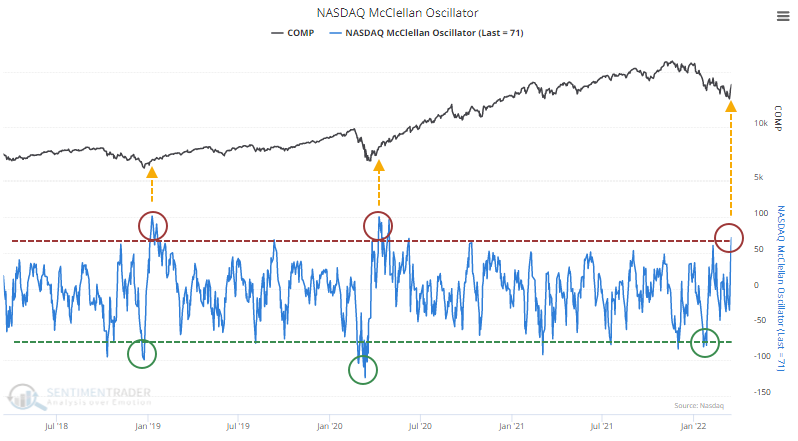

Another sign of internal Nasdaq strength

A surge in the Nasdaq's internal momentum

Ever since we looked at the disaster among stocks trading on the Nasdaq exchange, we've been looking for signs of a recovery. Few signs are better than a thrust of buyers returning quickly and en masse.

There are nascent signs we're seeing that now. The McClellan Oscillator for the Nasdaq has cycled from below -70 to above +70. Over the past 5 years, it has done this only 2 other times, preceding sustained rallies.

The Nasdaq Composite's returns following all similar reversals over the past 40 years were good, with 14 out of 17 signals showing a positive one-year return. The biggest issue is the post-bubble bear market. That, and the financial crisis, were the only times when sellers returned immediately and in force.

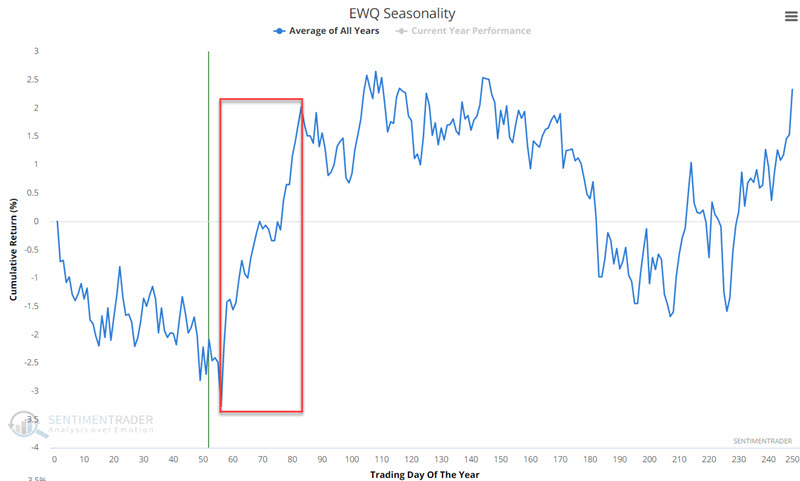

A nice time to visit France

Jay noted that some seasonal winds are becoming positive for various ETFs, including one focused on French equities.

The chart below displays the annual seasonal trend for EWQ (iShares MSCI France ETF). The fund is about to enter its most consistently positive time of the year.

During this seasonal window, EWQ has rallied 21 times and declined 5 times, with an average gain more than twice the average loss.