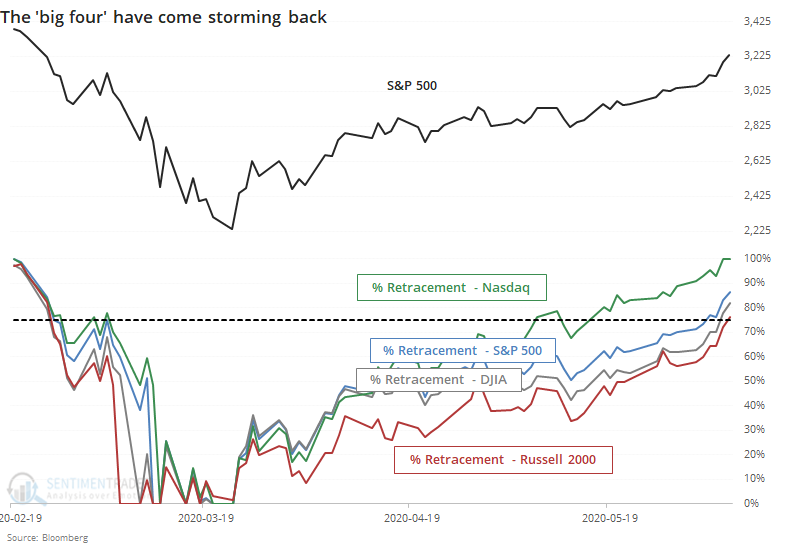

All of the 'big four' indexes have come at least 75% back

With the latest surge in small-cap stocks, all of the 'big four' equity indexes have made back at least 75% of their declines. The Russell 2000 was the last holdout, being led by the Nasdaq Composite, S&P 500, and Dow Industrials.

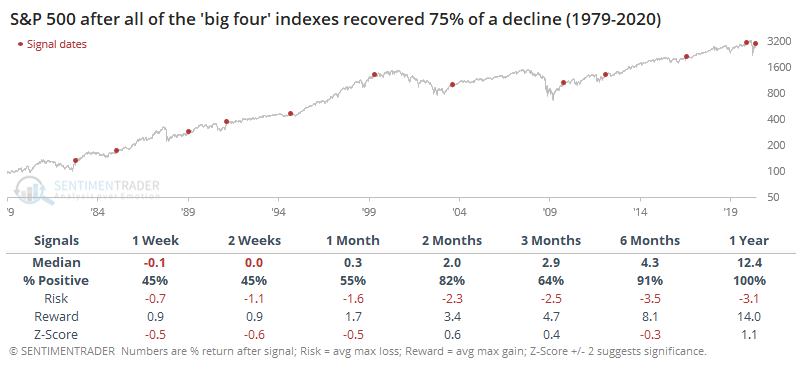

Since the inception of the Russell 2000 in 1979, by the time all four indexes had recovered at least 75% of their declines from a 52-week high to a 52-week low, it indicated strong, broad-based recoveries. This also meant that stocks had traveled far, and usually fast, so short-term returns were below average. But by the time it entered a medium- to long-term time frame, returns were good.

Among the other indexes, one in particular performed even better than the S&P.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Returns in each index when all of the 'big four' indexes retrace at least 75% of major declines

- The NBER has announced a recession (business cycle peak) - what happens to the S&P 500, factors, sectors, and other assets

- Almost all of the Fidelity sector funds are beating the return on cash

- Every developed market index has beaten the yield on 10-year notes over the past 3 months

- Almost every S&P 500 sector has beaten that return, too

- It's a risk-on environment, but the U.S. dollar is falling - what that means for stocks, the dollar, gold, and silver