Another thrust narrowly missed

Once again, we almost got an "official" thrust, but didn't quite make it.

Starting in late March and triggering multiple times since then, there have been days with overwhelmingly positive buying pressure (see here and here and here and here).

Even so, at the start of this month we narrowly missed a commonly-defined breadth thrust. By the smallest of margins, breadth wasn't quite good enough to trigger a Zweig Breadth Thrust. As we saw at the time, that was not a good reason to worry.

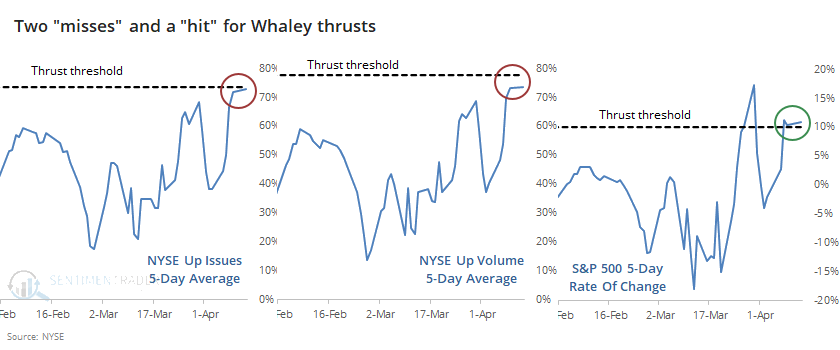

Heading into Monday's session, we were on track to trigger another type of breath thrust, popularized in a white paper by Wayne Whaley over a decade ago. Like the Zweig thrust, it relies on very precise parameters. And like the Zweig concept, we barely missed triggering those parameters because of one bad day. Out of 3 possible triggers, only 1 of them actually exceeded the required threshold.

Because of a relatively large number of declining issues on Monday, stocks barely missed triggering one of the conditions. But it does't really matter, it's the concept that counts.

There were some periods in history when there was a surge in Up Issues, but not Up Volume. Or maybe breadth was good, but the return in the S&P wasn't so great. Over the past week, though, we've seen a surge in all three measures, even if they didn't quite exceed the precise thresholds given in the white paper.

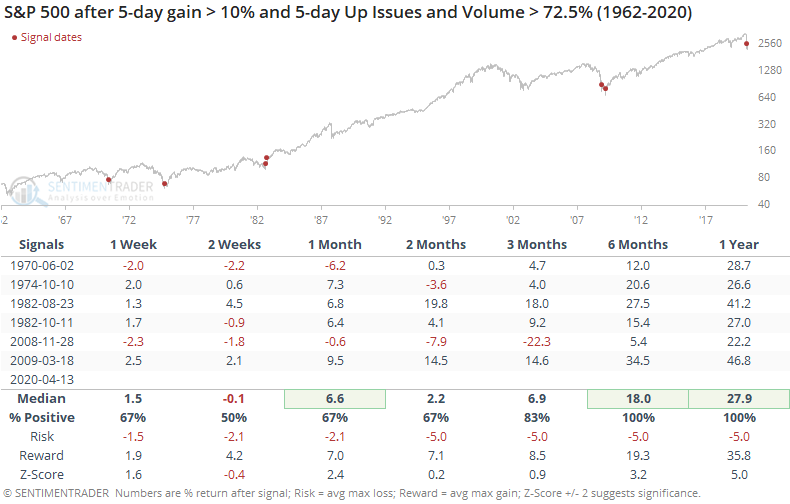

Below, we can see every time since 1962 when Up Issues and Volume both hit a very high level, along with a big surge in the S&P 500.

Like we've seen after a lot of thrust-type signals, returns in the shorter-term were mixed to weak. But over the medium- to long-term, these were important signs of a change in buyers' mentality. The overwhelming display of buying interest was an important sign that sentiment had shifted enough to be permanent, or at least enough to lead to another 6-12 months of a get-me-in mentality.