Despite the big rally, it's hard to see who's buying

The latest survey of individual investors from the fine folks at the American Association of Individual Investors (AAII) showed a big drop in optimism. It's not just that one survey - several others are also showing tepid sentiment at best.

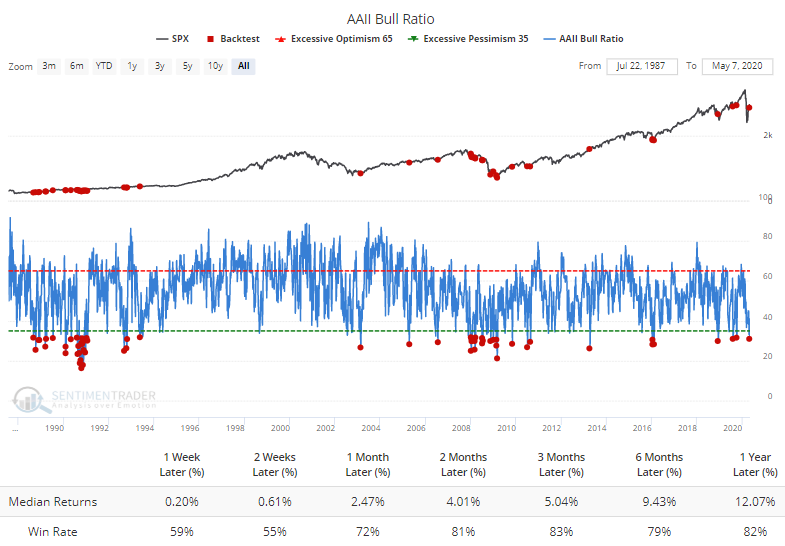

Our Backtest Engine shows that following any week when the Bull Ratio (Bulls / (Bulls + Bears)) was below 32%, forward returns in the S&P 500 were consistently positive.

What's outstanding about the current week's reading is that it isn't coming after a big decline. Quite the opposite.

There has never been a period when optimism was so low after such a big rally. Out of the 54 times when the S&P 500 showed a gain of 10% or more over a 7-week period, not one of them (until this week) saw more than 50% of respondents consider themselves bearish.

The only times more than 40% of respondents were bearish were December 1990 and a few weeks from April - August 2009.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- News sentiment is nearing the most pessimism in 35 years

- Hedge funds don't seem to be levering up

- Fund flows continue to be weak into equities

- Rydex traders are still showing pessimism

- Consumers' outlooks on stocks are still tepid

- The VIX Term Structure hit a 50-day low even while most stocks are still below their 200-day moving averages

- Optimism on XLK is extremely high

- The Nasdaq keeps moving by +/- 1%, nearing the most such moves over a 2-month period

- The Nasdaq/S&P 500 ratio is well above its 50-day average

- Canadian stocks keep rising