An 85% Chance That Stocks Won't Suffer a Pullback

It is not a secret that the 4th quarter tends to be good for stock market investors, particularly beginning in late October. Jay examined one specific period and measured the results.

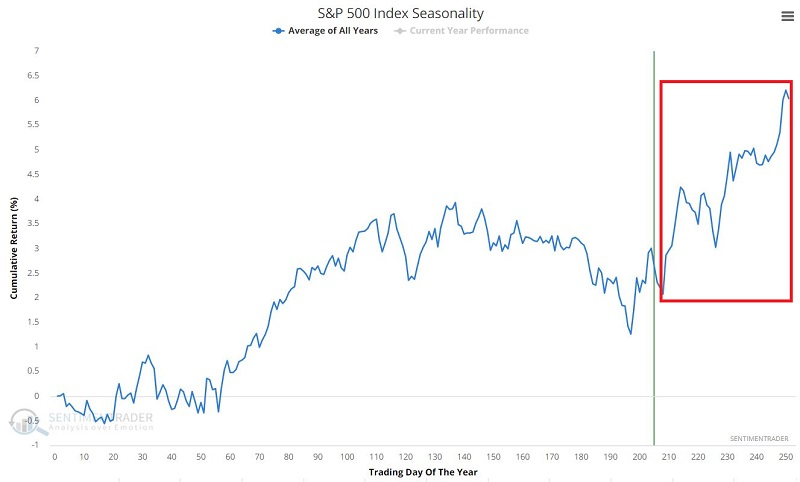

The chart below displays the Annual Seasonal Trend for the S&P 500 Index.

As you can see in the chart above, the market appears to show seasonal strength from Trading Day of Year (TDY) #208 through the end of the year. So that will be our test - buying the S&P 500 at the close of TDY #208 and selling at the close of the last trading day of the year.

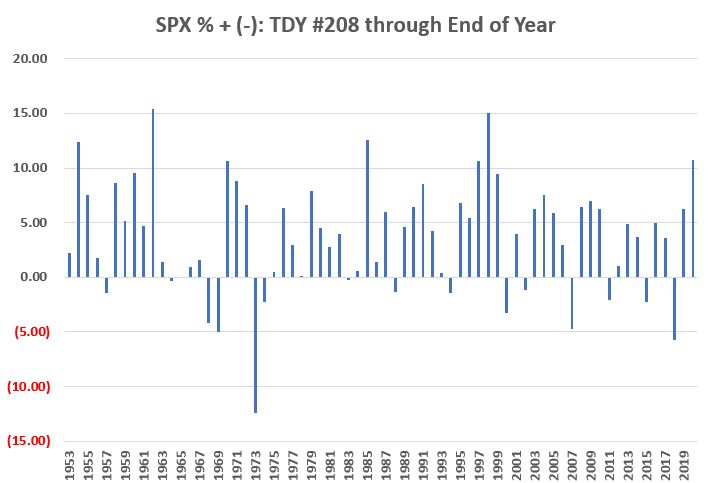

We will start our test in 1953 (because before 1953, the NYSE was open for a few hours on Saturday). The chart below displays the year-by-year results in column form.

Even more impressive than the consistency was the tendency to see small drawdowns.

- 41.8% of all years saw a drawdown of LESS THAN -1% (a dip).

- 85.1% of all years saw a drawdown of LESS THAN -5% (a pullback).

- 95.5% of all years saw a drawdown of LESS THAN -10% (a correction).

It's the most wonderful time of the year for stock investors.

What else we're looking at

- More details on S&P 500 upcoming seasonality

- Another look at breadth in Brazilian stocks and a way to trade it using options

- A unique look at breadth underlying the S&P 500's recent advance

| Stat box With another $2 billion inflow on Friday, traders flooded the SPY fund with an average of $1.3 billion of inflows each day last week. That's the 7th-highest amount of 2021. |

Etcetera

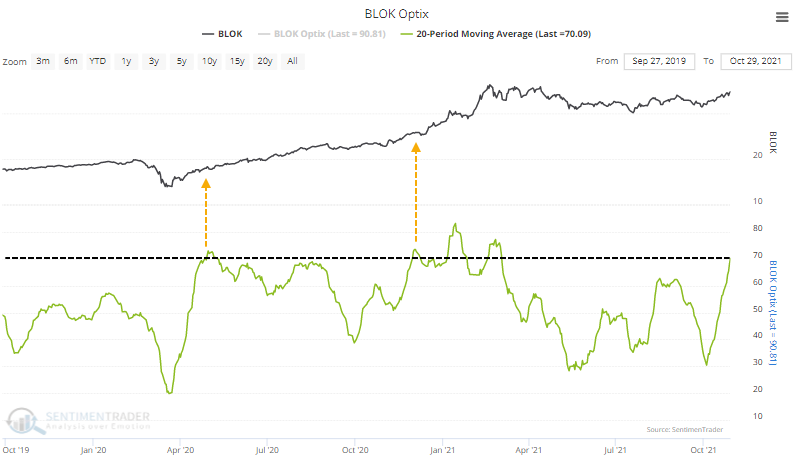

Off the 'chain. Enthusiasm for all things crypto has pushed the 20-day Optimism Index for the BLOK blockchain fund above 70% for only the 3rd time. Unlike most markets, when enthusiasm was high in this fund the last two times, its uptrend accelerated instead of decelerated.

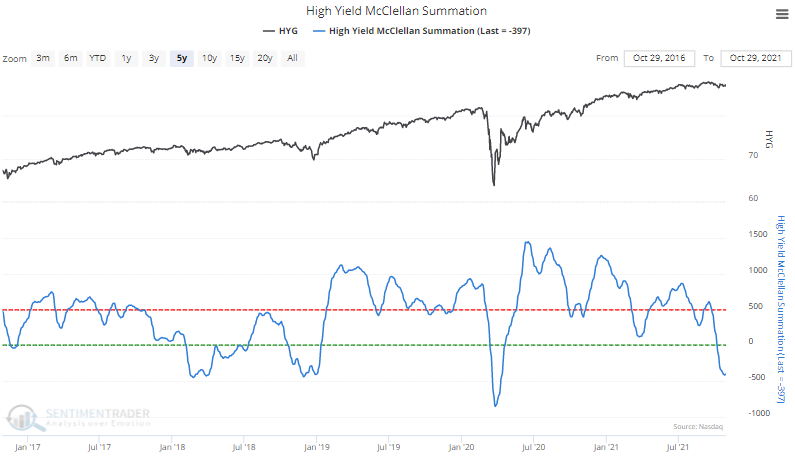

Junky action in junk bonds. Selling pressure has been fairly heavy in high-yield bonds. The McClellan Summation Index for the high-yield bond market is nearing -500 for only the 3rd time in the past 5 years.

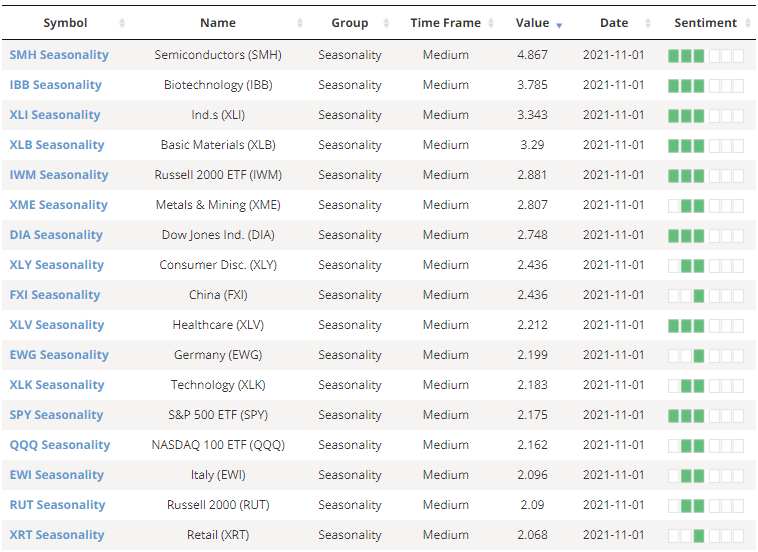

Nice time of year. Out of 46 different funds for which we track seasonality, 17 of them show an average return of more than +2% during November. High-beta groups like Semiconductors and Biotechnology lead the positive seasonal bias.