All Aboard The Bond Bandwagon

Bond bandwagon

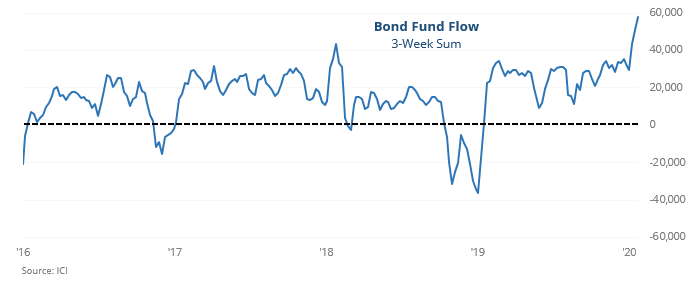

Investors have moved more than $15 billion into bond mutual funds and ETFs in each of the past three weeks, pushing the total over those weeks to a new record.

We might suspect this is a contrary indicator, likely leading to losses in bonds (and funds like TLT) while also leading to gains in stock funds like SPY.

That was kind of the case, at least for one of them - bonds tended to decline in the months following such an extreme inflow, but stocks didn't react the way we'd probably think they would.

Muddy metals

Whether the coronavirus outbreak is a legitimate global economic concern or a convenient excuse for eager sellers, one of the hardest hit markets has been copper. But it’s not just copper. As a whole, other industrial metals like aluminum, lead, nickel, and zinc have been steadily dropping and just hit a multi-year low.

For the S&P, multi-year lows in industrial metals did lead to meaningfully weak prices over the next two months. Among other markets, there was more consistent weakness in industrial metals themselves, as well as the dollar and general commodities. Gold was the most consistent gainer.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Short-term breadth panic readings in energy stocks

- A breadth aggregate shows stress in emerging markets

- Utility stocks have been shrugging off overbought readings

- AAII sentiment showed a sharp pullback

- Taiwanese stocks plunged soon after hitting a high