Gold Mining Stocks Are Surging...and Have a Lot To Prove

After being left for dead, companies who mine the barbarous relic have made a comeback. Gold mining stocks are showing a thrust in medium-term trends, but longer-term trends remain poor. That has preceded mostly negative returns for the HUI Gold Bugs Index.

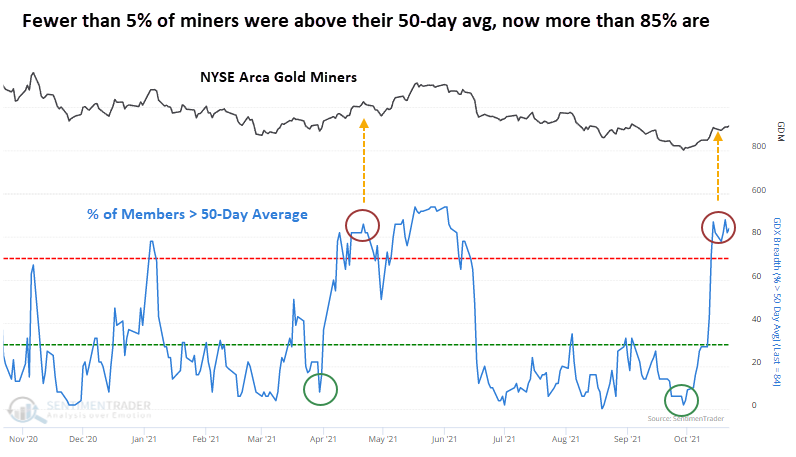

Less than a month ago, fewer than 5% of gold mining stocks traded above their 50-day moving averages. With a surge in gold prices in recent weeks, miners got bid, and several days recorded more than 85% of the stocks trading above their averages.

When these stocks have cycled like this, from few to most of them trading above their 50-day averages within 30 days, the sector showed mediocre returns. It rallied most of the time over the next 1-2 months but then often saw those gains peter out. Over the next 6 months, the average return was a woeful -4.4%.

We also looked at medium-term breadth thrusts when few stocks traded above their 200-day moving averages. And times when most of the stocks were emerging out of bear markets. Forward returns were not encouraging.

What else we're looking at

- Full results after breadth thrusts in gold miners

- What happens when miners end a long streak with more than 75% of stocks mired in bear markets

- The S&P 500 is about to enter a "power period"

- What momentum in the S&P equal-weight index means for future returns

| Stat box The S&P 500 Equal-Weight Index, which gives equal weight to each of the 505 stocks in the index, just ended a streak of 10 consecutive positive days for only the 2nd time in a decade (October 5, 2017, was the other). |

Etcetera

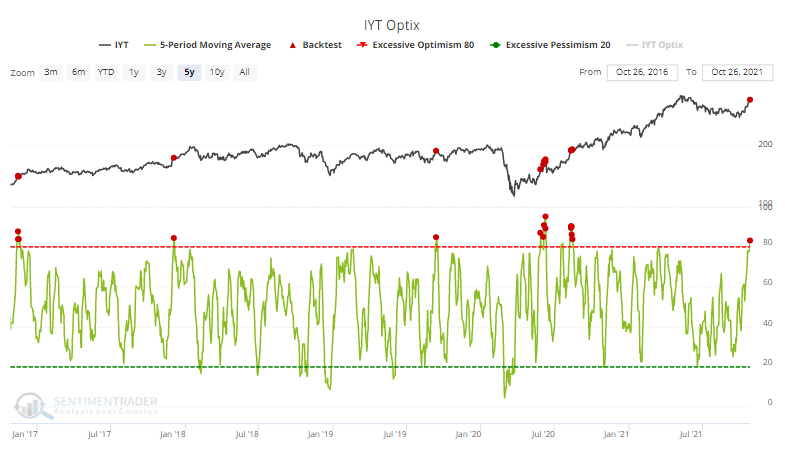

Transportation stocks are really moving. Over the past week, the Optimism Index for the IYT fund has averaged more than 83%, among the highest in 5 years. There is often a burst of optimism like this after emerging from a prolonged downtrend.

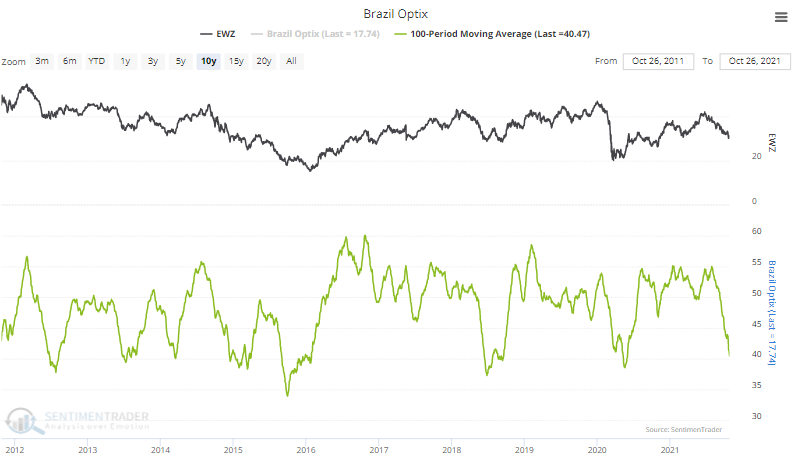

Brazil waxed. Sentiment on Brazilian stocks is morbid and getting even worse. Over the past 100 sessions, the Optimism Index on EWZ has dropped near 40%, among the lowest levels in a decade.

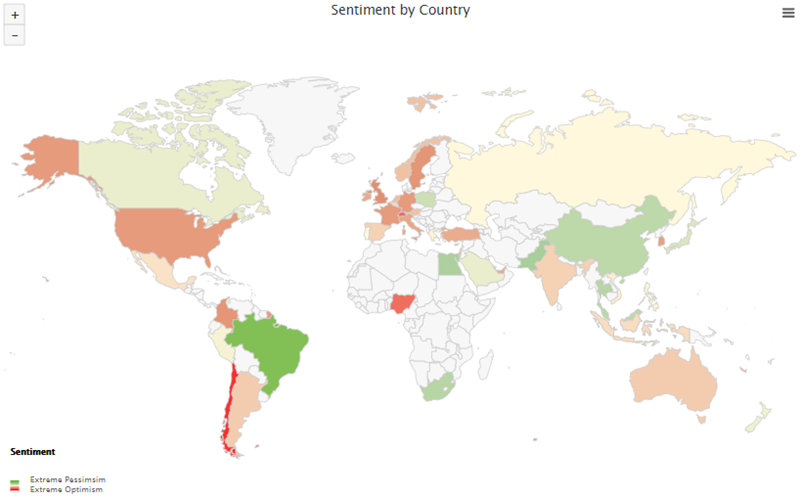

Around the globe. Our Optimism Index Geo-Map shows that Brazil is one of the few countries where investors show low optimism (green color).