Cyclical stocks transition to uptrends

Key points:

- Stocks within cyclical sectors transitioned from downtrends to uptrends

- After similar price trend shifts, the broad market enjoyed impressive returns

- Historically, equal-weighted cyclical sectors tended to outperform cap-weighted ones

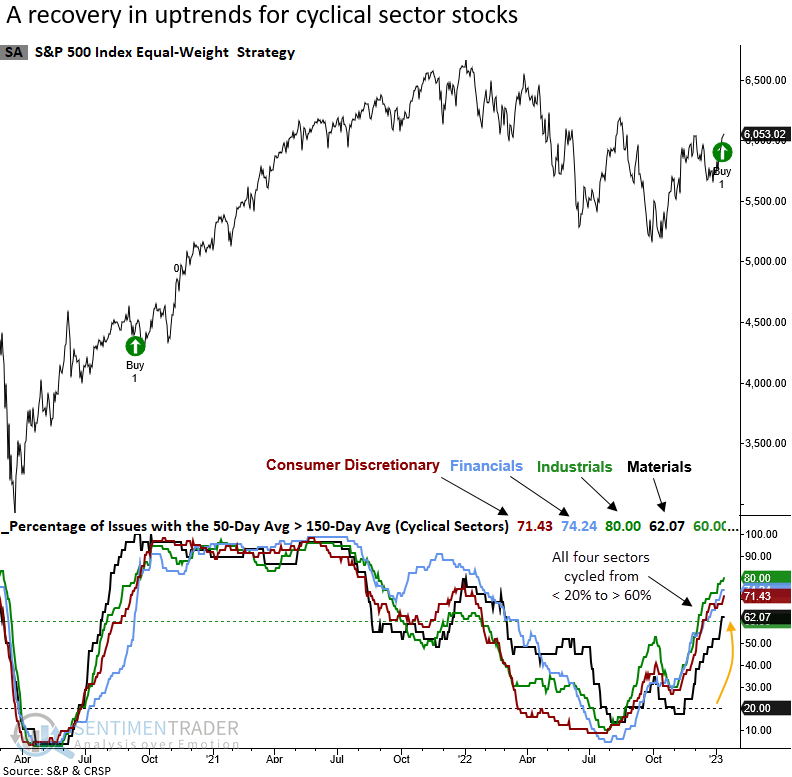

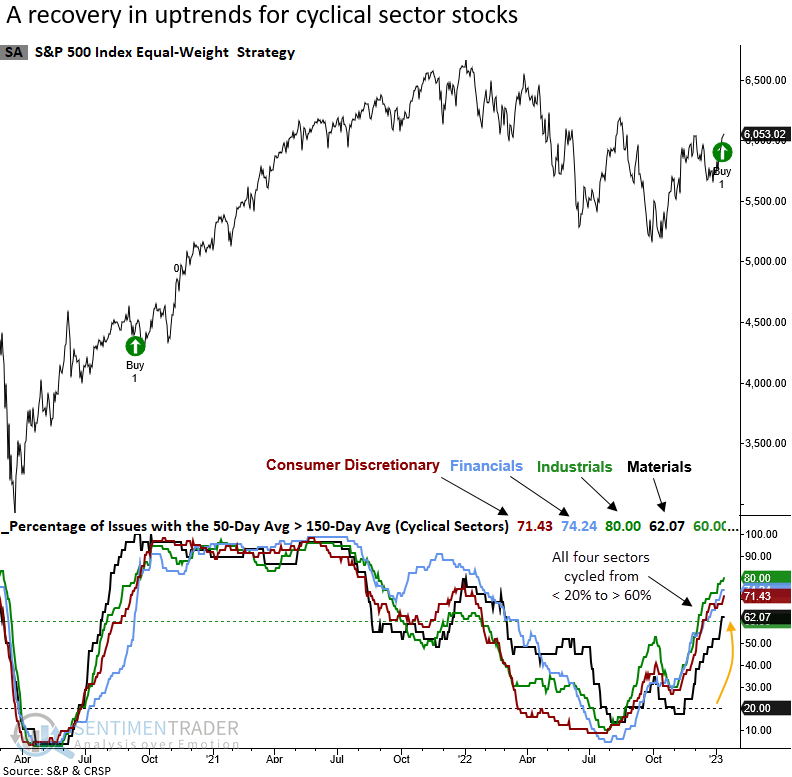

Most cyclical sector stocks are now in an uptrend

In the last few months, we've shared several research notes highlighting impressive recoveries in various cyclical/value-oriented sectors like Industrials, Financials, and Materials. And last week, the Consumer Discretionary sector turned the corner.

Until now, most studies relied on short to medium-term indicators. However, that's now starting to change as longer-duration measures are improving.

The percentage of issues with their respective 50-day average > 150-day average for cyclical sectors cycled from < 20% to > 60%, triggering a buy signal for the broad market for only the 18th time in more than 60 years.

Cyclical sectors include Consumer Discretionary, Financials, Industrials, and Materials.

Similar price trend recoveries in cyclical sectors preceded excellent results

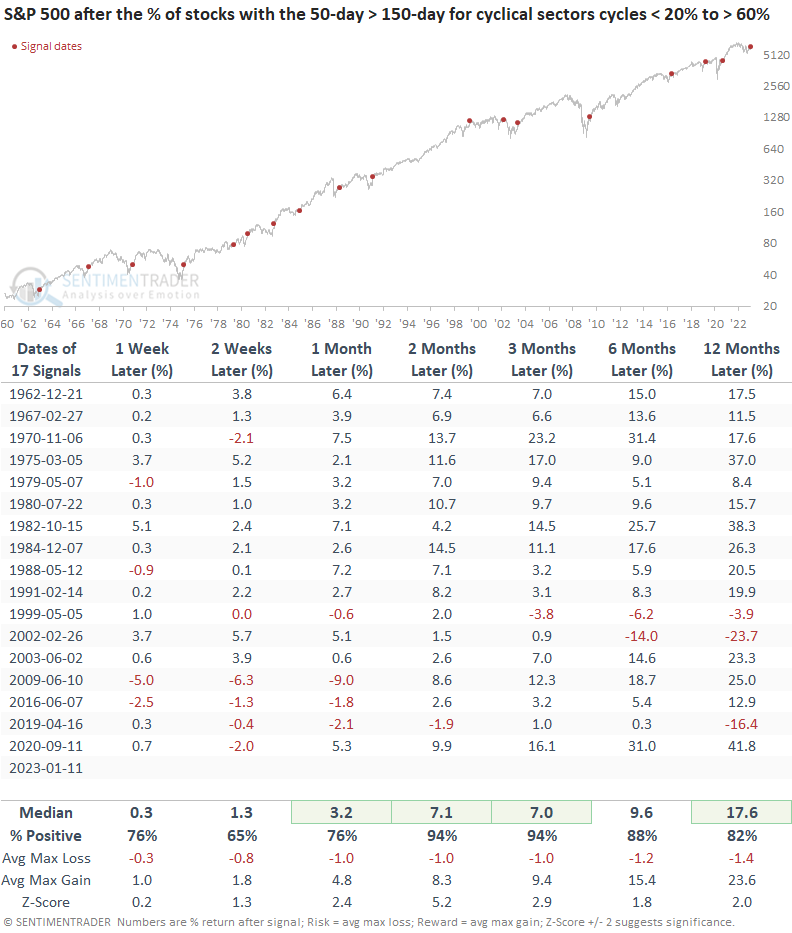

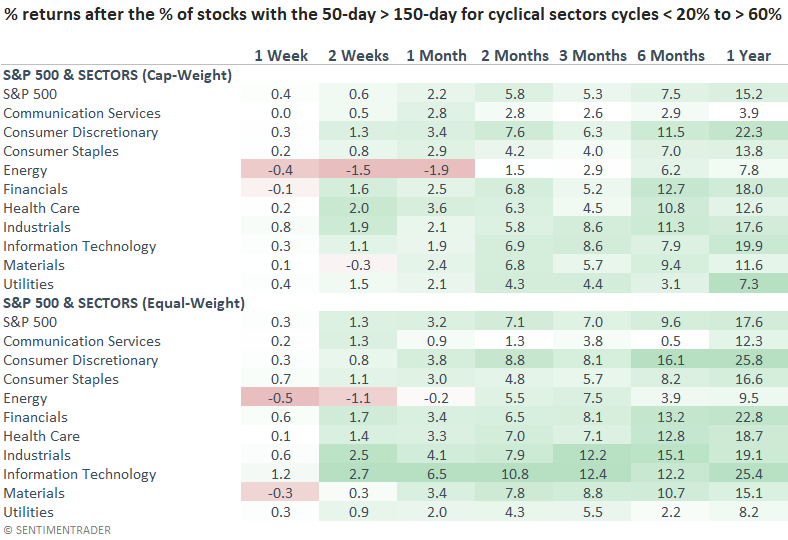

When the percentage of stocks with their respective 50-day average > 150-day average for cyclical sectors cycles from < 20% to > 60%, forward returns for the equal-weighted S&P 500 index were excellent across all time frames. The signal shows a solid risk/reward profile, with relatively benign drawdowns in the first three months, even for the whipsaw instance in 2002.

The signal marked the end of 20%+ drawdowns in 8 out of 9 cases, with 2002 being the exception.

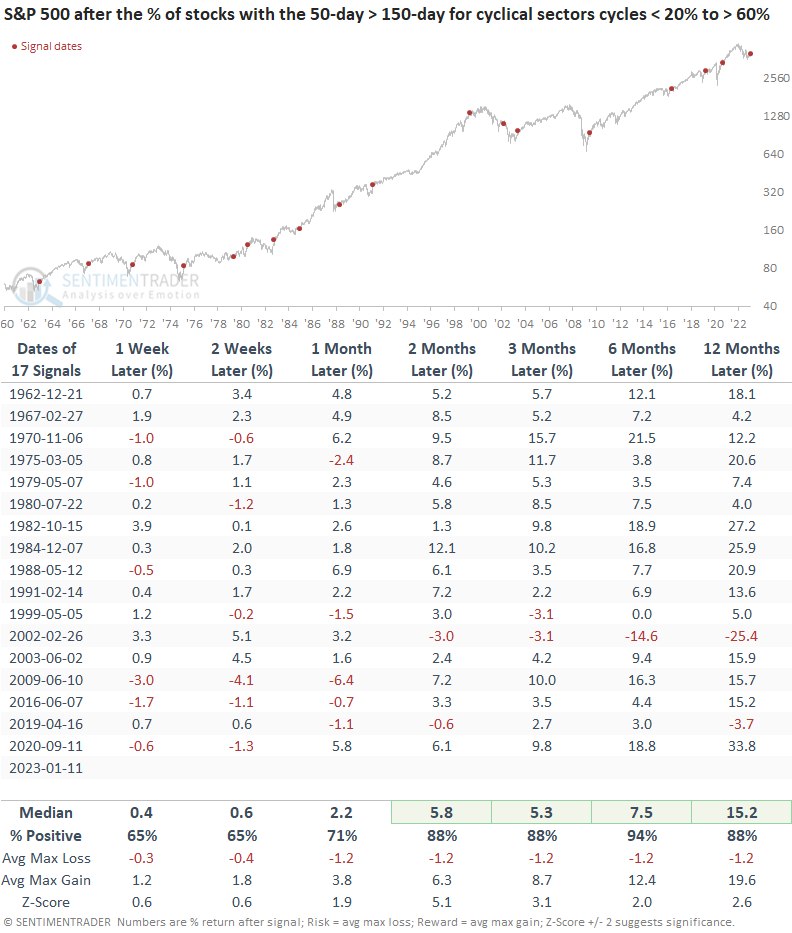

Performance for the cap-weighted S&P 500 index looks equally impressive. Drawdowns across short to medium-term time frames were slightly less than the equal-weighted version.

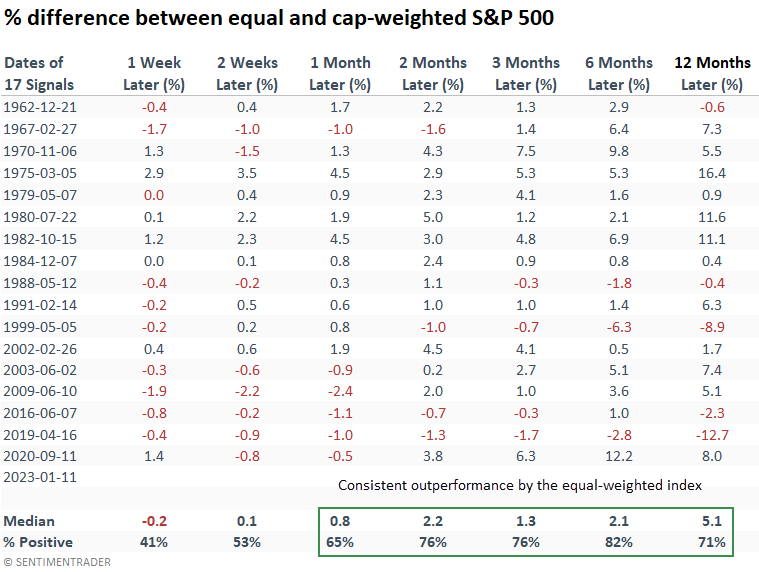

Typically, the recovery in cyclical sector stocks foreshadows an end to significant drawdowns. When it does, passive investors would have been rewarded by allocating to the equal-weighted S&P 500 index, as it tends to outperform the cap-weighted index up to a year later.

If the recovery turns out to be a false signal, like in 2002, the equal-weighted S&P 500 still outperformed the cap-weighted version.

When I apply the signals to the two different index weighting methodologies, the equal-weighted cyclical sectors consistently outperform the cap-weighted ones across most time frames.

While historical performance trends are lovely, one should always utilize a comparative relative strength indicator to see if the current environment aligns with historical precedents.

What the research tells us...

When markets transition from a bear to a bull environment, it's imperative to see longer-duration indicators confirm the message from short to medium-term ones. Otherwise, the odds of a false signal are greater, which was the case in 2022. So, with the percentage of stocks with their respective 50-day average > 150-day average for cyclical sectors cycling from < 20% to > 60%, the evidence is starting to build in favor of a new bull market. However, we need to see other long-term trend measures improve. Stay tuned.