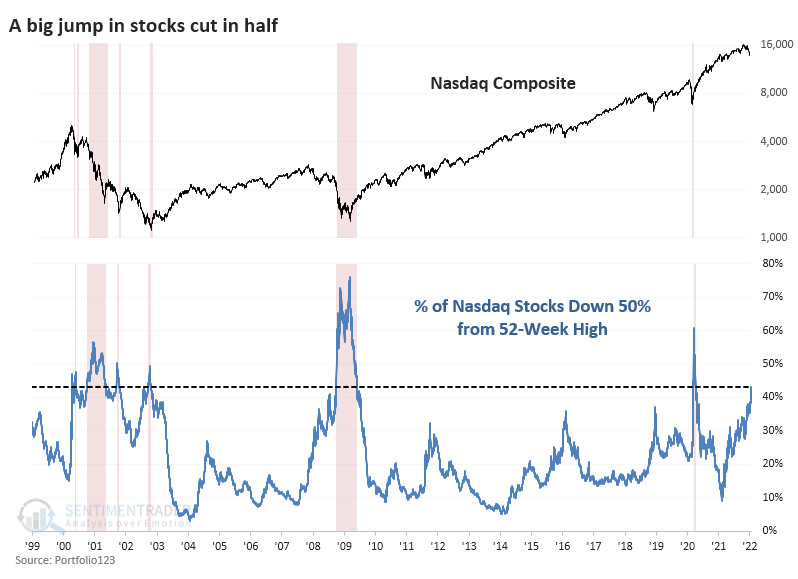

Another jump in stocks cut in half

Even more Nasdaq stocks get cut in half

A few weeks ago, we looked at the number of stocks cut in half. It's only gotten worse.

As of Friday, 42% of stocks on the Nasdaq were down by half. That's on par with the very worst markets of the past 20 years. Since the 2008 financial crisis, only 20 days from March 12, 2020, through April 16, 2020, saw more stocks down by 50% or more from their highs.

The Nasdaq Composite performed okay after any day on which 43% or more of securities had been cut in half. There were some significant losses in 2001 and 2008, though. It was a much safer bet to wait until the smoke cleared and miss trying to buy the bottom.

Curiously, relatively few stocks are down 5%, 10%, and 20% from their highs, compared to past severe declines. And while the carnage is focused on Nasdaq-listed issues, Technology stocks aren't the main drivers of the declines. A different sector has seen even worse selling pressure...

| Stat box Traders poured more than $1 billion into the GLD gold fund on Friday, the 11th time in the fund's history it saw at least a $1 billion single-day inflow. Our Backtest Engine shows that after the 10 other days, GLD showed a positive 2-month return only 2 times. |

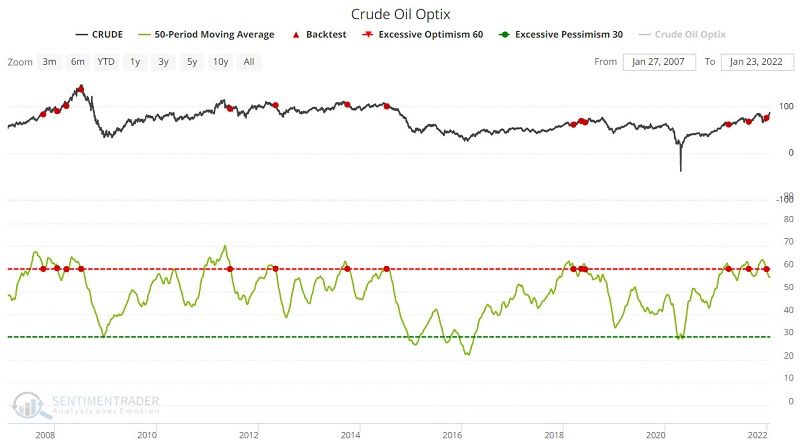

Worries about the oil market

Jay showed some factors that suggest a tough time ahead for crude oil. Taken together, they do suggest that the oil market may soon become a much more volatile affair and less of a one-way street.

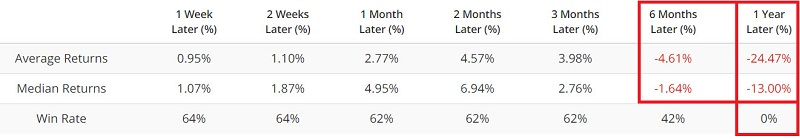

The chart below displays those times when the 50-day average for our crude oil Optix indicator dropped below 60. You can run this test in our Backtest Engine.

The table below displays a summary of results following previous signals. Note that results are "OK" for the first three months. After that, results tended to fall off significantly, all showing losses over the next year.

Another worrying factor is the term structure of crude oil futures, showing the relationship of the near-term futures contract to a further-out contract.