Another gap preps SPY for record momentum

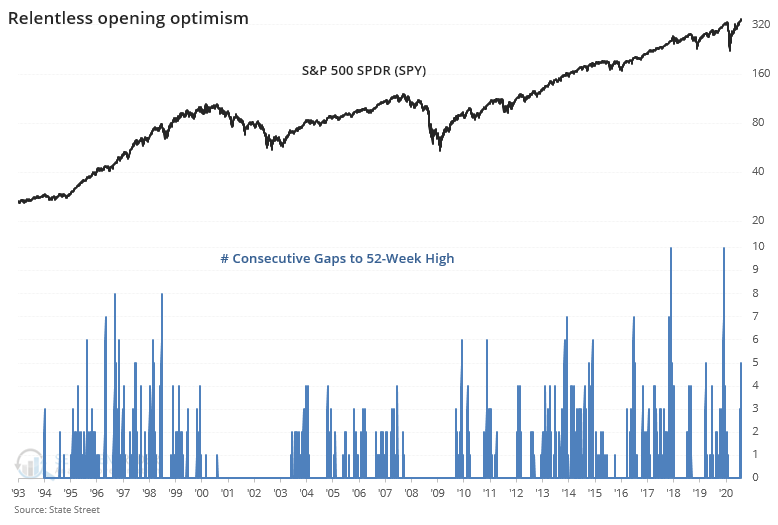

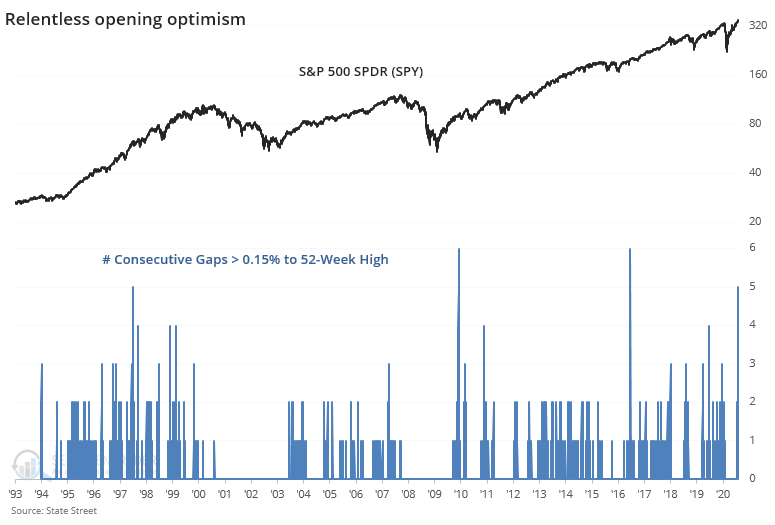

This is a quick post in answer to a number of questions revolving around this week's relentless momentum - has the S&P ever gapped up this many days, setting a new high every day?

Yes, but not many.

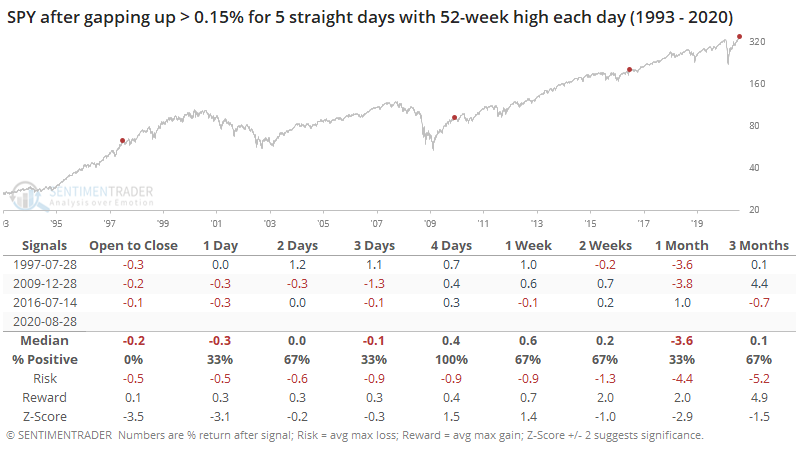

Friday's open marks the 5th consecutive time that SPY gapped up, moving above the highest close of the prior 52 weeks. It's gone on much longer, but it's rare to see this many days strung together.

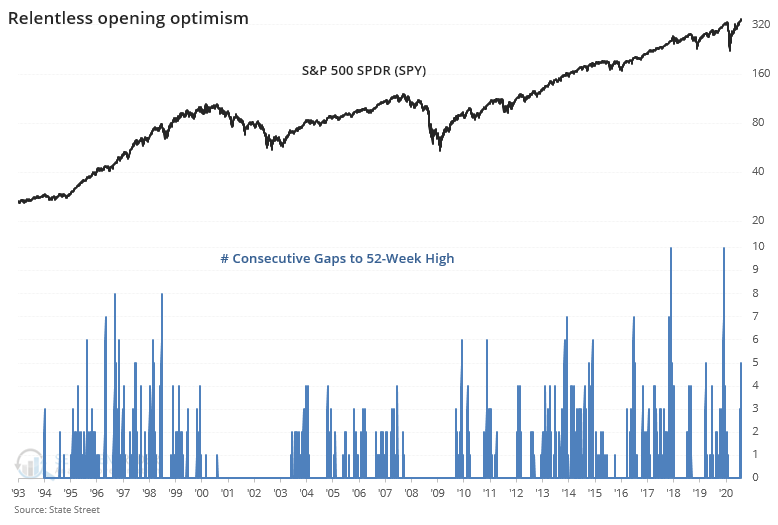

Going forward from the open on the 5th day, returns were below average. The risk/reward was about even, which is quite a bit worse than random with 70% of them seeing a negative return anywhere from 1-12 weeks later.

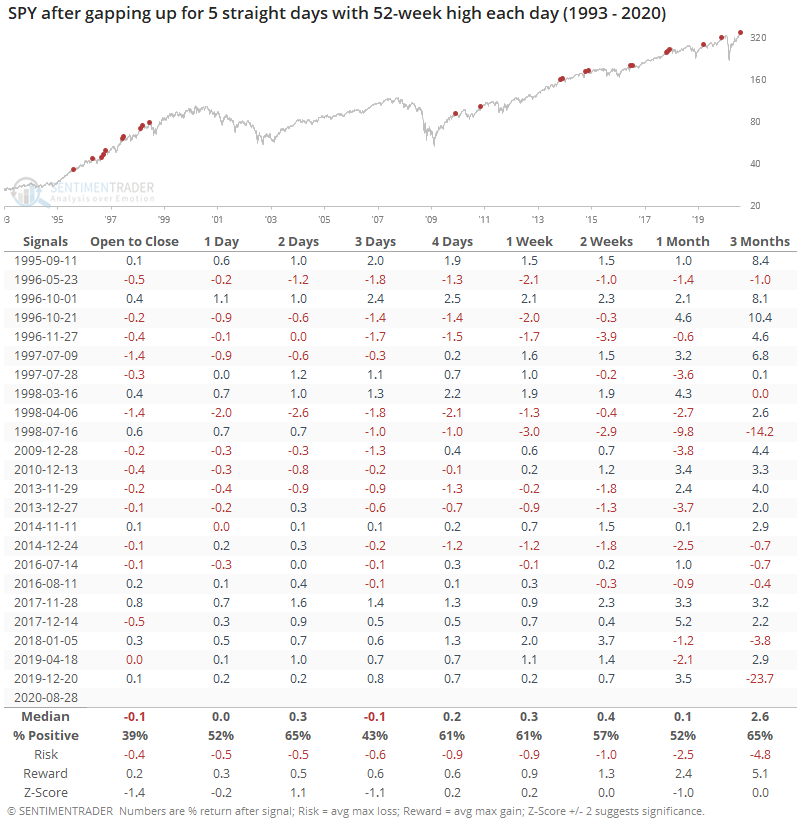

Some of those prior days with an opening gap were very small, barely registering. But this week, each day has opened at least 0.15% higher. This is just shy of the longest streaks in the 27-year history of the fund.

Each of the other signals led to subdued returns.

There hasn't really been any change to where we left off last week - the market environment remains mixed, optimism is still (mostly) showing extreme optimism, oddities with breadth underlying these moves have continued...and yet here we are showing signs of yet more momentum in the S&P 500. The power of the large "safe" stocks has been unparalleled and the underlying issues haven't been enough to stop their momentum.