An overbought and volatile combination

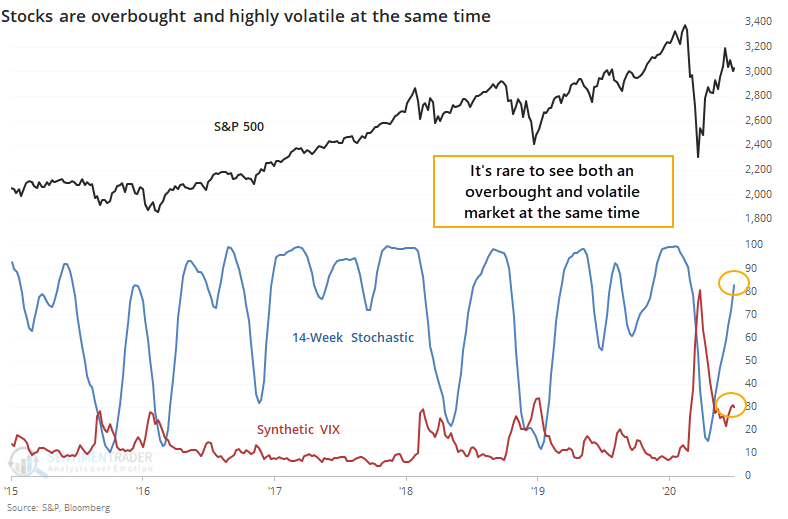

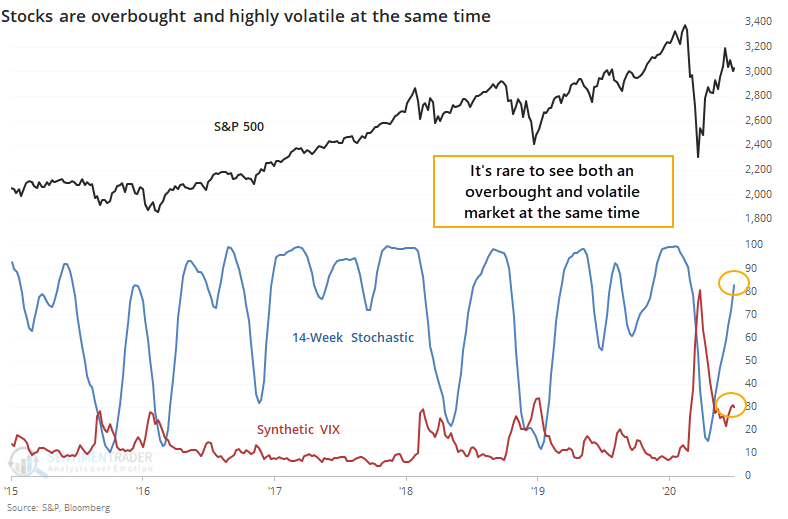

By the end of last week, the most benchmarked index in the world accomplished something it rarely does - it became overbought at the same time it was highly volatile.

Our good pal, and one of the most balanced strategists on Wall Street, Tony Dwyer from Canaccord Genuity noted to clients that when the 14-week stochastic indicator became overbought at the same time that the VIX was above 30, then it preceded positive returns over the next 6-12 months.

The reason this is unusual is that when an oscillator like the stochastic becomes overbought, it usually happens during calm markets, so the VIX tends to be low. If the VIX is high, then stocks have been volatile (almost always to the downside), so the stochastic is usually low.

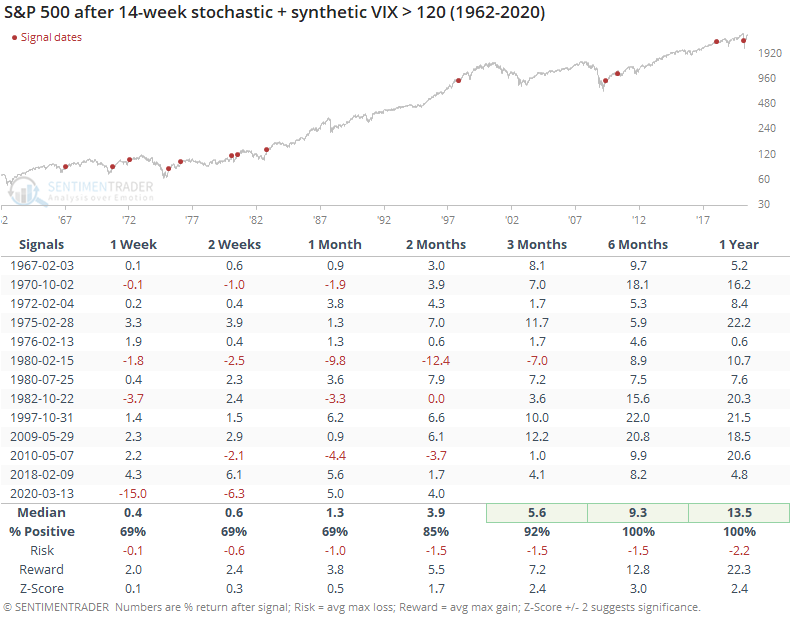

Using the same process for creating a synthetic VIX index that we've used in the past, we can go back to 1962 and look for other times this might have happened. Like Tony mentioned, it has been a very good longer-term sign for stocks.

The table below shows times when a combination of the stochastic and VIX was above 120. The stochastic can't go above 100, so it means the VIX must be at least above 20. Usually, there was some combination of them both being relatively high.

This typically triggered when stocks went through a severe, or at least fearful, decline, then jumped far and long enough for the stochastic to hit 80. While that preceded some shorter-term bumps a few times, the S&P was higher over the next 6-12 months every time.

The signal in March of this year is unusual because it was mostly due to the VIX being extremely high and the stochastic not being oversold yet. Maybe that will lessen the impact of the signal, which is the only reason we're not including this in the Active Studies.