Assessing the S&P 500's quick correction

The world's most benchmarked index falls into a correction

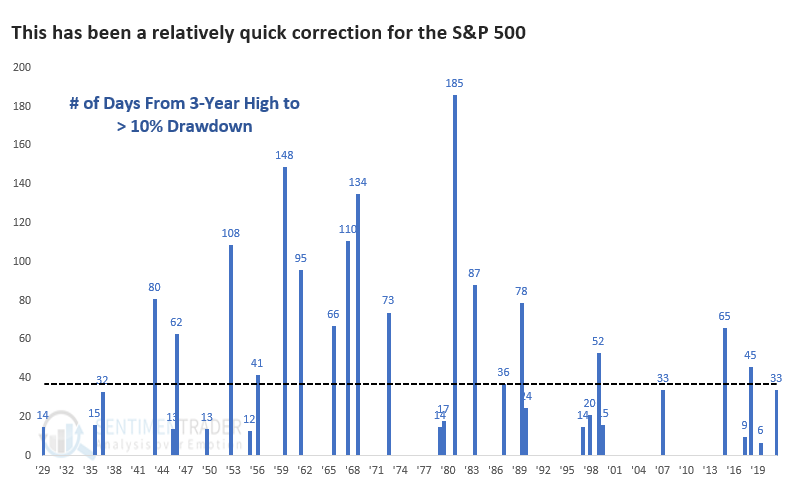

The S&P 500 has finally endured a drawdown of more than 10% from its most recent multi-year high. For brevity's sake, we use the commonly accepted definition of calling this a correction.

This ended the S&P's 11th-longest streak of hanging within 10% of its high.

After the S&P fell into a correction following a long absence, it tended to bounce back, especially over the next 1-4 weeks. At only 33 days removed from its most recent multi-year high, it seems like this has been a quick about-face among investors. But it's not far below the median number of days it took for the S&P to cycle into a correction.

Again, the S&P tended to bounce after quick corrections as dip-buyers finally found their chance to jump on what had been an excellent trend. Returns after these corrections were better over the medium- to long-term.

We also took a look at the index's average price path, depending on whether the correction ended up morphing into a bear market or not.

| Stat box Heavy selling on Wednesday pushed 100% of S&P 500 Technology sector stocks below their 10-day moving averages. That's only the 37th day in 22 years this has happened. |

A gold soft spot

For years gold has been touted by some as the ultimate inflation hedge. Yet despite the massive spike in inflation in the last year, gold has not made great headway.

Jay noted that a period of seasonal strength is about to end, a period of seasonal weakness is about to begin, and a period of seasonal "blah" (for lack of a better term) extends for the next several months.

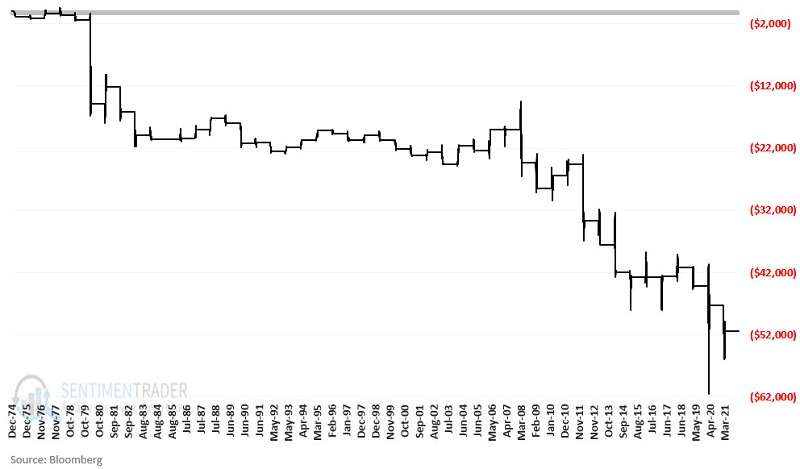

One seasonal period to pay attention to begins the close of the 18th trading day of February and extends for a little more than a month. The chart below displays the cumulative hypothetical $ +(-) achieved by holding a long position in gold futures only during this period each year since 1975.