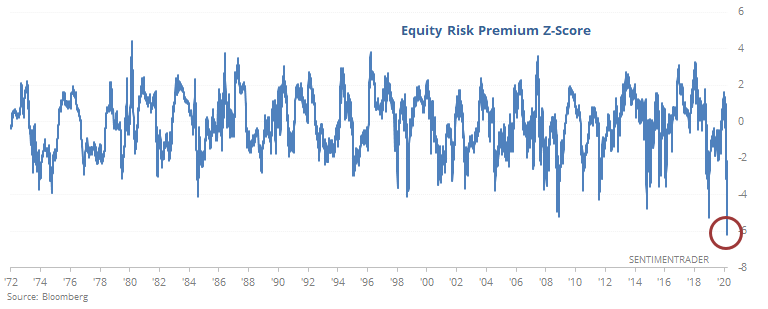

As volatility explodes, the Equity Risk Premium hits a record low

Less risk in Equity Risk Premium

The concept of valuation is up in the air for now, since nobody knows how earnings are going to be impacted by the economic shutdowns. That's always the case in times of tumult, though the uncertainty now seems far beyond the typical.

Even though we know earnings will be dramatically lower, and dividends will also be cut, for now they're commanding a big premium over Treasuries.

This proved to be a false bottom a couple of times in 2008 as the extreme volatility caused it to swing back and forth, and shorter-term risk was still high. But over the next year, all the signals showed a positive return, and well above average.

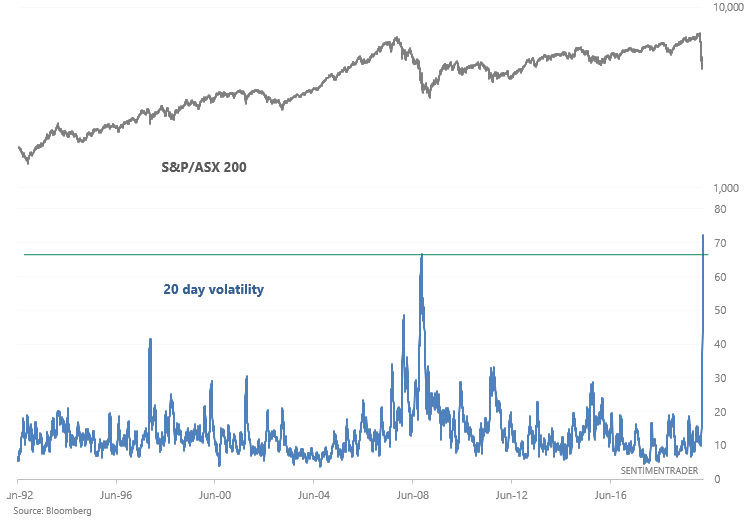

Record volatility

Volatility is extremely high across markets, which *should* be a bullish sign for equities. But given the extremely rapid pace of this recession+bear market, a lot of historical comparisons have not worked out so far.

The S&P 500's 20 day volatility can only be compared to 2 periods in history: the start of the 1929-1932 bear market, and the 1987 crash. It's not just the U.S., though - volatility is high across assets and across countries. In Australia, it's at its highest reading ever, higher than even during 2008:

In the end, extremely high volatility is a medium term bullish sign for stocks. But to think that the next 1-2 years will play out "just like 1929-1932" or "just like 1987-1988" is folly. The future is never just like the past.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- What happens after the largest reversals from a 52-week low

- A comparison of fiscal and monetary policy measures in 2008 vs 2020

- Historical volatility keeps rising as implied volatility falls

- What happens when stocks and volatility drop at the same time

- Volume is exploding across markets and countries