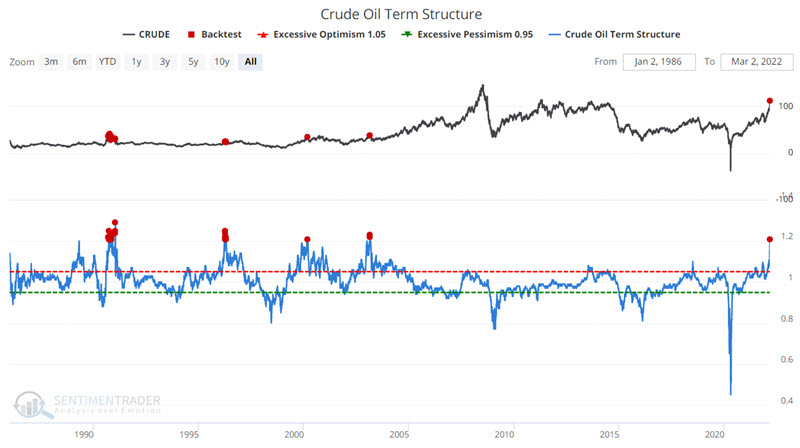

Crude oil traders haven't behaved this way in nearly 20 years

A historic flip in crude oil

The war in Ukraine has lit a rocket under energy products. When a market starts to rally vertically, a) no one knows when the rally will end or how far it will run, but b) when the end comes, the reversal can be swift and severe.

Jay noted that a concern for energy bulls is the recent spike in the term structure for crude oil futures.

The term structure of crude oil futures shows the relationship of the near-term futures contract to a further-out contract. If it is above 1.0, the near-term contract is priced higher than the further-out contract, called backwardation. Severe backwardation highlight times when the crude oil is forming a top (although it can take a little while to get there).

The chart below displays all days when crude oil term structure was above 1.20 according to our Backtest Engine.

These results do not guarantee a significant reversal in crude in the months ahead. However, they suggest that traders should be prepared for just such an occurrence.

| Stat box Traders love a good breakout, and they're chasing the one in the XME metals & mining fund, shoving more than $150 million into the fund on Thursday. That's the fund's 6th-largest single-day inflow since inception. |

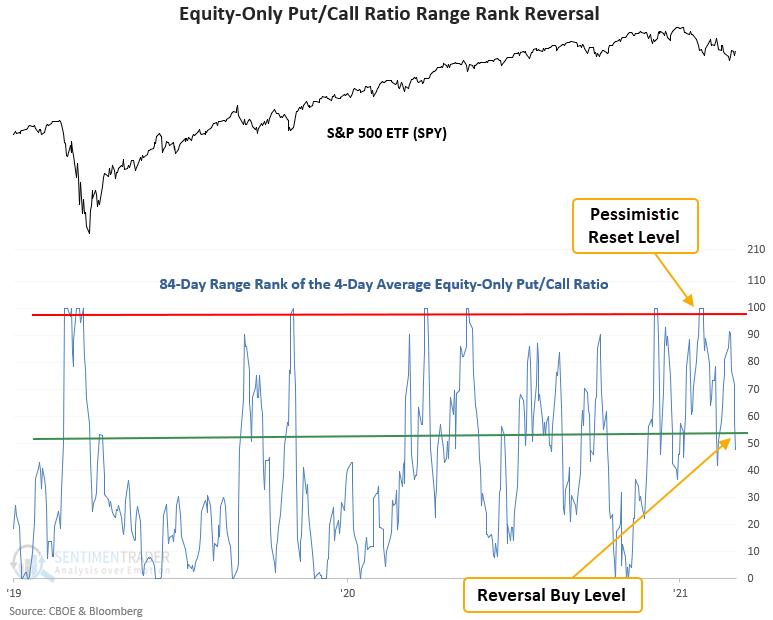

A put/call ratio reversal signal

When investors are bullish on stocks, they buy call options to bet on rising prices. Conversely, when they are bearish on stocks, they purchase put options to bet on declining stocks. The equity-only put/call ratio can be used as a contrary indicator to identify an environment where sentiment has become too pessimistic on the future direction of stocks. When opinions become too bearish, stocks tend to rally.

Dean outlined a trading model using the Equity-only Put/Call Ratio that identifies times when traders went from relative pessimism to neutral, while stocks showed positive momentum.

This signal triggered 43 other times over the past 25 years. The signal shows positive performance at some point in the first month in 41 out of 43 instances.