A week of records

Record volatility

Its hard to overstate the level of volatility investors have suffered across assets. Cross-asset whipsaws are setting records.

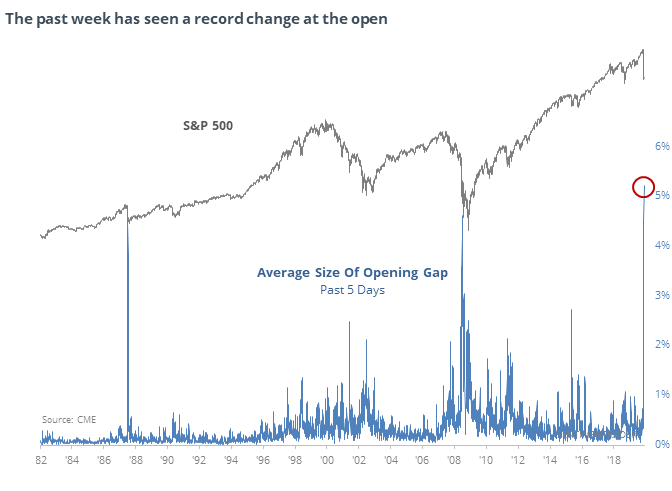

Stocks are the most widely held, though, and have the greatest impact on the general population’s sense of well-being. Even before Monday's near-record decline at the open, Friday marked the 8th straight session with an opening gap more than 2% from the prior day’s close.

Over the past week, the S&P 500 futures have gapped open an average of more than 5% from the prior day's close. It's never been higher, even during the depths of 2008.

Wicked swings

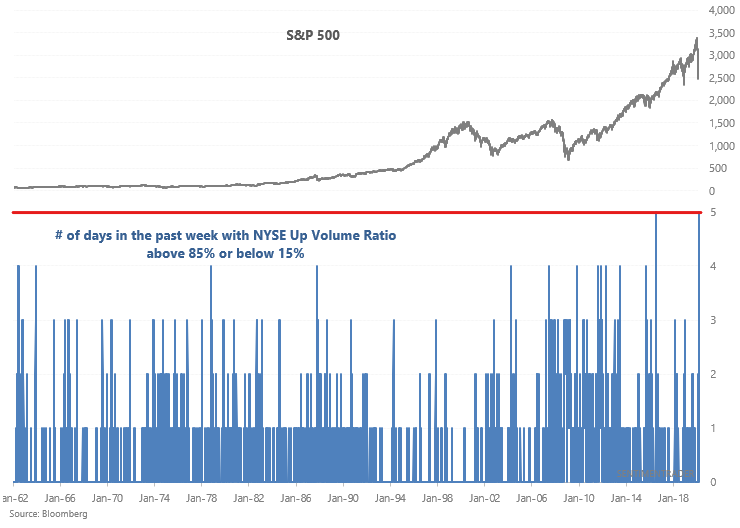

The stock market has experienced extreme swings up and down each day. Each of the past 5 days has seen either at least 85% of NYSE volume flow into issues that went up, or at least 85% of NYSE volume flow into issues that fell. This all-or-nothing attitude is extremely rare:

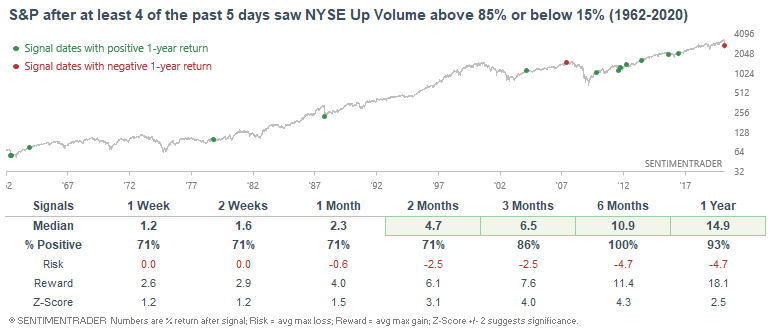

When the stock market was anywhere near this choppy in the past, the S&P 500 always rallied over the next 6 months:

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Correlation among S&P 500 sectors is nearing the highest since 1950

- Put/call ratios are soaring

- Money market funds have seen a 10-year high flow over the past 2 weeks

- The McClellan Summation Index is getting very negative

- A BlackRock risk gauge is showing that stocks are heavily undervalued

- Asset managers are aggressively selling

- Looking at the past week's crash across overseas indexes and commodities and bonds

- Record oversold readings within sectors and overseas indexes

- Smart Money vs Dumb Money Spread is nearly at a record