Gold miners take off while financials sink

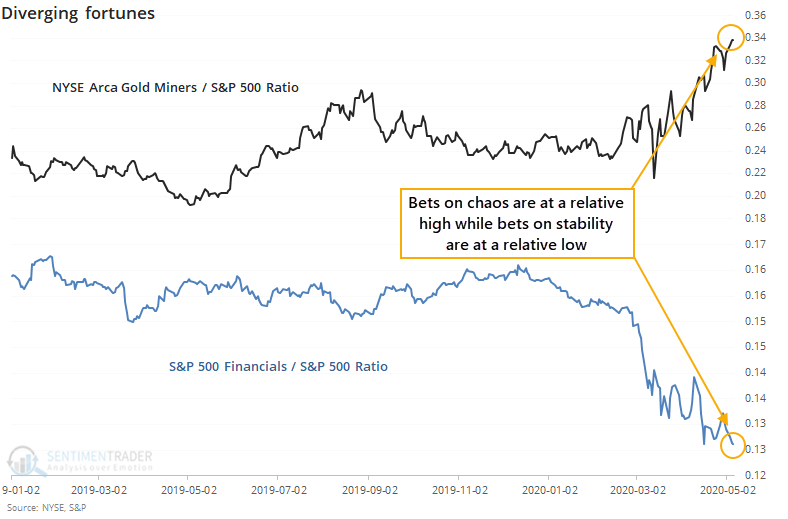

Lately, gold has been holding up and gold mining stocks have been rocketing higher. At the same time, financials have been barely holding water. Relative to the S&P 500 index, the NYSE Arca Gold Miners index has made consistent new highs, while the S&P 500 Financials index has been mired near its lows.

This does not seem like an auspicious setup for the broader market. Bets on gold mining stocks are commonly taken as a bet on general chaos, while bets on financials are a bet on economic growth and stability. The fact that the former is at a new and the latter is at a low seems troubling.

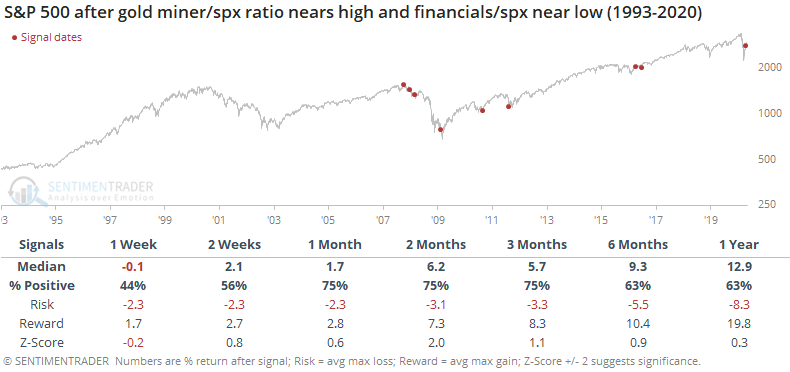

Like a lot of things market-related that sound good in theory, there is maybe a shred of truth in it but overall it's not a consistent factor. When the ratio of gold miners to the S&P was within 0.5% of a 52-week high and financials to the S&P within 0.5% of a 52-week low, it was a major warning in late 2007 - early 2008, but after that, not so much.

Financials fared worse than the overall market, and gold miners worse still, at least longer-term, since most of the signals triggered in the past decade.

When we go back further using a specific gold mining stock, the same general pattern held true.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- What happens after other front-loaded (versus back-loaded) 30-day rallies from a low

- The Nasdaq 100 to S&P 500 ratio has soared over the last 100 days

- That's while the Financials to S&P ratio has cratered

- Growth to value stocks have also seen a near-record bout of momentum