Big momentum in the big indexes

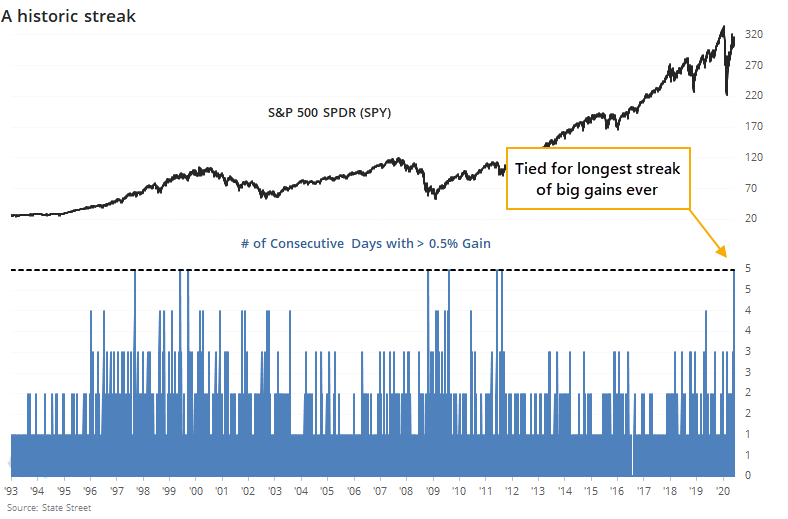

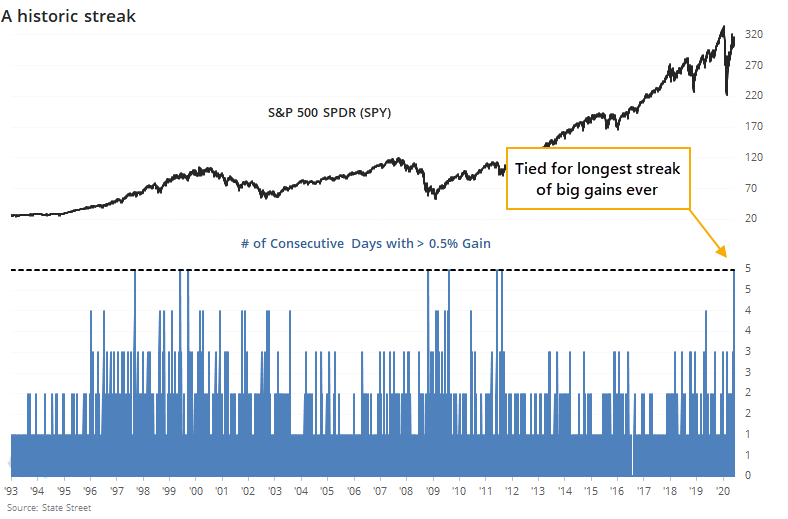

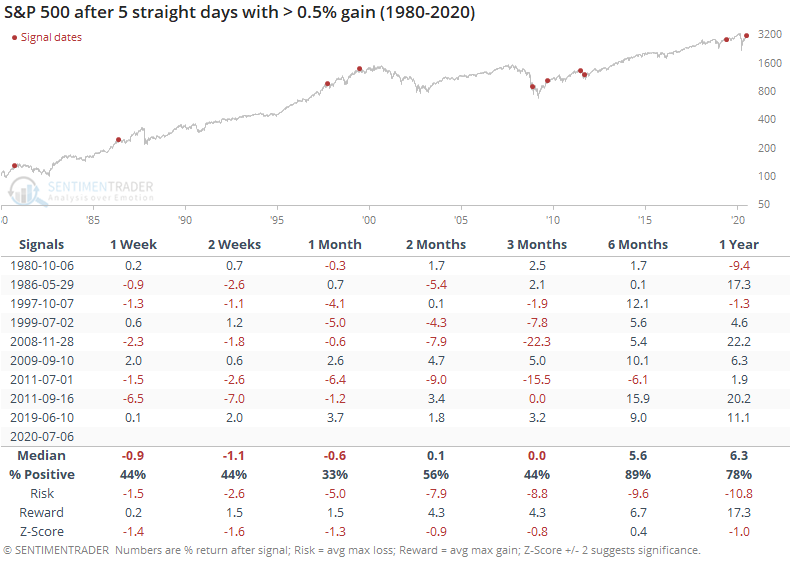

On Monday, we highlighted the fact that the largest ETF in the world had just enjoyed its fifth straight day with at least a 0.5% gain, tied for the longest streak in its history.

There have only been a couple of clusters when SPY managed this feat, those (very roughly) being the lead-up to the 2000 bubble peak and the end of the financial crisis. Even though they were opposite environments, SPY struggled over the next month, with two exceptions.

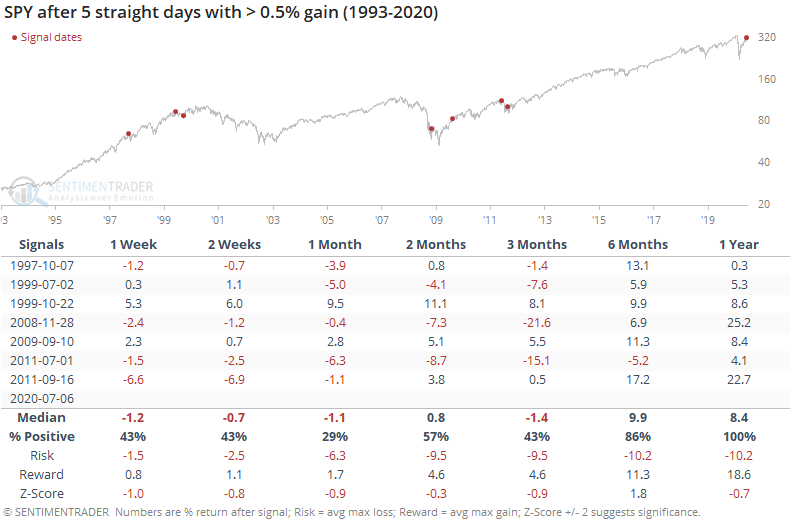

The S&P 500 index itself didn't quite make it, but if we round a 0.45% gain to 0.5%, then it does and ranks among the longer streaks since 1928.

Future returns were about in line with random, with a tepid risk/reward ratio. In recent decades, returns up to three months later were poor, with all but two of the signals since 1980 showing a negative return sometime between 1-3 months later.

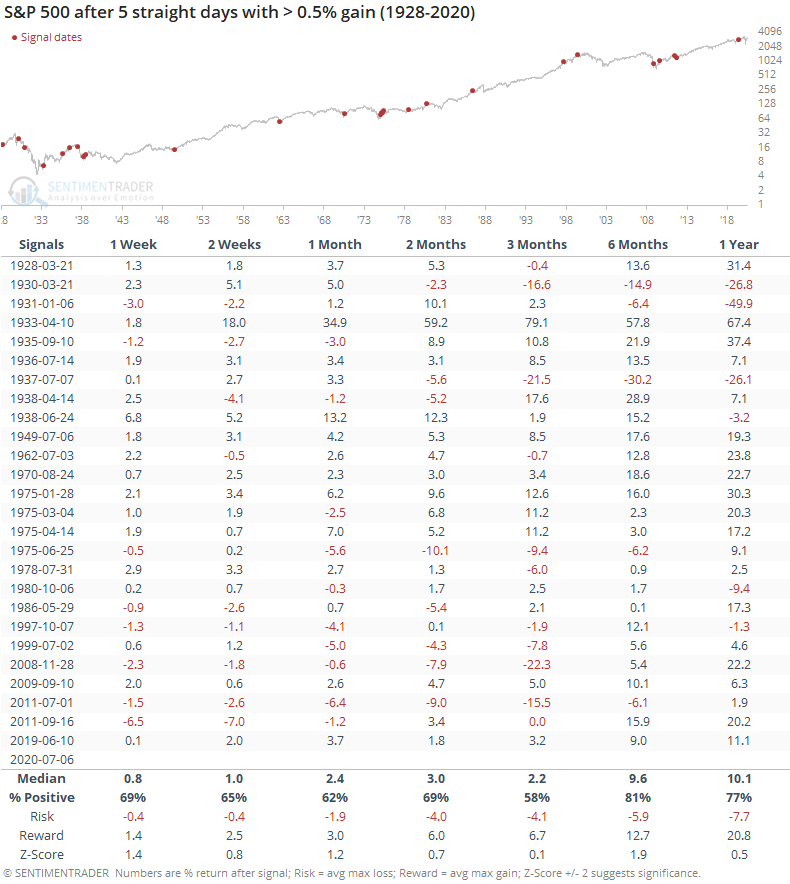

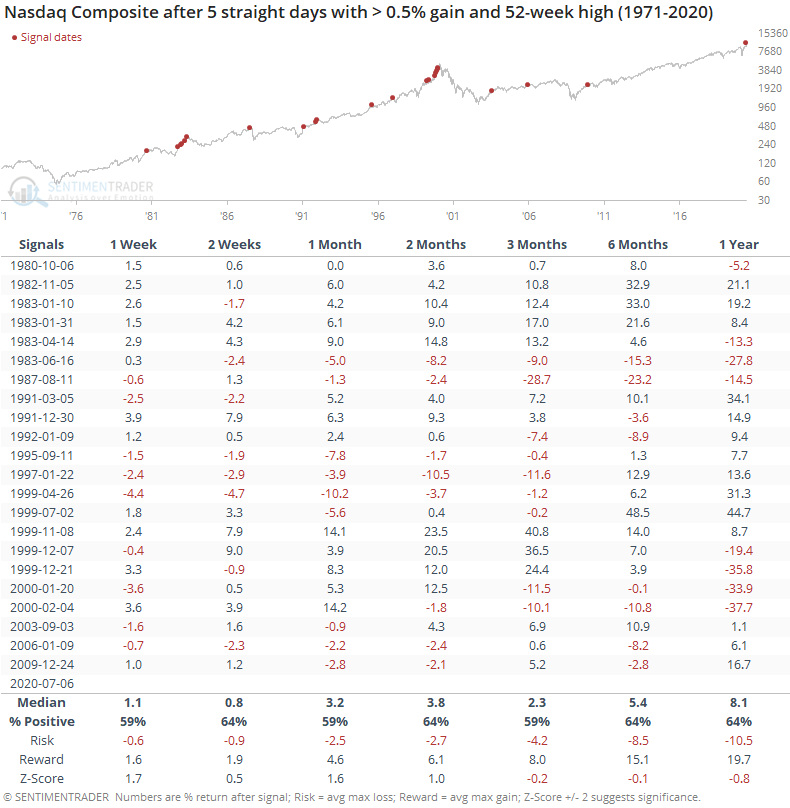

The Nasdaq Composite has also enjoyed a streak with big gains, with the added boost of hitting at least a 52-week high.

This was not a consistent sign of buying exhaustion, though returns from three months and beyond were below random.

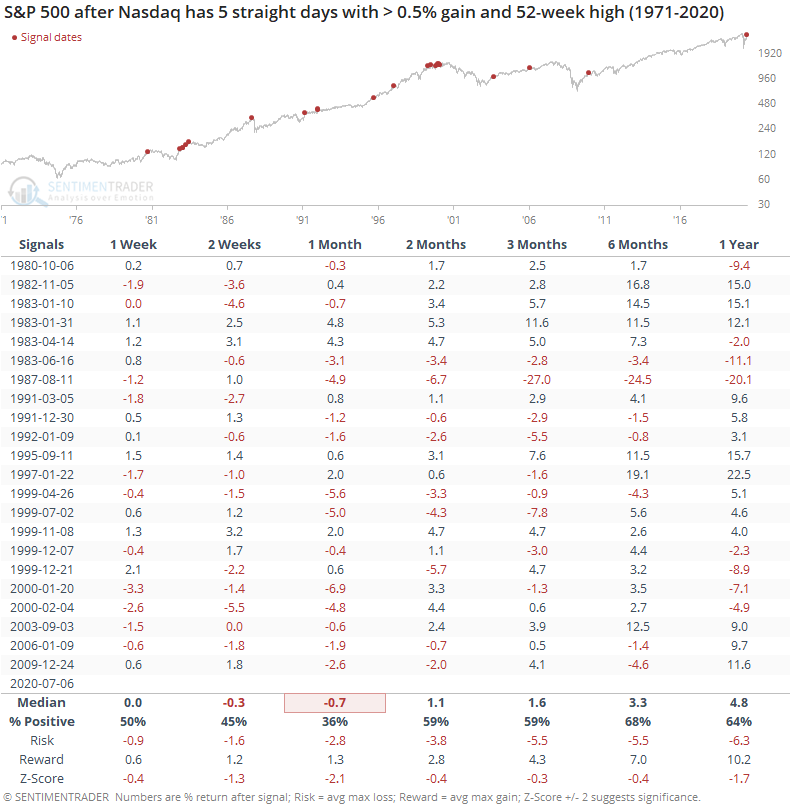

For the S&P 500, the Nasdaq's streaks were less kind.

When tech stocks had enjoyed such heavy and persistent buying pressure, the S&P was higher a month later only 36% of the time, and the risk/reward was negative up to three months later. Since 1997, there has only been one signal that did not show a negative return at some point over the next 1-3 months.

Momentum can be a good thing, and it can override sentiment extremes, which is why we spend quite a bit of time looking at it from various perspectives. This recent run has been notable enough to suggest future returns over the medium-term face a headwind and it has not been the kind of activity that would allow stocks to run uninterrupted over signs of excessive optimism.