies. Jay noted that rour that tend to experience late winter weakness are silver, platinum, sugar, and the British pound. No seasonal trend is perfect, but being aware of tendencies can offer a trader a critical "edge" in deciding how to play certain situations.

The chart below displays the annual seasonal trend for sugar futures. Note the period highlighted in red.

Starting now and lasting through early May, sugar showed a gain during only 21 out of 61 years.