Energy stocks have been sucking the hind teat for a very long time

Energy stocks have lagged. That's a shocker to exactly nobody.

The sector has been so bad that they've been the worst-performing stocks out of all sectors for 69 days out of the past 200, per the fine folks at Bespoke. That's an awful lot of days of sucking the hind teat as my grandpa used to say.

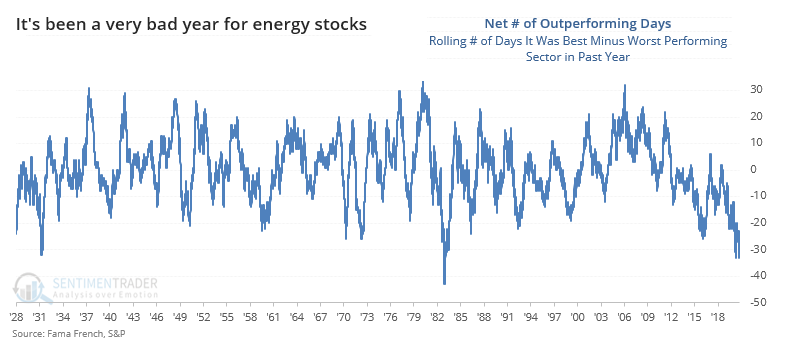

It's worse than that. On a daily basis, the percentage change in energy stocks has lagged all other sectors for 85 sessions out of the past 252 (roughly one year). This can be misleading, however, because a sector that underperforms so much tends to be extremely volatile, so it often sees a lot of days when it outperforms all other sectors as it bounces along with swings in investor emotions. Indeed, energy stocks have been the best-performing sector on 54 days in the past year.

If we net out the number of days in the past year when energy was the worst-performing minus best-performing sector, the spread is still extremely negative at more than -30 days. Going back to 1928, this is one of the widest spreads ever. The only time it got worse than this was in late 1982.

Remarkably, when we go back to 1928 and look at all of the major sectors and how often they were the worst vs. best performing sector, this stretch in energy stocks ranks among the very worst of any sector. Ever. The others showed a fairly consistent tendency to be long-term contrarian indicators.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A look at other sectors and their history of under- vs. over-performance

- All energy stocks are below their 10- and 50-day moving averages

- There has been a big spike in 3-month lows among them

- Long-term internal momentum is showing a "shot-chaser" pattern

- What happens to energy stocks when speculators are heavily short the buck

- Seasonality on oil vs energy stocks

- Corporate insiders in energy companies have pulled back on selling their shares

- Breadth on the NYSE has gone from terrible to great

- Asian markets are seeing internal weakness